Market meltdown ‘the worst ever’

The most brutal selldown in Australian stockmarket history has left share prices, super funds and share portfolios pummelled.

The most brutal selldown in Australian stockmarket history has left share prices, super funds and share portfolios trading at fractions of their former value as the financial impacts of coronavirus continue to carve through the market.

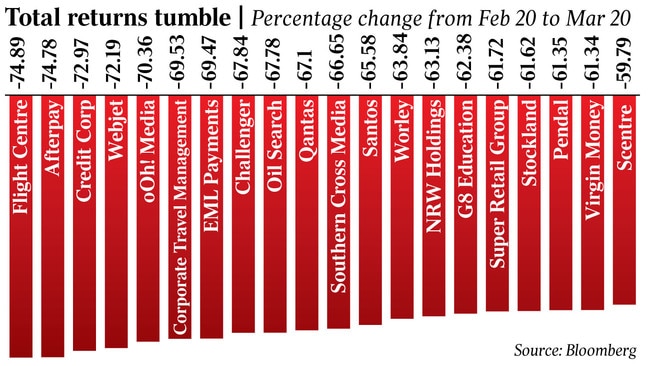

Even after a rally on Friday that led to double-digit gains for some stocks, the violent plunge over the past month has caused eye-watering losses for some of corporate Australia’s most recognisable names.

For long-term market watchers, the coronavirus collapse has quickly established itself as a rival to the infamous market falls such as the global financial crisis, the Asian financial crisis and the 1987 market crash.

MST Marquee investment strategist Hasan Tevfik said there was a case to be made that the meltdown was the most severe seen on our shores.

“There’s never been a bear market this sharp and brutal in Australia, not even during the 87 crash,” he told The Weekend Australian.

Of the 200 stocks that make up the S&P/ASX 200 index of Australia’s biggest and most traded corporate names, almost a quarter have fallen by more than 50 per cent over the last month.

Among them are household names such as Qantas (down 60 per cent) and Flight Centre (down 75 per cent), and large-cap stocks that would have been a part of portfolios across the country such as Woodside Petroleum (down 47 per cent) and Santos (down 60 per cent).

The new wave of tech start-ups that have been flying high in recent years have fallen sharply back to earth as they attempt to navigate through their first genuine economic crisis. Afterpay had shed an astounding 75 per cent in value before rebounding yesterday, while WiseTech had halved.

Casino heavyweight Crown, meanwhile, entered a trading halt on Friday pending an update on its discussions with the Victorian government over the fate of its Melbourne casino. It has also halved in value over the past month.

Of those 200 stocks, only seven have shown positive returns — supermarket duo Coles (up 6.3 per cent) and Metcash (up 13.3 per cent), Fisher & Paykel Healthcare (up 7.15 per cent), funeral homes company InvoCare (up 7.2 per cent), Fortescue Metals (up 4 per cent), telco Chorus (up 2.9 per cent) and A2 Milk (up 2.1 per cent).

Exacerbating the fall has been the fact that much of the market entered the crisis carrying high valuations.

Those high trading multiples may now be a thing of the past, and yesterday’s rally points to some investors feeling prepared to look for value.

But Mr Tevfik warned that valuations were but one part of the story facing investors today.

“You can say valuations are attractive, but as always valuations alone are never enough. In bear markets, the cause needs to get addressed,” he said.

“The cause here is the healthcare crisis that is causing an economic collapse.”

While the waves of stimulus and quantitative easing announced in both Australia and internationally have had some impact on the health of the financial system, Mr Tevfik noted that the underlying health and economic challenges remain. The GFC had provided a playbook for governments and central banks to follow: “Every central bank has channelled their inner Mario Draghi; They’ve all basically said they will do whatever it takes,” Mr Tevfik said in reference to the former European Central Bank president. But tackling the virus itself was a tougher challenge for western governments and investors who had never been in a situation like this before.

Until the medical crisis was resolved, Mr Tevfik recommended investors tread with caution.

“There is a health crisis that has turned into an economic crisis that turned into a financial crisis.

“Authorities have probably done enough to stem the financial issues. That’s partly because they’re pretty well versed from the global financial crisis. Now they have to deal with the economic issues and maybe some time down the road you will have some alleviation on the health issues as well.

“But they still remain, so there’s still going to be pressure on risky assets,” he said.

AMP Capital chief economist Shane Oliver said the unfolding crisis had continued to worsen over the past week, noting that signs of market stress and illiquidity had ramped up “dramatically”.

“While the unfolding human crisis is horrible and the flow on to economies makes it all seem increasingly bleak, it is worth continuing to bear in mind some positives from an economic and investment perspective,” he said.

“After 30 per cent-plus falls shares are now cheap, particularly against ultra-low bond yields and interest rates. Forward PEs are now well below long-term averages, even allowing for a fall in earnings.”

He noted the more than 200 stimulus announcements around the world since the crisis began, and said the hit to the economy from coronavirus could be worse than anything seen since World War II.

The aggressive intervention in financial markets would help, but Mr Oliver agreed that investors were not going to see a sustained improvement until the underlying cause of the crisis started to abate.

“While these things will help minimise the downside and boost the recovery, we still need to see evidence that the virus and its economic impact will come under control such that shares and other investment markets can be confident that the worst has been factored in before markets will bottom.

“Right now, this is still lacking.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout