Markets: Australian investors stay calm amid uncertainty

Markets were unruffled by the election but confirmation of a majority Labor win was awaited. But the local sharemarket ended near flat on light volume after an early gain.

Markets were unruffled by the election but confirmation of a majority Labor win was awaited.

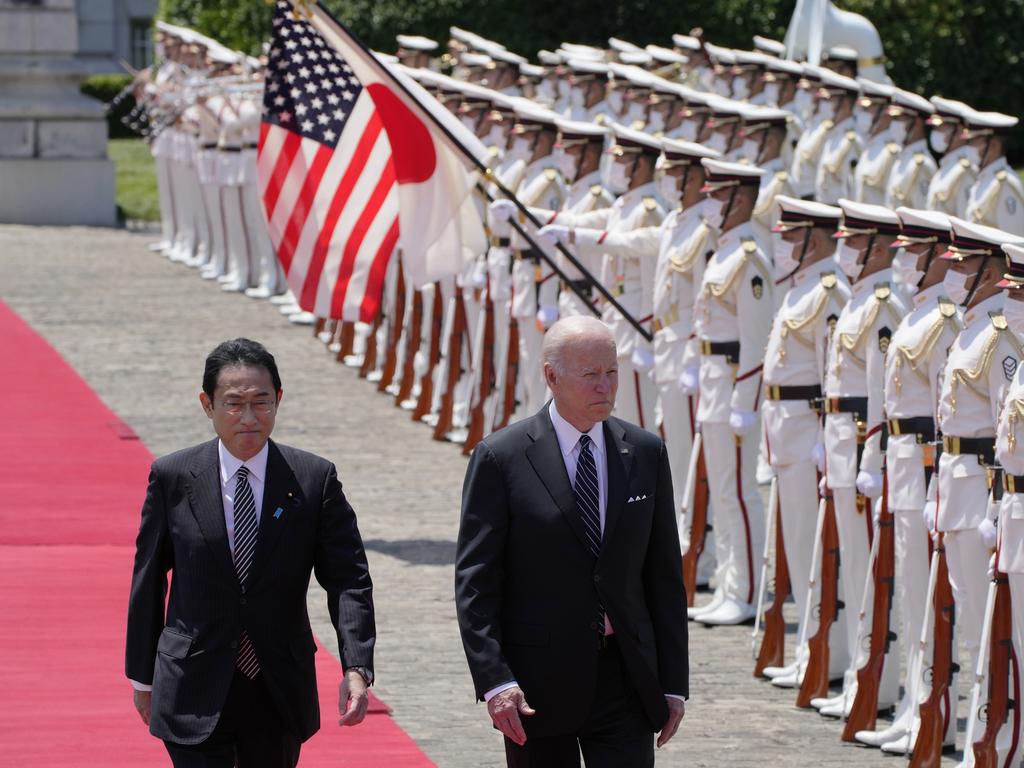

US share index futures, the Australian dollar, government bond yields and commodities rose after US President Biden said he was “considering” lifting tariffs on China.

But the local sharemarket ended near flat on light volume after an early gain.

Since the 1980s, the local market has risen about 4.5 per cent within three months of federal elections as uncertainty about the outcome lessens, according to AMP Capital.

But the first day’s impact appeared to be limited as Labor won with the lowest primary vote since 1934 and investors were uncertain about the influence of minor parties and independents.

Canaccord Genuity analyst Tony Brennan said that while the Labor government’s prospects for implementing its policy agenda look promising, it faced “inevitable challenges”.

“It is likely to get pressure from the cross benches to do more on climate and social policy, particularly if it cannot form a majority government (but) it may have to consider limiting its expenditure initiatives if the economy is too strong and inflation is higher than expected,” he said.

“If the government proceeds as its policies suggest, it could increase the amount of tightening the RBA will have to do over time, potentially adding to the headwinds for markets, which are the basis for our present defensive asset allocation strategy, underweight fixed income and equities.”

RBC chief economist Su-Lin Ong said the lingering uncertainty is a “small negative for markets” while confirmation of a majority government could see a small positive reaction from markets. In the event of a minority Labor government, she expects a small negative reaction from markets.

“Labor will likely need to negotiate with the Greens and a few independents and there is much common ground but such discussions will likely involve some compromise and expenditure. In both outcomes there’s moderately more spending than had Liberal-Nationals won.”

The costings released by Labor indicate that the budget would be $7.4bn worse over the next four years with $18.9bn in additional spending partly offset by $11.5bn in savings measures. A refreshed Labor budget is due to be released in October.

“At the margin, we remain of the view that this keeps pressure on the RBA to continue to normalise policy and move towards neutral sooner rather than later,” Ms Ong said.

“This has more mixed longer-term implications for markets all else being equal – slightly positive for the Australian dollar and marginally negative for bonds.”

“Labor will not control the 76-seat Senate and will need to negotiate with the Greens – who could possibly hold the balance of power – which is also likely to add to some fiscal pressure.”

But the election is unlikely to have a significant or lasting impact on markets given the lack of substantial policy differences between the two major parties.

CBA head of Australian economics Gareth Aird said his forecasts were unchanged after the election and the case for the Reserve Bank to deliver another “business as usual” rate hike of 25 basis points at the June board meeting, rather than something larger, is strong.

He said the latest wages data indicated that Australia is “not facing a prices and wages spiral anything like what is currently being observed in some other jurisdictions” and as a result, the RBA “does not have to run hard against wages growth by aggressively hiking the cash rate”.

In addition, the optics of delivering a larger than 25 basis points increase in the cash rate in June might imply that the RBA board has changed their assessment of the outlook for inflation based on the change of Government,” he added.

But Morgan Stanley equity strategist Chris Nicol said a minority outcome would limit fiscal flexibility as monetary policy tightens, and markets should focus on wage and inflation paths, evolution of climate policy and “any off ramps to alleviate trade friction” with China.

“After election day, it is clear that there will be a change in government to Labor,” he said.

“What is less certain is the incoming party’s ability to achieve a lower house majority of 76 seats.”

“The moderate vote has shifted towards an ever-increasing independent bias, and a greener agenda is clear for younger cohorts, and even if a small majority is achieved, it seems logical to assume that policy will need to evolve to calibrate a broader agenda than prior decades of ‘two-party’ politics.”

A scenario of less-effective fiscal policy settings would “sit somewhat uncomfortably against near-record highs for both housing and equity prices, and the intent of monetary policy to tighten conditions and cool inflation”.

Labor campaigned on wage adjustment to offset cost-of-living pressures, so trade unions and collective bargaining regimes will “start in earnest the debate on wage reset”.

“It is a fine balance, as any perceived wage spiral could only be met with faster and tighter monetary policy adjustment,” Mr Nicol warned.

Labor’s climate policies were more specific in targeting faster decarbonisation and the government will need greater policy in order to placate and satiate a larger independent and Green vote.

“We would look for policies that drive faster adoption rates from both consumers and business,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout