Janet Yellen says Fed will take a break from rate hikes

Former US Federal Reserve chair Janet Yellen expects the central bank to take a break from its tightening cycle.

Former US Federal Reserve chair Janet Yellen expects the central bank to take a break from its interest rate tightening cycle before it resumes rate hikes to ensure the world’s largest economy doesn’t overheat.

Dr Yellen told the UBS Greater China Conference in Shanghai she expects the Fed to take a pause from rate hikes.

“It makes sense to call a time-out to evaluate policy.”

She also noted America’s labour market was tight and getting tighter: “I would anticipate that one or two rate hikes could be needed to stop the US economy overheating,” she told the conference via video link from Atlanta.

The US central bank raised the federal funds rate four times in 2018 as the economy gathered momentum and jobs were created. The US unemployment rate sits at 3.9 per cent after 312,000 jobs were added in December, making 2018 the best year for job creation since 2015.

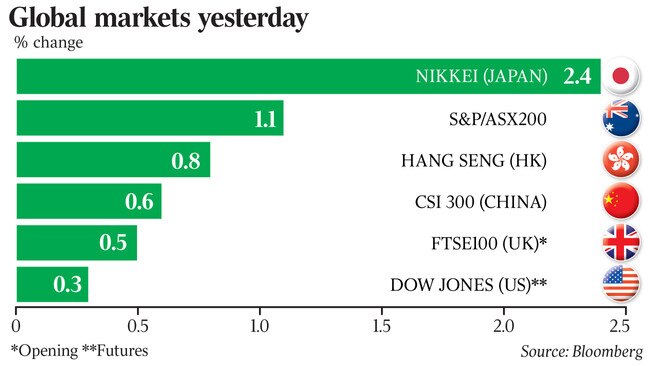

Amid wild market swings and concerns over US company earnings and trade disputes, market participants have, however, adjusted their expectations for US rate hikes in 2019 over recent weeks.

Ms Yellen’s latest comments are consistent with those of current Fed chair Jerome Powell, who on Friday said he was aware of the risks being priced in by markets and was “listening very carefully” to investor signals.

“As always, there is no preset path for policy,” Powell told the at the American Economic Association’s annual meeting. “And particularly with muted inflation readings that we’ve seen coming in, we will be patient as we watch to see how the economy evolves.”

Ms Yellen is also understood to have told UBS conference attendees she did not see “serious imbalances” in the US economy, although sensitivities in trade policies with China had the potential to curtail investment spending by companies.

In December a quarter-point rate hike in 2019 was being pencilled in, but now the market is factoring in a more than 50 per cent chance of a reduction this year.

Still, the Federal Open Market Committee last month said in light of its expectations on the labour market and inflation it had raised its target range for the federal funds rate to 2.25 per cent to 2.5 per cent. “In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realised and expected economic conditions relative to its maximum employment objective and its symmetric 2 per cent inflation objective.”

Participants at the UBS conference — 2800 attendees including institutional investors and companies - were also keen to hear views on trade ructions between the US and China, and expectations for the latter’s economic prospects.

Dr Zhou Xiaochuan, ex-Governor of the People’s Bank of China, told investors at the conference he expects “more proactive fiscal and monetary policies in these circumstances.”

“We still have room for quantitative adjustment for monetary policy,” Dr Zhou said.

“Monetary policy will continue to support economic growth, job creation and investment. We hope to see better co-operation between fiscal policy and monetary policy. China is going in a good direction in better exchange rate policy.”

UBS chairman Axel Weber said Presidents Donald Trump and Xi Jinping last meeting showed they want an agreement on the US-China trade dispute. “It is really setting the stage for collaboration between the economies rather than confrontation,” he said.

The US and China are continuing discussion over their trade relationship but need to reach a conclusion by March 1, or new tariffs will be imposed.

On the outlook for Europe, Dr Weber said policymakers were treading cautiously.

“The European Central Bank is clearly in a wait-and-see mode. The amount of uncertainty and volatility is a factor monetary policy has to look at. Uncertainty per se has been at a record low. Uncertainty has normalised as monetary policy has normalised,” he added.”

The author travelled to Shanghai as a guest of UBS

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout