Philip Lowe shortens odds for Melbourne Cup day rate cut

The odds of an interest rate cut on Melbourne Cup Day are firming after the RBA shifted its monetary policy outlook.

The odds of an interest rate cut on Melbourne Cup Day are firming after the Reserve Bank suddenly shifted to a neutral monetary policy outlook this week, sending the dollar sharply lower.

Traders are expecting a quarter per cent cut in the official cash rate by next February and the market-implied chance of cut by November rose to 56 per cent, from 34 per cent two days ago.

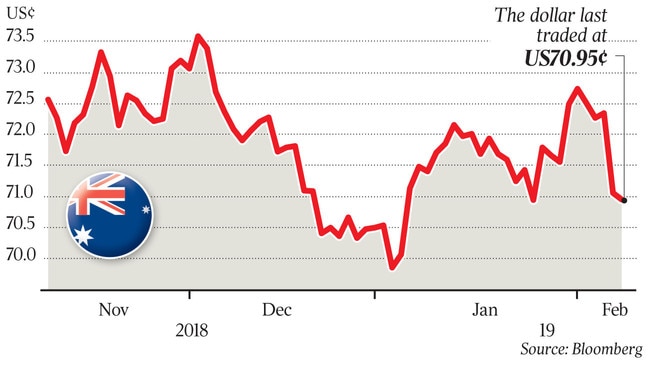

The dollar slipped below US71c last night after falling almost US1.5c since RBA governor Philip Lowe surprised investors on Wednesday by completely abandoning his previous guidance that “the next move in interest rates is more likely to be an increase than a decrease”.

But shares reacted positively, with the S&P/ASX 200 hitting a fresh four-month high of 6105.9.

While most economists expect interest rates to remain on hold, a growing minority feel the RBA will be forced to cut by the end of the year as a slowdown in the global economy combines with weak domestic demand and a sharp fall in house prices, exacerbated by a credit squeeze.

UBS economist George Tharenou was the latest to join the rate-cutting camp, predicting the RBA would lower its cash rate by 25 basis points after its November board meeting — which falls on Melbourne Cup Day — and cut again to a record low of 1 per cent in the first half of 2020.

“We are now officially changing our base case to the RBA cutting,” Mr Tharenou said.

The RBA has held its cash rate steady at a record low of 1.5 per cent since August 2016.

“Given UBS sees economic growth slowing to a below ‘trend’ pace of 2.3 per cent year on year in 2019, and hence a likelihood of a softening — rather than tightening — of the labour market over the next year, and hence little inflation pressure, we now look for a 25-basis-point cut in November, and an additional 25-basis-point cut in the first half of 2020,” Mr Tharenou said.

He said the outlook for rates would depend on how much the jobs market softened in response to slower domestic and global growth and what this meant for inflation and wages.

Other factors would include the duration of the housing downturn amid credit tightening, the extent of the “negative wealth effect” from falling house prices on consumption, and the extent of the pass through of rate cuts to borrowers — especially mortgagees — given “elevated” funding costs at the banks.

“If housing needs support, the RBA would need to cut since regulators effectively ruled out further macroprudential easing recently,” Mr Tharenou said.

“The key near-term upside risk to our view is a much larger than expected fiscal stimulus, albeit we allow for moderate tax cuts and cash transfers in the April budget.”

UBS until recently expected rates to be on hold through to the end of 2020, with a “risk of a cut”.

Economists at Capital Economics and AMP Capital recently predicted that the Reserve Bank would start cutting rates by year end and follow up with another cut in the first half of 2020.

The RBA will detail its updated economic forecasts in its Statement on Monetary Policy today.

Other institutions have recently pushed out the expected timing of the start of rate rises.

CBA was the latest bank to do that, with senior economist Gareth Aird saying the RBA was now unlikely to lift rates until November 2020. He previously forecast a rate rise in November this year.

“Despite retaining an optimistic outlook for the economy as the central bank’s ‘base case’, Dr Lowe has admitted that the RBA is less certain that its next move will be policy tightening,” Mr Aird said.

“Notwithstanding, the RBA’s forecasts imply that the next move is up rather than down.”

He noted that apart from the employment reports, the run of domestic data had been softening over the past two months, and there had been a softer tone to the global data.

“The governor has clearly responded to the signals in the data by changing his forward guidance,” he said. “We continue to believe that governor Lowe is a reluctant rate cutter, but equally, the RBA looks further away from a hike than we previously thought.”

Mr Aird added that a rate rise looked to be “off the cards for the foreseeable future” and a first rise would only be appropriate if the RBA’s forecasts for growth, wages and inflation came to fruition.

NAB’s head of FX strategy, Ray Attrill, argued that Dr Lowe’s comment on Wednesday that it was “entirely plausible” the next move was up, and “possible” it could be down, suggested the RBA still thought a rate rise was slightly more likely than a cut, albeit not for a while.

But he noted that with the money market now fully pricing in a 25-basis-point cut by February next year, it could be interpreted as meaning there was a strong chance rates could eventually hit 1 per cent, given that when the RBA changed tack in early 2016 it cut rates rapidly from 2 per cent to 1.5 per cent.

“On this, while we are not rushing to challenge the currency market’s response to Lowe’s comments, (we) tend to agree that if rates were to be cut once there’s a fair chance they would be cut twice,” Mr Atrill said.

“We would point out that in our short-term fair value model, a 50-point cut to the cash rate only produces about a US1c fall in fair value (for the dollar) and we currently peg fair value at about US71.5c. As such, we aren’t rushing to suggest we are headed back sub-US70c.”