More pain as Australian stockmarket nears bear market

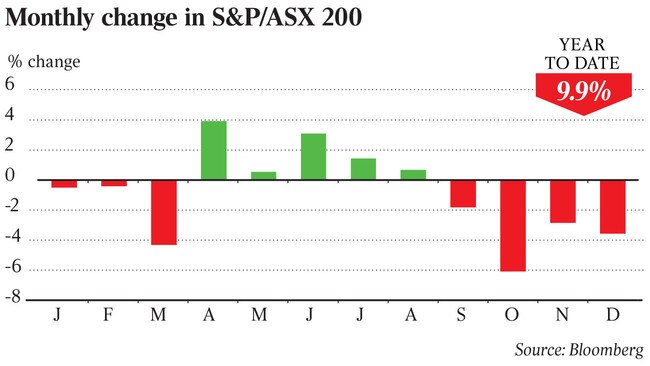

Australian shares are on track for their worst year since 2011 as confidence in the global economy falters.

Australian shares are on track for their worst year since 2011, with most investors facing double-digit losses as confidence in the global economy falters.

Local shares are set to be joining emerging markets and Japan in a bear market for the first time since 2016. At the same time, a 12 per cent fall in the past three months marks the worst December quarter for Australian equities since the global financial crisis erupted in 2008.

The losses come on the back of a wild week in markets that saw further big falls in shares and crude oil and a rush for safe haven assets including government bonds, gold and Japanese yen.

The benchmark S&P/ASX 200 hit a two-year low of 5426.6 points before ending down 0.7 per cent at 5467.6 yesterday.

The falls come on the heels of further sharp losses on Wall Street and renewed selling in Asia. Japan’s Nikkei Stock Average yesterday closed 1.1 per cent lower at a fresh 15-month low, and China’s Shanghai Composite Index was down 0.8 per cent.

Last night futures pointed to opening losses for Wall Street’s S&P 500 and the Dow Jones Industrial Average of 0.4 per cent and 0.3 per cent, respectively.

Deteriorating relations with China also weighed on sentiment after Beijing warned Australia and other US allies that they risked damaging their relations by backing US allegations that the Chinese government had been behind global cyber hacking and intellectual property theft.

After Australia expressed “serious concern about a global campaign” of cyber hacking by a group said to be acting on behalf of China’s Ministry of State Security, China’s Foreign Affairs Ministry warned that countries should “stop deliberate defamation of China, so as not to damage their bilateral relations and co-operation in important areas”.

Beijing said the allegations “severely damaged China-US relations”, casting more doubt on hopes that the retaliatory tariff increases would not go ahead after the trade war “ceasefire” ends on March 1.

“Trade war technicals and geopolitics remains at the top of the list of concerns that could upset the global economy in 2019,” Morgans chief economist Michael Knox yesterday. “The ongoing US-China trade dispute could persist.”

Elsewhere, brokerage Bank of American Merrill Lynch said the US-China trade war was “the main reason for market weakness this year”.

Among China-exposed stocks in Australia, Navitas fell 2.3 per cent, a2 Milk fell 1.6 per cent, Bellamy’s lost 3.6 per cent and Fortescue Metals slipped 1.5 per cent yesterday, but Treasury Wine Estates rose 1.5 per cent, BHP was up 2.3 per cent and Rio Tinto rose 0.7 per cent.

Although there was no broad sell-off in China-facing stocks, the tension fuelled negative sentiment.

Still, this added to an already volatile week where global shares dived after the US Federal Reserve said “some further gradual hikes in interest rates” and quantitative tightening on “automatic pilot” would be consistent with sustained economic expansion after it lifted rates and trimmed its rate projections.

The S&P 500 had its worst reaction to any Fed meeting since 2011 and, in a sign that the longest US bull market in history may have already ended, the Dow Jones Industrial Average was down 10.5 per cent for the month, its worst December since 1931.

Rising bulk commodity prices lent support to the Australian resources sector, although West Texas crude oil dived more than 10 per cent to an 18-month low of $US45.67 a barrel after record production from the three biggest producers in recent months.

Plunging oil prices may also be a canary in the coal mine for the global economy, with a 40 per cent fall in the past three months reminiscent of the savage decline that preceded the 2016 bear market in shares.

Underscoring the demand for safe-haven investments amid concern that economic growth will slow due to lessening central bank liquidity, the US-China trade war, slowing credit growth and a rapidly cooling housing market in Australia, 10-year bond yields hit an 18-month low of 2.33 per cent, while the price of gold and the Japanese yen hit multi-month highs.

After its fall this week, the S&P/ASX 200 index was trading on a 12-month forward price-to-earnings ratio of 13.7 times, the cheapest PE valuation in almost four years and significantly below its decade average of just over 14 times. The forward dividend yield of the index rose to 5.3 per cent, the highest in two years.

From a decade high of 6373.5 points four months ago, the Australian sharemarket has now fallen almost 15 per cent, its biggest correction — defined as a fall of at least 10 per cent — since 2015-2016.

The local bourse is now just 5 per cent off a bear market — defined as a fall of at least 20 per cent.

But analysts said a sustained bear market was not justified as a global recession was not imminent.

“The risks remain skewed to further weakness into the early part of next year as uncertainty remains regarding global growth and investor sentiment looks like it’s still not fully washed out,” said Shane Oliver, head of investment strategy and chief economist at AMP Capital.

“However, we remain of the view that this will be more likely part of a ‘gummy bear’ market that leaves shares down 20 per cent or so from their highs a few months back after which they start to rally again — like we saw most recently in 2015-16 — rather than as part of a long and deep ‘grizzly bear’ market like we saw in the global financial crisis.

“The main reason for this is that we don’t see the US, global or Australian economies sliding into recession anytime soon.”