Record high as S&P/ASX 200 nears 7000-point heaven

The Australian sharemarket is within striking range of the key 7000-point barrier, as stocks surged to a fresh record.

The Australian sharemarket is within striking range of the key 7000-point barrier, as stocks surged to a fresh record after the US held out an olive branch to China ahead of a trade deal due to be signed on Wednesday.

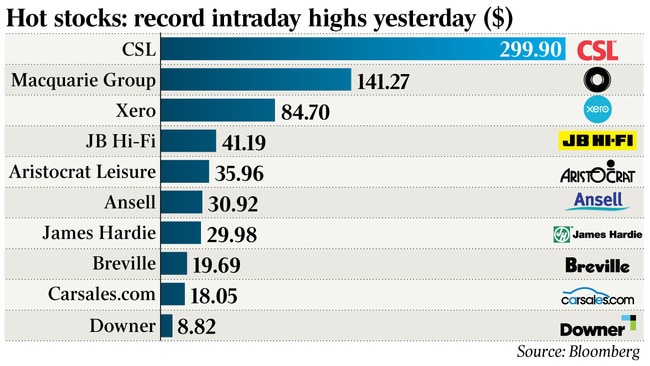

The bounce delivered a lift to a string of blue chip names with players including healthcare company CSL, investment bank Macquarie and retailer JB Hi-Fi hitting record intraday highs on Tuesday.

The benchmark S&P/ASX 200 index rose 0.9 per cent to 6962.2 points, adding $19bn in value.

The index set an all-time high of 6962.8 — its second such milestone in the past three sessions — although trading volumes were relatively light with many fund managers sitting on the sidelines.

Other S&P/ASX 200 names to touch record highs on Tuesday included Xero, Aristocrat, James Hardie, Ansell, Breville, Downer, EML Payments and National Storage REIT.

But much of the focus was on CSL, which just fell short of the $300-a-share mark after hitting a peak of $299.90. This level gives CSL a market value of $134bn, ranking it slightly behind Commonwealth Bank at $147bn.

Macquarie touched a record high of $141.27, putting the financial giant within reach of becoming a $50bn company.

“These are unique times,” said Mirrabooka managing director Mark Freeman.

“While some have focused on multiples and price-to-earnings levels, others are chasing yields and it does feel a little bit like money chasing assets.

“There are lots of people just buying stocks because they are not getting income from fixed income, and they have a different view to our quality models entirely.”

The local jump came after Wall Street benchmark the S&P 500 rose 0.7 per cent to a record 3288.13 points after the Trump administration abruptly removed its designation of China as a currency manipulator.

The decision boosted expectations that the trade deal agreed last month would finally be signed by the two nations at the White House on Wednesday.

“China has made enforceable commitments to refrain from competitive devaluation, while promoting transparency and accountability,” said US Treasury Secretary Steven Mnuchin. His statement accompanied the Treasury’s foreign exchange report, which addresses the currency practices and macroeconomic policies of US trading partners.

The report said the trade agreement’s chapter on Chinese currency practices addressed many of the concerns raised when the US applied the manipulator designation in August.

As part of the agreement, China will commit not to depress its exchange rate and will make additional disclosures about its foreign-exchange practices.

The Treasury also noted the Chinese currency had strengthened in recent months, a development that helps address US concerns that the yuan is too weak.

Citi economist Xiangrong Yu argued that the move signalled a further de-escalation of the tit-for-tat tariff war.

He estimated the partial rollback of the September tariffs embedded in the upcoming deal would boost China’s economic growth by 0.2 percentage points, holding other things constant. “These developments should be cheerful for the market,” he said.

Following Wall Street’s lead, the Australian sharemarket was the strongest performer in the Asia-Pacific. China’s Shanghai Composite was flat, Japan’s Nikkei 225 was up 0.7 per cent, the Hang Seng was down 0.3 per cent and the KOSPI was up 0.3 per cent in late trading.

Bell Potter’s head of institutional sales and trading, Richard Coppleson, said high price-to-earnings ratio stocks were making a comeback after falling or trading sideways from October to December.

Strong performers in that group included Afterpay, Pro Medicus, Treasury Wine, Brambles, Breville, Hub 24, Carsales.com and Domino’s.

“There were plenty of experts reminding us that these stocks are on big PEs and are all overvalued,” Mr Coppleson said.

“So with their bad December quarter we saw some institutions reduce their holdings and so a lot of the ‘hot money’ also exited. That cleaned the share register.”

He warned that in a 15-20 per cent correction “almost every one of these stocks will get smacked hard”. However, he said still expected most of them to be higher by the end of the year.

But with the 12-month forward price to earnings ratio of the local market hitting a record high near 18 times and its dividend yield hitting a decade low below 4 per cent, upside potential this year is expected to be less than 2019, when it rose 18.3 per cent, its best year in the past decade.

GSFM adviser Stephen Miller said the strength of returns from global and Australian shares last year — driven primarily by central bank liquidity — was a surprise. In his view, investors should be expecting a total return including dividends of little more than 5 per cent in 2020, versus an impressive total return of 23.4 per cent in 2019.

“Monetary policy is almost exhausted, and ongoing global tensions, such as the US-China trade negotiations, US and European politics, Hong Kong and more recently Iran, mean that risks may be asymmetrically weighted to the downside,” Mr Miller said.

Last year “surprised us by how bloody good it was and when it’s good, markets can become complacent. He added: “When something goes wrong, the correction might be shorter but it can also be deeper and investors need to be alert to that potential.

“There’s a lot of uncertainty out there and while some of the geopolitical issues existed 12 months ago … it only takes one or two of these to flare up at once and markets take flight.”

Of concern is that authorities have limited levers to stem the consequences of such a drop, with central banks globally running out of policy ammunition.

“We may well see the cash rate at 25 basis points in Australia, but I’m not convinced of the potential for meaningful quantitative easing in a local context, and that may make things difficult,” Mr Miller said.

“At some stage in 2020 the federal government might have to give up on the surplus, but if you want to mitigate a severe downturn, you need a mechanism that delivers it quickly.”

Citi recently set a target of 7000 points for the S&P/ASX 200 in 2020. The US investment bank kept an underweight rating, arguing that valuations were expensive, earnings and dividend momentum were weak, and high payout ratios reduced the scope for share buybacks.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout