Market rebounds, but a wild ride ahead

Analysts have warned investors to expect wilder swings in stock prices this year.

Analysts have warned investors to expect wilder swings in stock prices this year as central banks around the world unwind their unprecedented stimulus.

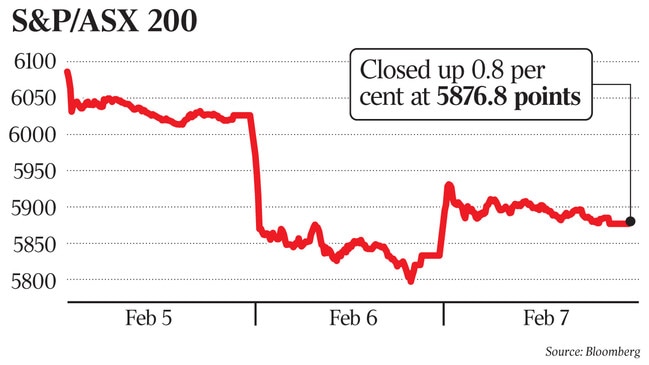

Taking their cue from a resurgent Wall Street, local blue- chip shares yesterday clawed back some losses, the ASX 200 index rising 0.9 per cent yesterday to 5885.

The gains were about half those US stocks enjoyed a day earlier, but the market remained almost 5 per cent down from its January peak of 6141 — the highest point since the global financial crisis a decade ago.

AMP Capital’s Dermot Ryan said: “Volatility has jolted to life in the last few days. Global growth has been running hot and some in the market have forgotten this was facilitated by large amounts of monetary and interest-rate stimulus, which needs to be slowly withdrawn.”

ANZ analyst Tom Kenny said volatility was likely to be higher this year after a remarkably calm few years. “The recent run-up in US equities has, in fact, been remarkable in its lack of volatility,” Mr Kenny said. “The US equity market has had a record-breaking stretch of more than 400 days without a drop of more than 5 per cent. This bout is up there with the 2015 episodes of China instability and the euro area sovereign crisis in 2010-11.”

Scott Morrison yesterday suggested share prices in the US had risen too high given the level of profits. “I think for many there was an expectation that a recalibration was going to occur at some point,” the Treasurer said. “Our market’s different.”

Release of a US payroll report last week showing stronger than expected US wage growth alongside sharply higher US bond yields prompted a rout in US share markets. Over Monday and Tuesday, the ASX200 shed more than $84 billion, or 4.7 per cent of its value — the sharpest drop since Britain voted to leave the EU in 2016.

The S&P 500, the equivalent stockmarket barometer in the US, rallied 1.7 per cent on Tuesday, but not all markets heeded the call. While Australian shares rose by almost 1 per cent, Japan’s benchmark Nikkei 225 index finished up just 0.2 per cent yesterday after paring most of an earlier 3.4 per cent intraday rise, the Hong Kong markets were down 0.6 per cent and China’s Shanghai Composite index closed down 1.8 per cent.

Most analysts said the global shakeout didn’t spell trouble for the US or global economies. “Whatever your fundamental view of the economic backdrop was prior to last week’s jobs report, and the market drop, it should still be exactly the same today,” said Royal Bank of Canada analyst Tom Porcelli.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout