Relief rally on cards for markets as Labor policy agenda binned

Financial markets are expected to receive a boost from Scott Morrison’s surprise Coalition victory.

Financial markets are expected to receive a boost from Scott Morrison’s surprise Coalition victory, while the economy is set to benefit from a wave of pent-up investment.

The defeat of Labor is expected to resonate positively with investors, business and consumers concerned about the economic and financial impact of the opposition’s ambitious reform program, including plans to wind back negative gearing and capital gains tax concessions for investment properties, scrap cash refunds on excess franking credits and increase spending.

While Reserve Bank governor Philip Lowe is expected to strengthen the case for interest rate cuts in a landmark speech tomorrow, the effective removal of anxiety about Labor’s policy agenda was expected to provide a much-needed shot of confidence.

Wilson Asset Management chairman Geoff Wilson is expecting a strong “relief rally” in the broader sharemarket and dollar.

“This should be positive for the Australian dollar and equities because Labor’s redistributive policies were high risk,” Mr Wilson told The Australian.

Although the opinion polls had narrowed in the Coalition’s favour in recent weeks, bookmaker odds had suggested a Labor victory was a certainty, and that would have been priced in by financial markets, according to Mr Wilson.

Although the Australian sharemarket has been exceptionally strong this year, rising 13 per cent amid a broad recovery in global markets after central banks pivoted away from interest rate rises, Mr Wilson feels Australian shares have been restrained by political uncertainty.

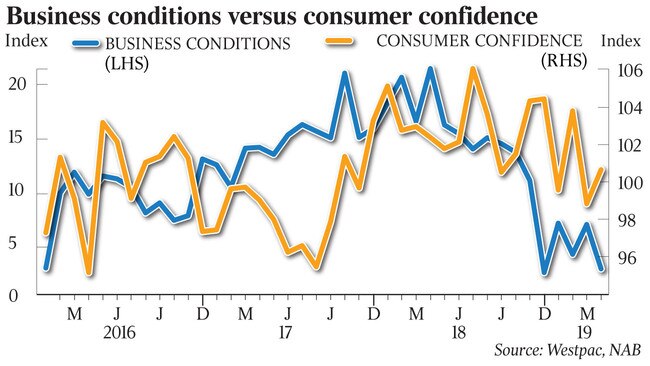

The election outcome will be good for consumer and business sentiment, which have been trending down for the past 10-12 months, and any such improvement in sentiment could trickle through to labour hiring, wages and consumer spending.

Citi Australia senior economist Josh Williamson said the election outcome means Scott Morrison will now be able to “align the Coalition and put an end to the instability that resulted in coups that removed the two previous Coalition prime ministers”.

“The election victory is also a victory for employers of labour and owners of capital,” Mr Williamson said.

“The election result means an end to potential Labor policies such as removing negative gearing and preferential tax treatment of investment properties, ending excess franking credits to shareholders and raising the minimum wage to the level of a living wage.”

AMP Capital head of investment strategy and chief economist Shane Oliver is tipping a positive sharemarket reaction.

Dr Oliver noted that after nine of 13 elections since 1983, shares were up three months later with an average gain of 4.8 per cent. However, the sharemarket has “run hard and fast” since December and was vulnerable to a further short-term pullback.

“With the return of the Coalition with its more pro-business policies, and uncertainty now removed around changes to excess franking credits, changes to negative gearing and capital gains tax adversely affecting the property market and increased industrial relations regulation, it’s possible we will see a bit of a short-term bounce in the sharemarket,” Dr Oliver said. Property-related shares, banks and retail shares could be the key beneficiaries in his view.

“Against this, though, the Australian sharemarket has already performed pretty well over the last few months and is likely to be dominated by issues around global trade, slowing growth, interest rates and the iron ore price and so will quickly move on from the election,” he said.

Dr Oliver maintains that the dollar is likely to fall further to about US65c as the gap between the RBA’s cash rate and the US Fed Funds rate is likely to push further into negative territory as the RBA moves to cut rates as soon as next month, although “excessive short positions and high commodity prices (particularly iron ore) will likely prevent a crash” in the exchange rate.

The dollar tumbled to a fresh four-month low of US68.65c on Friday evening.

Nomura Australia strategist Andrew Ticehurst said he planned to “immediately square up our tactical short in the Australian dollar” because he was now “quite confident” the dollar would rise after the surprise election result.

He also expects short-term interest rates and the sharemarket to rise because Labor’s tax proposals were “off the table”.

“A net-positive response in the equity market seems likely, particularly from higher dividend-yielding shares,” Mr Ticehurst said. “The beleaguered housing sector will likely receive a significant boost, too. “The Liberal-National Party is also seen by many as the stronger economic manager.

“Collectively then, we also expect to see some improvement in business sentiment.

“We think this will also be negative for the short end of the Australian yield curve, particularly June and July OIS (overnight index swaps) which, on Friday, were implying an 80 per cent and 92 per cent chance, respectively, of a 25 basis-point interest rate cut.

He noted that Dr Lowe’s speech to the Economic Society of Australia in Brisbane tomorrow would be critical for the near-term direction of the dollar and interest rates.

AMP Capital’s Dr Oliver said the Morrison government now faced four key challenges, including minimising the fallout from the housing downturn without setting off another housing boom, getting wages growth up to more reasonable levels by lifting economic growth and lowering underemployment, addressing perceptions of “unfairness” in the economy, and solving the “climate action-high energy price puzzle” which, in his view, may become essential if support from independents was required to govern.

“Apart from the housing deposit scheme the Coalition did not promise a lot in this election — which is a good thing — beyond what was laid out in the budget, so it’s back to business as usual in terms of the immediate economic policy outlook with modest tax cuts for low and middle-income earners on track for the next few months,” Dr Oliver said.

“Increased short-term fiscal stimulus on the back of a still improving budgetary position thanks to the surging iron ore price is on the cards but unlikely to be big enough or come early enough to head off interest rate cuts.”

But while the scale and timing of the first-home buyers scheme meant it was “probably not a game changer at this stage”, he said the deposit scheme could “morph into a far more attractive homebuyer grant at some point”.