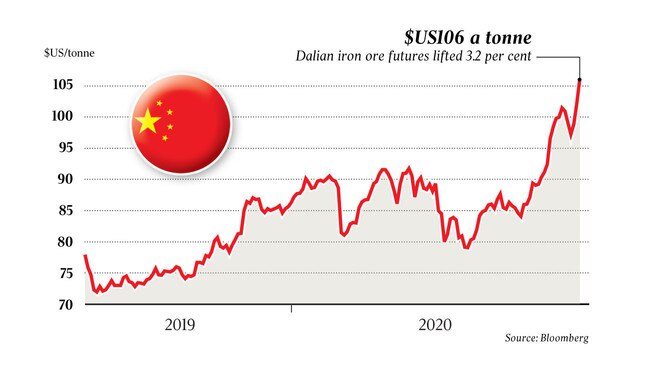

Miners surge as iron price tops $US100

A 3 per cent-plus surge in iron ore futures has bolstered the stocks of Australian miners.

Iron ore futures on the Dalian exchange rose more than 3 per cent on Monday as the iron ore price breezed through the $US100-a-tonne mark to the highest levels in 10 months, lifting shares in Fortescue Metals to record highs.

The resurgent iron ore price came as stocks of iron ore at Chinese ports fall as its industrial heartland recovers from the coronavirus pandemic, and as Brazil’s rampant outbreak puts Vale’s production in renewed doubt.

Late last week Vale successfully fended off a move by Brazilian authorities to close the Itabira iron ore hub — accounting for 36 million tonnes of production in 2019, or about 12 per cent of its total output.

But local media reports indicate the mine, and a suite of others in the north of the country including its massive S11D expansion, remain under threat from the spread of COVID-19.

Any impacts to Brazilian mines are likely to spur further spikes in the iron ore price, which topped $US125 a tonne last year, given it takes about 45 days for a vessel to deliver Vale’s iron ore to Chinese ports and cargoes being delivered now were loaded before the coronavirus became rife in Brazil.

Port stocks in China are now below 110 million tonnes, the lowest levels since 2016, as steel mills increase output, with the price of reinforcing steel bar also up in trading in China on Monday.

Spot iron ore prices hit $US102.50 a tonne over the weekend, spurring strong rises in Australian iron ore producers, largely unaffected by the pandemic.

Iron ore futures traded on China’s Dalian exchange climbed to as much as 775.50 yuan ($US109) on Monday, before falling back in afternoon trading.

Fortescue shares hit a record high of $14.80 on Monday and closed at $14.79, up 89c, or 6.4 per cent. BHP shares gained $1.07, or 3.1 per cent, to close at $35.71, with Rio Tinto closing up 4.1 per cent, or $3.83 at $97.23.

Mount Gibson Iron closed up more than 8 per cent, or 5.5c, at 73.5c, while Mineral Resources gained 3.1 per cent to close at $19.40.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout