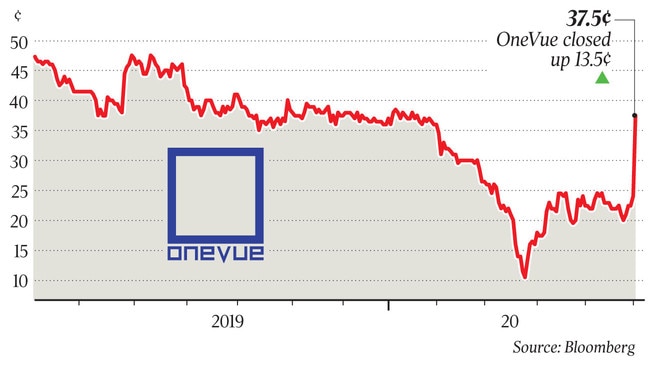

OneVue shares surge on Iress takeover offer

OneVue shares rocketed close to 60 per cent on Monday after financial software company Iress lobbed a $107m takeover offer for the wealth platform provider.

OneVue shares rocketed by almost 60 per cent on Monday after financial software company Iress lobbed a $107m takeover offer for the wealth platform provider.

The takeover, done through a scheme implementation agreement and backed by the OneVue board, will see Iress pay 40c per OneVue share, a 66.7 per cent premium to its last closing share price of 24c.

The takeover will be funded via an equity raising Iress also announced on Monday.

OneVue’s shares surged 58 per cent to 38c on the news and remained at that level through the session, closing just 2c shy of the offer price.

Iress chief executive Andrew Walsh said the acquisition was part of the company’s strategy to generate long-term growth opportunities, leveraging technology and automation, while helping clients achieve efficiency, compliance and growth.

“The combination of OneVue’s strength and position in administration of managed funds, superannuation, and investments, with Iress’ strength in software and data will drive innovation through technology,” he said. “This includes the development of software and services that brings advice and investments closer together, resulting in greater efficiency and productivity for professional advisers and businesses in Australia.

“OneVue has scale in managed funds administration as the largest single third-party fund registry in Australia and there is opportunity to build on OneVue’s business.”

OneVue managing director Connie Mckeage will assist with the transition period and consult on growth, strategy and clients after its completion, Mr Walsh added.

Commenting on the takeover, Ms Mckeage said the all-cash offer would provide certainty for OneVue’s shareholders.

“Iress is a company we have significant respect for and we know they are committed to continuing to deliver high levels of service and excellence to our clients and are looking forward to working more closely alongside our clients and partners,” she said.

The takeover, expected to be completed in late September, is subject to a number of conditions, including regulatory approvals, but is not subject to financing.

Iress will raise $170m through an equity raising, a portion of the funds to be used to fund the acquisition. It will raise $150m via a fully underwritten placement, and $20m via a non-underwritten share purchase plan open to eligible shareholders.

The raising will also help strengthen Iress’ balance sheet and provide it with the capacity to pursue additional investment opportunities, Mr Walsh said.

The software provider chose an equity raising over debt to fund the acquisition because of the current economic environment, he added. “We would have been able to support that level (of debt) and we would have been able to pay it down … it’s really just prudence. We think, on balance, not knowing what’s happening in the broader economy and the world, that was the right conservative move.”