Miners slide on sharemarket after plunge in iron ore prices

Earnings forecasts for Australia’s biggest miners have been slashed by plunging iron ore prices, sending stocks sliding amid expectations of further pain to come.

Earnings forecasts for Australia’s biggest miners have been slashed by plunging iron ore prices, sending stocks sliding as investors’ nerves frayed amid expectations of further pain to come.

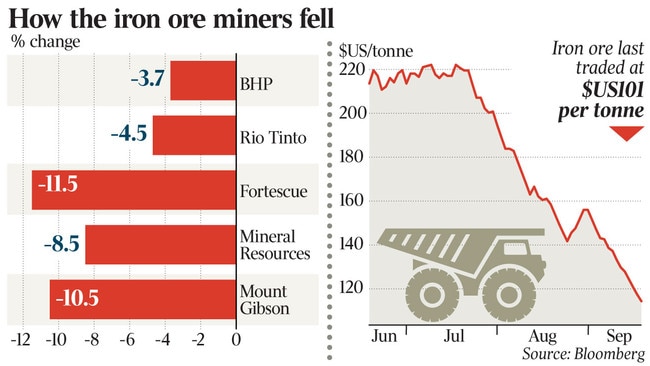

Fortescue shares fell 12 per cent to a 14-month low of $15.27 on Friday.

Rio Tinto fell 4.7 per cent to a 10-month low of $98.80, and BHP fell 3.7 per cent to a 10-month low of $39.16.

The S&P/ASX 200 index fell 0.8 per cent to 7403.7 points.

The price of Australia’s biggest export has more than halved in the past few months after China began enforcing a policy of capping its steel output at last year’s level to curb pollution.

After surging from about $US80 a tonne in April last year to a record high of $US233 in May as Covid-19 disrupted supplies from Brazil and unprecedented policy stimulus fired up China’s economy, the benchmark spot price for 62 per cent iron ore fines hit a 10-month low of $US106.50 on Thursday.

Singapore iron ore futures touched a 10-month low of $US101.30 on Friday.

The iron ore price remains above a decade average of about $US84.50, but the share prices of Rio and BHP – the world’s second and third-biggest iron ore miners behind Brazil’s Vale – have fallen almost 30 per cent from record highs of $137.33 and $54.55 respectively in July.

Shares in Fortescue Metals – the world’s fourth-biggest iron ore miner and Australia’s biggest purely iron ore mining company – have fallen 43 per cent from a record high of $26.58 in July.

Share price falls in the iron ore miners accelerated on Friday after UBS lowered its rating on Fortescue to sell, from neutral, and cut its 12-month target price by 17 per cent to $15.

The Swiss investment bank also cut its target price for Rio by 16 per cent to $86 and its BHP target price by 10 per cent to $38.

“The correction in iron ore prices has played out faster than expected,” UBS analysts said.

“This reflects a sharper than expected slowdown in property activity in China thanks to tightening measures/Evergrande (China’s biggest property developer) risk of default impacting confidence.”

After lowering their iron ore price forecasts to $US89 and $US80 a tonne for the 2022 and 2023 calendar years respectively, down from previous forecasts of $US101 and $US85, UBS analysts consequently cut their earnings per share forecasts for the miner by 31 per cent for both the 2022 and 2023 financial years.

They said Fortescue’s share price was discounting a long-term iron ore price of about $US100 a tonne, well above their long-term price forecast of $US65.

UBS also saw a risk of Covid-19 border restrictions causing further delays and capital expenditure requirements for Fortescue’s $US2.6bn ($3.5bn) Iron Bridge magnetite project, and a risk of wider discounts being applied to Fortescue’s lower-quality ore as China steel mills focus on productivity.

They expected a surplus of iron ore to push prices below $US100 in the next few months.

UBS was also cautious on the medium-term outlook, noting that the incumbents planned to increase supply, Guinea was set to add 100-200 million tonnes a year from 2025-26, and steel scrap in China was expected to increasingly displace iron ore demand.

The iron ore majors would generate free cashflows of less than 5 per cent at normalised prices, according to UBS, potentially weighing on their ability to sustain record high dividends.

JPMorgan analyst Lyndon Fagan said that despite the recent fall in spot iron ore prices, BHP and Rio were trading on free cashflow yields of 16 per cent for the 2022 calendar year and showed upside potential relative to consensus earnings estimates.

Reports of China’s policy of output cuts had been circulating as early as December 30 last year.

But it was not until mid-2021 that the plan to cap steel output at 2020 levels was formalised.

Steel output cuts were mostly implemented in Tangshan in the first half of the year, but because steel margins lifted steelmakers elsewhere in China lifted output.

“Nationalising the policy was key to see China’s total steel output fall and that was formalised around mid-year,” CBA mining and energy commodities strategist Vivek Dhar said.

China’s crude steel output has fallen in each of the past three months. A 13.2 per cent year-on-year fall in August was the biggest since March last year, when Covid-19 hit.

China’s crude steel output still needed to fall about 12 per cent on-year from September to December to keep China’s crude steel flat this year, Mr Dhar said. But he said policymakers would eventually relax steel output restrictions when steel prices increased because the steel output cuts were more severe than any slowdown in China’s steel demand.

“Higher steel and other commodity prices have already irked policymakers because of the concern that it may translate through to higher inflation,” he said.

“In mid‑May, we saw policymakers step into commodity markets in China to limit speculation.

“With steel rebar futures in China having lifted since mid-August, the risk that policymakers relax output cuts has increased, but we’d likely need futures to increase 10-15 per cent from here to warrant meaningful attention from authorities.”

The collapse in iron ore prices has claimed its first victim after listed junior producer Venture Minerals suspended mining operations amid market volatility.

Venture said it had suspended operations at its Riley iron ore mine in Tasmania as it assessed the rapid change in the market.

Congestion in Chinese ports had also added to a volatile shipping market, with shipping rates tripling from the $US18-a-tonne assumption used for its feasibility study to $US54 a tonne now, the company said.

“Although the company believes that some of the external pressure in the market will only be temporary, Venture believes the best course of action is to temporarily suspend mining operations to preserve the reserve base while the company works through potential cost efficiencies and assesses the broader market volatility.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout