Kogan dives, Nanosonics surges – ASX 200 edges up as hits and misses roll in

Mixed results have led to big moves in share prices but overall reporting season has been good enough to allow Australia’s sharemarket to keep edging up.

Mixed results and outlook statements from corporate Australia have caused some big moves in share prices so far this week but overall the reporting season has been good enough to allow the sharemarket to keep edging up amid a strong rebound in global equities and commodities.

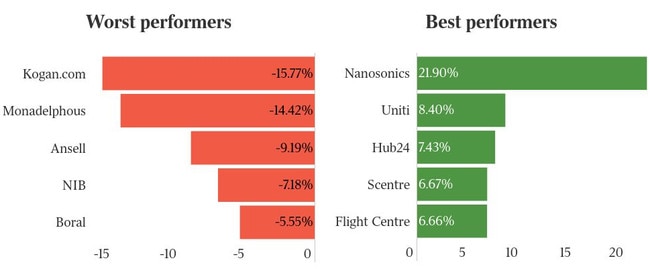

Kogan.com plunged 16 per cent, Monadelphous dropped 14 per cent and Ansell dived 9 per cent after reporting on Tuesday, but Nanosonics surged 22 per cent, Uniti Group jumped 8.4 per cent, HUB24 rose 7.4 per cent and Scentre jumped 6.7 per cent.

The overall market rose for a second day amid solid gains in resources stocks as global equites and commodities bounced and travel stocks got a handy lift from offshore peer gains after the US regulator gave full approval to the Pfizer-BioNtech vaccine, with Qantas up 5.5 per cent.

NSW Premier Gladys Berejiklian’s plan to announce later this week some lessening of restrictions for vaccinated people in September offered some light at the end of the tunnel.

Kogan’s result was largely pre-released, but the retailer was tracking ahead of expectations for July and August, with gross margins better than June, according to RBC’s Chami Ratnapala.

“Our pricing analysis as of mid-August has seen largely reduced levels of discounting within Kogan’s key products categories and if these trends continue amid supply shortages and ongoing lockdowns, we expect upside to Kogan’s gross margins at the next result,” he said.

He saw Kogan as a “key beneficiary of the ongoing lockdowns”, similar to other e-commerce players.

JD.com shares surged 15 per cent in Hong Kong on Tuesday after reporting surprisingly strong revenue growth.

Alibaba shares were up 9 per cent on the back of that.

Monadelphous shares dived as the company forecast 2021-22 revenue declines which, when combined with ongoing labour pressures, may result in “meaningful consensus earnings downgrades for the year ahead” before recovering in 2022-23, according to JPMorgan’s Wei-Weng Chen.

The engineering and construction services group said 2021-22 revenue was likely to be lower due to the timing of new projects before an expected pick-up in construction activity in 2022-23.

Buoyant resources, energy and infrastructure sectors were expected to provide a solid pipeline of activities and maintenance activity was expected to grow steadily, although a shortage of skilled labour shortages remained a major challenge.

“Following today, we would expect revisions to consensus sales estimates with larger revisions to earnings due to continued margin pressure,” said Mr Chen.

Life science company Nanosonics reported stronger than expected 2020-21 revenue growth as US consumables sales came in about $7m higher than forecast in the second half, with ultrasound procedure volumes normalising and some possible stocking adjustments.

CEO Michael Kavanagh said Nanosonics’ growth agenda remained “very much intact with significant opportunities for growth of the trophon franchise”, plus the release of new products.

Japan is set to become an important contributor to its growth as well as further expansion across Asia-Pacific including China, and it flagged a new revenue opportunity associated with its global launch of AuditPro and other new products. Ansell was smashed as its 2020-21 normalised earnings per share of $US1.92 missed the consensus estimate by 3.5 per cent, even though the midpoint of its 2021-22 guidance range of $US1.75-$US1.95 was “comfortably above the median consensus forecast of $US1.78”, according to JPMorgan’s David Low.

The guidance implied the 2020-21 profit – significantly boosted by Covid – can be maintained in 2021-22.

Mr Low also noted that health division results were “very strong” and 3 per cent ahead of his forecasts, although the industrial result missed his estimate with EBIT declining in the second half.

“This was still up 21 per cent on FY20 results but the deterioration is concerning,” he said.

Operating cashflow was “well below” his forecast as the group raised inventory to meet demand.

On the demand side, Ansell flagged continued strong demand across the portfolio, except for areas that benefited the most from Covid – Hemical body protection and exam gloves.

On the supply side, it said increasing Covid cases in South-East Asia impacted production which may impact sales in 1H22, and elevated freight costs and shipping delays are expected to stay in 2021-22.

For HUB24, Citi’s Siraj Ahmed said underlying net profit of $15m was 16 per cent below a market consensus of $17.9m, with the miss driven by lower than expected revenue margin, with the core HUB24 revenue margin declining 7 basis points half of half.

But 2022-23 funds under administration guidance was about 7 per cent better than expected.

Mr Ahmed said a weaker than expected revenue margin could have been anticipated by the market given recent results by Netwealth and Praemium.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout