Reporting season outlook brightens despite focus on costs

Reporting season may have taken a late turn for the better despite an intense focus on costs.

Reporting season may have taken a late turn for the better despite an intense focus on costs.

At least in terms of the share price reactions of reporting companies, this reporting period doesn’t appear to be “saving the worst for last” as it often the case.

On Wednesday, shares of AUB Group, Domino’s Pizza, Home Consortium, Iluka, Netwealth, Worley, Sonic Healthcare, Reece, Seven Group, Tabcorp and WiseTech rose more than the index after reporting their results, while Nanosonics, Coles, Kelsian and APA Group fell.

That positive skew to share price reactions was in contrast to the first few weeks of reporting season, when the initial reactions were mostly negative.

That was the case even among stocks which clearly beat consensus estimates for earnings, as earnings guidance from a majority of reporting companies disappointed investors.

But that seems to be changing. Domino’s shares rose even as its earnings missed expectations.

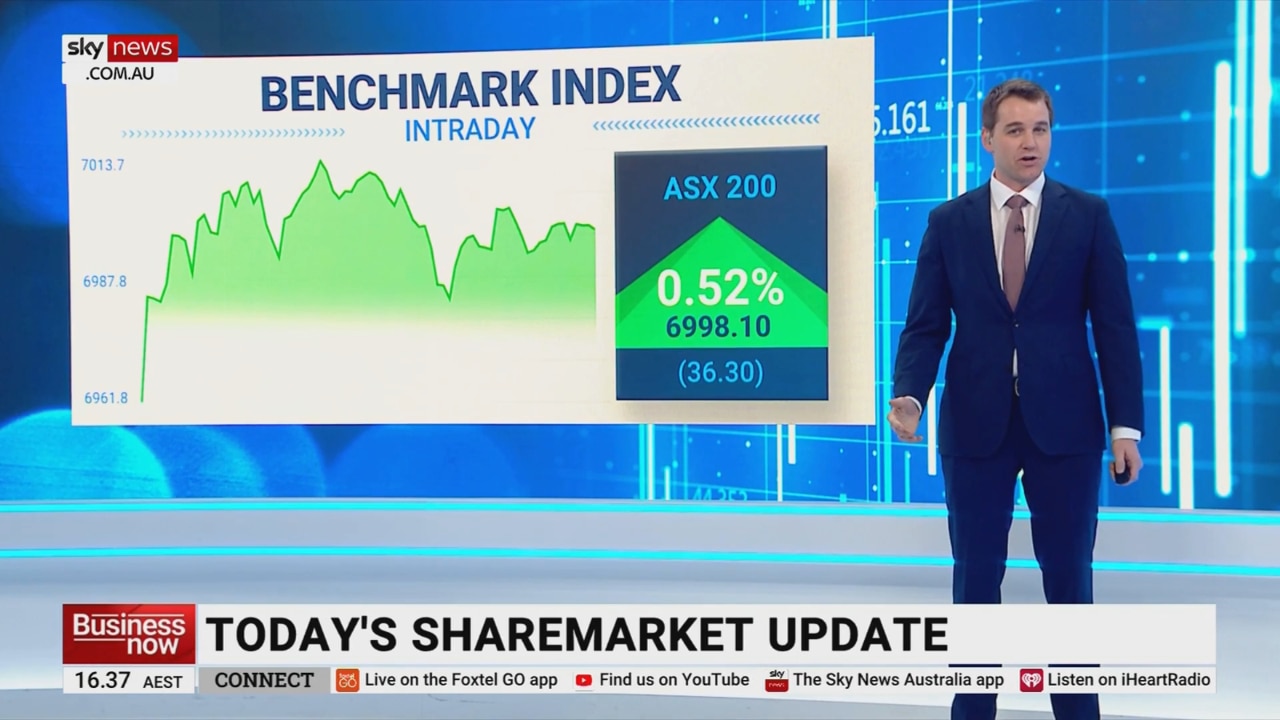

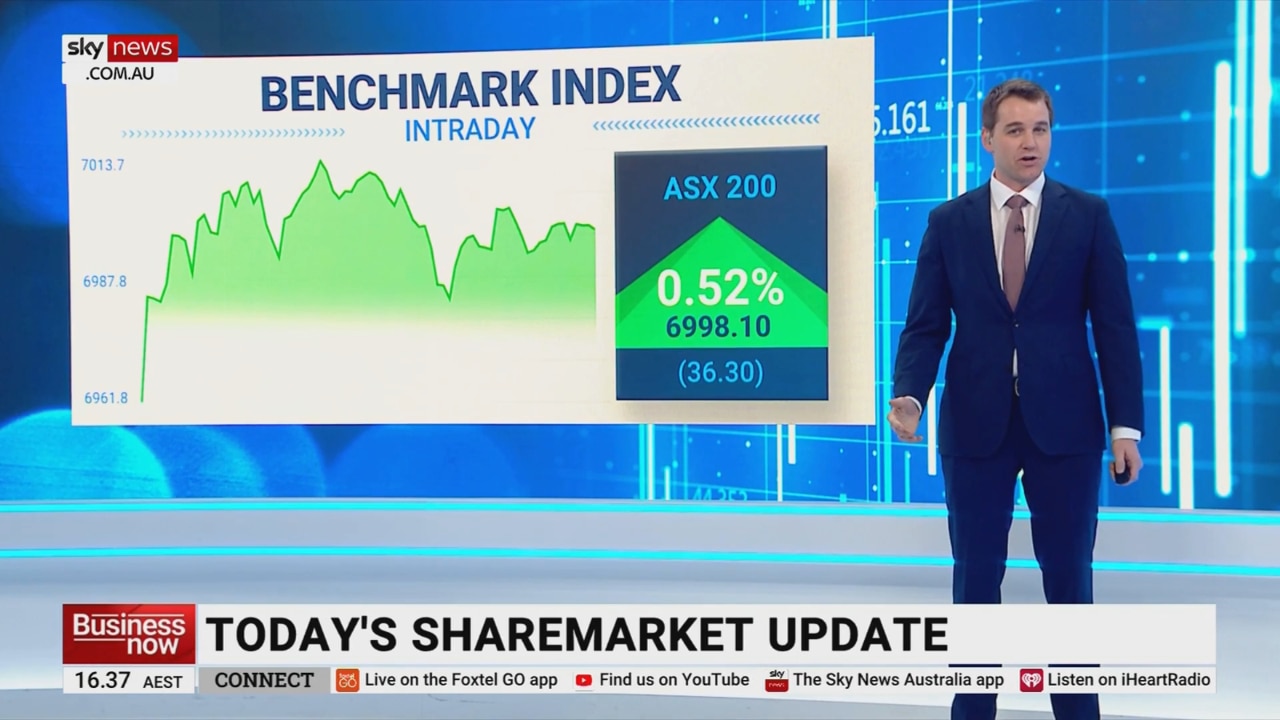

As Morgan Stanley Australia equity strategist Chris Nicol noted last week, a 2.7 per cent rise in the ASX 200 index for the month to date was driven by a few select stocks, some of which were yet to report, so there was always going to be a lot of interest in the tail end of reporting season.

Top 50 companies including Woodside, Fortescue, Northern Star, Mineral Resources, Ramsay Health Care, Wesfarmers, South32, Qantas and Woolworths are yet to report but it’s fair to say that the tone of reporting season has now been set.

Assessments of the earnings season have so far been mixed. Some analysts have focused more on the fact that there have been less earnings “beats” than usual, and forecasts for fiscal 2023 dividends and earnings have been downgraded.

UBS’s Richard Schellbach has argued that the fact that beats have still outnumbered misses is an “impressive showing” given the array of headwinds companies have faced over the last six months, and share prices should “digest downgrades thanks to already discounted valuations.”

That’s also been the view of MST Marquee senior analyst Hasan Tevfik. His overall assessment that corporate Australia is “weathering the cost storm”.

Mr Tevfik notes that there has been only a “modest” 0.3 per cent or $500m downgrade to the consensus estimate for ASX 200 company earnings for the year to June 2023 to $160.3bn.

That compares to a long-term average change of 0.7 per cent in reporting season months.

Financials have led the reporting season in terms of the impact they are having on analysts, with the sector as a whole enjoying upgrades of more than 1 per cent, according to Mr Tevfik.

The downgrades for commodity producers and industrials have been around 1 per cent.

“Australia Inc is weathering a considerable cost storm,” Mr Tevfik said. “While there are signs that raw material cost inflation – including freight – is peaking and potentially reversing, the headwinds continue with wage inflation and rising interest expense. Still, margins have held up reasonably well.”

On that point, he notes industrial company net profit margins have been revised down by only 20 basis points while commodity producer margins have come down by just 30 basis points.

To be sure, consensus forecasts for free cash flow and dividends are coming down but Mr Tevfik says this is linked to increased capital expenditure forecasts, and doesn’t see that as such a bad thing, except of course for those who own shares primarily for income from dividends.

“Companies are now guiding to more capex and this is a drag on free cash forecasts,” he notes.

“While the downgrades to free cash flow are not large in a historical context they are enough to contribute to a disappointing reporting period for income seeking investors.”

Dividend forecasts have come down by 1.2 per cent to $101.9bn for the year to June 2023.

There have been $1.6bn of new buybacks but he expects more on the strength of balance sheets.

Another point worth highlighting is the fact that Macquarie Equities slashed its iron ore price forecasts by about 20 per cent for the next 18 months as it said subdued steel demand in China – particularly from the property market – will push the market into a surplus.

Macquarie saw a 25 million tonne iron ore surplus in 3Q 2022, widening to 35 million tonnes in 4Q before improving demand returns the market to balance in the second half.

The broker consequently cut Rio Tinto to neutral, Champion Iron to neutral and Mount Gibson to underperform.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout