Meta’s fall the shape of things to come

The jaw-dropping plunge in the share price of Mark Zuckerberg’s Meta is an ominous pointer to the spectacular volatility the share market faces through a turbulent 2022.

The jaw-dropping mega plunge in the share price of Mark Zuckerberg’s Facebook – newly-named as Meta – is a telling and ominous pointer to the spectacular volatility the share market faces through a turbulent 2022.

I deliberately wrote ‘volatility’ because there will be spectacular rises as well as falls along the way, although the falls will almost certainly add to more than the rises.

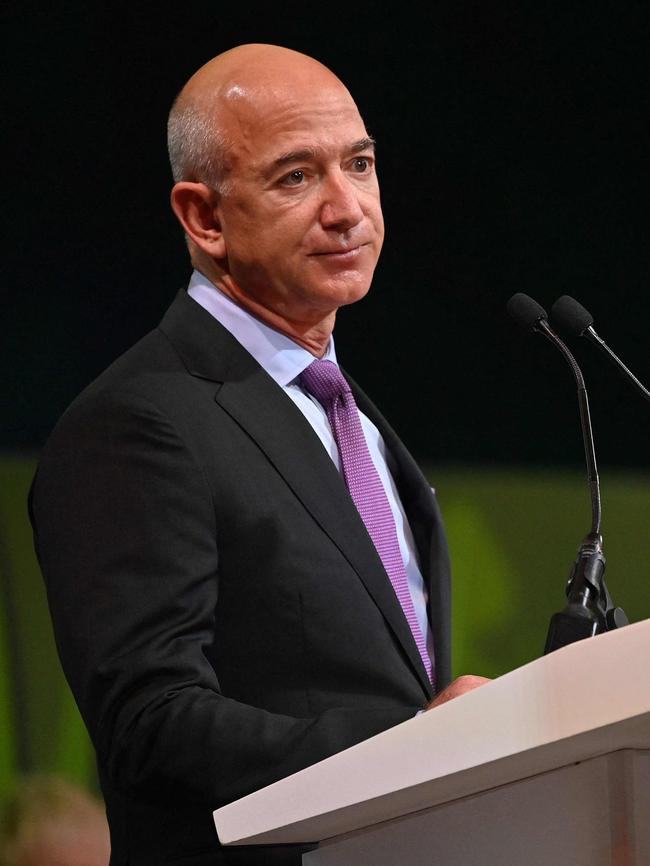

Indeed, we saw this almost immediately two days later – Meta actually plunged in after-market trading Wednesday evening in New York, although it was only officially recorded Thursday morning at the opening – with an almost as spectacular leap in the share price, overnight Friday our time, of Jeff Bezos’s Amazon.

Meta/Facebook plunged 26 per cent in that single day, slashing a numbing $US230bn – $320bn – from the company’s value and so the same percentage drop in the value of every individual shareholding. Zuckerberg himself lost over $US30bn.

Amazon “only” leapt 13.5 per cent, but it’s a much bigger company than Meta and so that meant the value of all its shares leapt almost as much – $190bn – as the fall in Meta’s value.

This added just shy of $20bn to the value of the Bezos fortune – not as much as Zuckerberg lost, but more than enough to pay for all the spaceships Bezos plans to send up.

That’s of course if the Amazon share price doesn’t ultimately follow Meta’s down, as we go through 2022 and Fed head Jerome Powell actually delivers on the interest rate hikes, which for the moment he’s still only “promising” to do, supposedly starting in mid-March.

What we saw so spectacularly in the two specific tech stocks rather neatly mirrored what’s been happening across Wall St so far this year – first, a big fall adding to 7 per cent, and then a sharp rise recovering more than 4 per cent.

Just as with Meta and Amazon, big in both directions, but bigger on the down side. Although I would add, in regard to that 7 per cent/4 per cent, we almost certainly “ain’t seen anything yet”.

Meta plunged despite only slightly missing forecasts of its latest quarterly profit. The market had expected close to $11bn in profit; it made “only” $10bn. And Amazon was the exact opposite, beating expectations.

In the case of Meta, the more telling indicator, that sent investors running for the exits, was Facebook users turning off in accelerating droves.

The broader, more relevant point out of all this for share investors, including Australians, is the extraordinary skittishness shown by investors.

You get a sense of passengers all suddenly surging from one side of the ship to the other – ripping money out of one stock, pouring it suddenly into another. And the “ship” is named “Titanic”: they are all still ultimately going down.

But obviously not all the way to the “bottom”.

That points to the other critical point, playing into this maelstrom of uncertainty and fear – and ever-present greed.

That’s the trillions – to emphasise, not billions but trillions – of dollars sloshing around the world, always searching, searching for an investment home and even more a return, in what had seemed to be a near-permanent time of zero interest rates, thanks to all the money-printing by the world central banks.

The money remains still “printed”; it’s not going to be un-printed anytime soon if ever.

And while interest rates are supposed to be going up, the few rises we’ve seen so far – NZ and the UK stand out, but both are still well below even just 1 per cent – have been tiny.

The share market and property values should fall, when those rates and especially US rates, go up. Indeed, further, the falls should come ahead of the rate rises, in anticipation of them.

And they would if we were talking “normal times”, with rates starting from, say 3 per cent and not zero; and if we didn’t have all those trillions of “extra” money looking for a home.

So this plays out in such spectacular moves in individual stocks. Yes, you flee a Facebook, but you desperately grab an Amazon. While the slow rise in rates slowly squeezes everything.

That’s if, the important qualifier, Powell does deliver; that he doesn’t back off when Wall St throws a real tantrum.

Nobody can therefore guarantee how the year will unfold, beyond the certainty of volatility, against an all-but certain backdrop of a broad move south.

Finally, just to put those Wall St moves in a downunder context.

The Meta/Facebook value plunge was the equivalent of the entire Australian market – the value of every share of every company listed here – plunging by 13 per cent.

Or the entire value of BHP, Australia’s biggest company, and that of Westpac, being entirely obliterated.

And it’s only getting started.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout