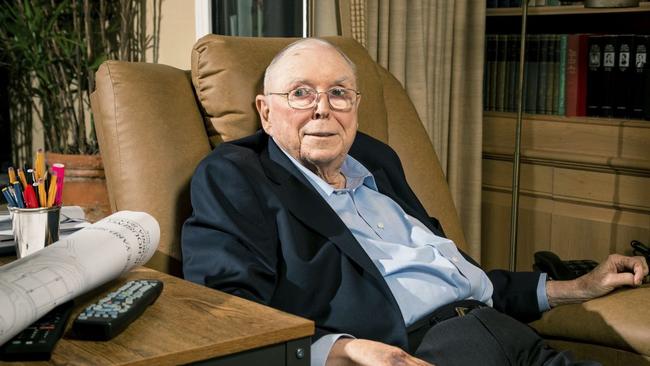

Market now is ‘crazier than the dotcom era’, says Berkshire Hathaway vice-chairman Charlie Munger

Berkshire Hathaway vice-chairman Charlie Munger delivers a trademark razor sharp take on the sharemarket at the Sohn investment conference.

The current sharemarket is “crazier than the dotcom boom,” Berkshire Hathaway vice-chairman Charlie Munger told the Sohn Hearts & Minds Investment Conference on Friday.

Interviewed by Caledonia chairman Mark Nelson, the 97-year-old Munger said the current sharemarket was the most extreme he had seen in recent history.

“Some of the valuations we saw in the dotcom boom were higher,” he said. “But overall, I consider this as being even crazier than the dotcom boom which blew up in 2000.”

He said many companies were now trading on the US sharemarket at prices that represented 35 times earnings – making it much harder for ordinary investors to make money on the market.

The higher prices now being paid for good companies made it more difficult to get good returns.

“It is hard to get results which could be called normal results in investing,” Mr Munger said.

In a wide-ranging video interview, the Los Angeles-based Mr Munger said Australia should play a role in promoting a better relationship between the US and China and hit out at cryptocurrencies, which he said “should never have been invented”.

He said China and the US needed to work harder to “get along with each other”. He said China had done the right thing by banning cryptocurrencies.

“My country has made the wrong decision (not to ban them),” he said.

“I want to make money by selling people things that are good for them, not things that are bad for them.”

He said the purveyors of cryptocurrencies were “not thinking about the customer, they are just thinking about themselves”.

A billionaire in his own right estimated to be worth more than $2bn, Mr Munger is well known for his lengthy and successful partnership with Warren Buffett.

The two have razor-sharp minds, with their investment strategies honed by the interaction of their behind-the-scenes debates over investments, a relationship that goes back decades.

Mr Buffett and Mr Munger were both born in Omaha but Mr Munger moved to the west coast to study at Caltech in Pasadena, where he still lives.

Mr Munger has been a long-time fan of US tech stocks, with Berkshire Hathaway now a major shareholder in Apple.

He is known for his dry comments on the madness of the investing crowds.

On Friday, he singled out US discount retailer Costco as one of his favourite companies, saying it had the right model – in having its customers become members – and a strong focus on holding down costs.

He said its business model allowed it to hold down prices by buying in bulk and deliver good value for its members. “We are all lucky to have Costco.”

He said having membership requirements for people to become shoppers meant people who went into Costco stores went into them to buy, adding he would back Costco over US internet retail giant Amazon. “I predict that Costco will eventually become a huge internet player,” he said.

“People trust it and they have enormous purchasing power to reduce prices.” He said it would be a “sentence from hell” to have to compete with Costco.

He said Chinese electric car company BYD was another great company. Berkshire Hathaway has been a long-time investor in the company that has pioneered the development of electric cars and buses in China.

“China is proud of BYD and it should be proud of it,” Mr Munger said. “It is one of the best companies in the world.”

Mr Munger said he was a big fan of the shift to renewable energy. “I would be in favour of using a lot more renewable energy from wind and solar, even if there were no global warming problem,” he said.

“Saving the hydrocarbons for future generations instead of blowing them all in one big blast is a very smart thing to do, even if there were no global warming.

“I love the fact we’re rapidly reducing the burning of coal and the burning of gasoline and diesel … and replacing them with electricity from renewable sources.”

Mr Munger said he was a big fan of Australia, which he has visited, as it was a country that had done well after its start as a penal colony.

He said Australia had also done well out of the growth of China.

He praised the leadership of Singapore founder Lee Kuan Yew and said countries would be better off if they had less “pure democracy” and more “oligarchy.”

Mr Munger said the world was “a very different world than what I am used to”.

He said he found millennials “very peculiar” as they were “ very self centred and very leftist”.

Mr Munger said he thought all successful investment was value investing “in the sense that you’re trying to get better prospects than you’re paying for”.

“There’s no great company that can’t be turned into a bad investment, just by raising the price,” he said.

Part of being a good business was knowing which areas to invest in and which areas to keep out of.

“Part of intelligent business is knowing the business that you don’t want and keeping (them) out,” he said. All investors in the market today, including him, were “still looking for more value than I pay for”.

Mr Munger said there were plenty of people around today who were overconfident of their own abilities, particularly those paid for their commentary or advice.

“The ordinary human experience is to be way overconfident in your own ideas, particularly if you’ve worked hard for them and express them to other people,” he said. “The world is full of insanely overconfident people and of course they make lots of mistakes.”

Mr Munger said the success of his long-term partnership with Berkshire Hathaway founder Mr Buffett was that they both had a clear idea of what areas they knew and what areas they didn’t.

“I don’t think we’re that smart, I don’t think that we’re that diligent,” he said.

“We’ve had more success than our smartness and diligence would normally cause. I attribute that to the fact that we’re better than most people at knowing what we know and what we don’t know.”

Mr Munger said there was less enthusiasm about China in the US than there had been in the past.

“Almost every capitalist is less enthusiastic about China than they were a year ago, but I am not despairing at all about China,” he said. “I don’t think we’re going to have a nuclear war.

“And if we don’t have one, I think the only thing to do is to get along with China and I think both China and the United States will be smart enough to see that … Nothing is more important to both countries than getting along with the other one. And that’s what I think will happen.”

He described Amazon founder Jeff Bezos as a “very brilliant man”.

“He’s worked very hard and he’s somewhat fanatic and of course he’s had a remarkable result,” he said. “And he caught a big wave on purpose, and played it harder than almost anybody else.

“He wouldn’t have been so successful if there hadn’t been an internet wave for him to ride, but there was an internet wave and when he saw it, he got aboard, he threw aside everything else in his life and just headed for the top of that wave and he’s been surfing ever since.”

He said Tesla founder Elon Musk was also very capable, but was overconfident in himself.

Mr Musk was “also very able, but he thinks he’s even more able than he is and that’s helped him … Never underestimate the man who over-estimates himself. Well obviously, some of the extreme successes are going to come from people who try very extreme things because they’re overconfident. And when they succeed, well there you get Elon Musk.”