Lithium stocks targeted by short sellers as electric vehicle sales fall flat

A growing number of ASX-listed companies are being targeted by short sellers seeking to take advantage of overinflated valuations and a bleak outlook for stocks exposed to EVs.

A rapidly growing number of companies on the Australian Securities Exchange are being targeted by short sellers looking to exploit inflated valuations as the bourse reaches record levels.

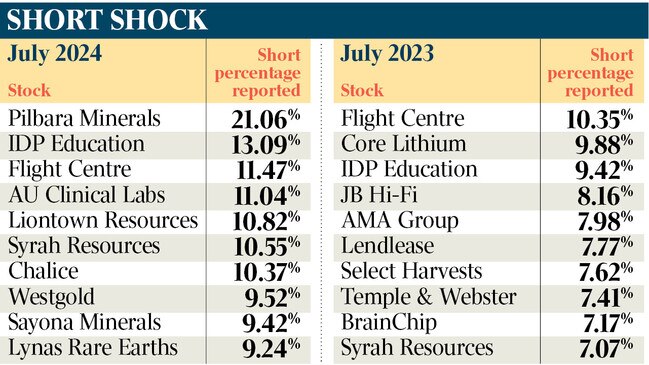

According to Australian Securities and Investments Commission data, as of July 12 seven companies on the ASX had more than 10 per cent of their shares reported as shorted, compared to one in the prior year.

Lithium and other miners of materials used in electric batteries make up seven of the top 10 stocks targeted by short sellers, with 21.06 per cent of Pilbara Minerals shares reported as shorted, compared to 6.2 per cent a year prior. This contrasts with 2023 when retailers were targeted as rising interest rates hit household budgets.

ASIC’s aggregated short position reports rely on the accuracy of reports received from short sellers.

Short sellers bet on and profit from a drop in a security’s price. They typically borrow stock, sell it, and hope to buy the stock at lower prices to meet their borrowing obligations.

Wilson Asset Management lead portfolio manager Oscar Oberg told The Australian that Pilbara Minerals’ reported short position was unheard of.

He said it was being targeted because demand for electric vehicles was not as strong as had been anticipated.

“It’s very rare to see a company with more than 20 per cent of the shares short,” he said.

“If you are a large hedge fund and bearish on the lithium sector there are not many companies to choose from globally. Pilbara is a big company and is very liquid compared to an array of global lithium companies which are not – so perhaps hedge funds are picking the most liquid one.”

Wilson Asset Management does not short stocks.

Pilbara Minerals has declined 41.4 per cent in the past 12 months, trading at $2.99 on Friday. This compares to a gain of 8.8 per cent on the ASX 200 in that period.

Liontown Resources, Syrah Resources and Chalice Mining all have short positions above 10 per cent, while Westgold Resources, Sayona Minerals and Lynas Rare Earths are also in the top 10.

Mr Oberg said short sellers were sophisticated investors or fund managers and were not interested in Pilbara’s free cashflow, but betting that future of lithium was bleak. “When looking to short-sell you are seeing opportunities where you think either the numbers are wrong, a view on valuation or a catalyst that can materially impact the share price,” he said.

Lithium carbonate prices in China are the lowest in three years at 85,500 yuan/tonne ($17,593), down by 85 per cent from a record high of 598,000 yuan/tonne achieved in late 2022.

UBS has a sell recommendation and target price of $2.50 for Pilbara Minerals.

It says valuations still appear stretched despite Pilbara being on track for the high end of fiscal year 2024 production estimates.

UBS analyst Levi Spry downgraded lithium carbonate prices by a further 5 to 16 per cent between 2024 and 2028, saying lithium markets remain “oversupplied” amid continued weakness in western adoption of EVs.

“With increased uncertainty on the long-term demand outlook ex-China and continued opaqueness on near-term supply additions from China/Africa, we remain underweight the sector,” he said in a broker note. “On the supply side, we continue to see new growth and have added significant new supply (recently).

“We continue to think downside risk remains and prices are unlikely to trend higher soon.”

International education provider IDP Education was the second-most-shorted stock on the ASX with 13.1 per cent of all shares reported as shorted, after the federal government moved to limit the numbers of international students.

Flight Centre was third at 11.5 per cent, partly from convertible note investors who want to protect themselves from capital losses. Australian Clinical Labs was next at 11 per cent.

Mr Oberg said that short sellers can often target sectors that are struggling, with an example being the pathology sector, where companies like Australian Clinical Labs and Healius had high levels of short interest. Some expect the former to face earnings downgrades.

“This theme filters into Healius (with a reported short position of 7.6 per cent), which we own. We think Healius can sell their radiology business and reduce debt, which should see the share price recover,” he said.

Mr Ober said traditional investors should be concerned if a company had not attracted the attention of short sellers suddenly began to.

“When someone takes a bet on the short side, they’re taking the reverse bet of someone looking to buy the company,” he said.

“When you own a company and you start to see the short interest build up, there is no doubt we are taking notice and trying to understand what that negative view on the stock is.

“For those long-only investors it provides an opportunity because if the short sellers believe their thesis is wrong, they will have to buy back the stock, which can send the share price higher”

In July 2023, the most-shorted companies included JB Hi-Fi, Select Harvests, Temple & Webster, BrainChip, Lendlease and Flight Centre.

The recent short selling follows rising interest rates and inflationary pressures that have reduced discretionary spending.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout