Josh Frydenberg shrugs off dollar’s ‘flash crash’ to 10-year low

Josh Frydenberg has played down a brief ‘flash crash’ in the dollar, which has briefly plunged to its lowest level in a decade.

Josh Frydenberg has played down a brief “flash crash” in the dollar, which plunged to its lowest level in a decade briefly yesterday amid broader fears of an economic slowdown in China that could have the potential to hurt the local economy.

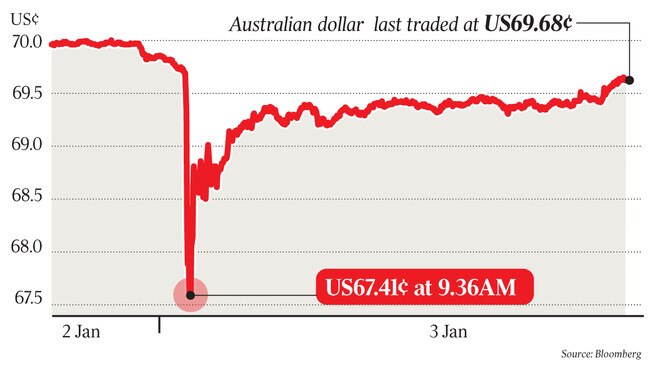

The currency, which was holding steady just above US70c on Wednesday, fell sharply to US67.41c early yesterday morning — the lowest point for the dollar since 2009.

The currency recovered from its shock 3 per cent collapse by the afternoon, with traders blaming the slump on algorithmic trading.

Other currencies were hit during yesterday’s sharp repricing. The British pound was down by 0.4 per cent against the yen and the US dollar fell 3.7 per cent against the Japanese currency, while other Asian currencies were also sold down. Last night the Aussie was trading at US69.68c.

Traders pointed to a significant jump in currency trading volumes on Japanese retail trading platforms, poor liquidity elsewhere in the market, and the fragility of investor sentiment after a bleak and volatile end to 2018 as key factors behind the market moves.

“Moves of this scale … carry all the hallmarks of a sudden disappearance of liquidity, which was initially most apparent in the US dollar-Japanese yen exchange — and on a day when the Tokyo market is out on holiday,” said Ray Attrill, head of forex strategy at National Australia Bank. “In past ‘flash crashes’, last witnessed in the New Zealand dollar in August 2015 and British pound in October 2016, the sudden disappearance of the liquidity otherwise provided by algorithmic trading entities greatly amplified initial sharp moves lower.”

Even so, the Australian dollar — a common barometer of risk appetite among traders — has come under pressure in recent weeks.

On Wednesday, figures showed China’s manufacturing activity contracted last month, the first contraction in two years.

Meanwhile, the acceleration in the housing market slide in Australia has spooked investors, who now fear the Reserve Bank could be forced to cut official interest rates further if falling property prices scare consumers into shutting their wallets.

The Australian 10-year government bond yield sunk to 2.16 per cent, down from 2.35 per cent just a week ago, as money managers fear a slower economic recovery.

The Treasurer yesterday said the Australian dollar was the fifth most traded currency in the world and bounced around from time to time.

“At this time of year you see a smaller volume of trade so I wouldn’t read too much into that,” Mr Frydenberg said yesterday. “The dollar moves up and down and it’s not for the treasurer to comment on the daily movements of the Australian dollar.

“There are a variety of factors at play when it comes to the dollar, including what’s happened in the United States with their interest rates and we’ll see what happens in future weeks and months.”

Chris Weston, head of research at Pepperstone Group in Melbourne, said the flash crash was “absolutely nuts”.

Mr Weston said it appeared the US dollar first collapsed against the yen, and that dragged the major currency pairs with it.

“It comes at a time when the markets are very anxious anyway,” he said.

IFM Investors chief economist Alex Joiner said there was a “fair bit of negative sentiment around” on both the Australian and global economy.

The Australian dollar has fallen more than US10c over the past year as the US Federal Reserve raises official interest rates, drawing more global money into the US.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout