Investors’ hope rise as states signal easing lockdown restrictions

Local equities are likely to open higher as investors focus on Australia’s plan to reopen the economy through stages.

Local equities are likely to open higher after a strong lead from Wall Street, as investors focus on Australia’s plan to reopen its economy with a three-stage easing of restrictions.

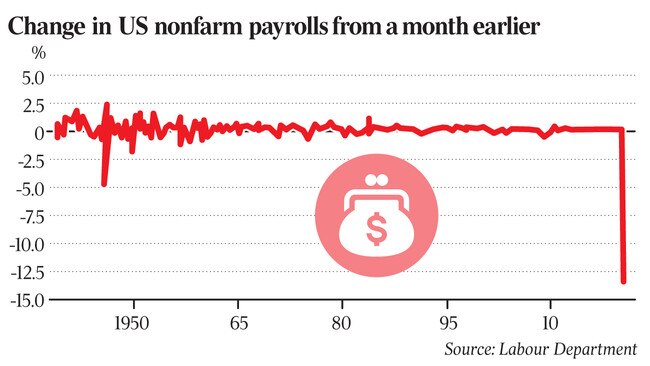

Benchmark indexes in the US shrugged off terrible jobs news on Friday, with 20.5 million positions lost as the country’s unemployment rate surged from 4.4 per cent in March to 14.7 per cent — the worst since the Great Depression.

Counterintuitively, the S&P 500 kicked up 1.7 per cent because the figures were not as bad as expected, and amid hopes of easing trade tensions between the US and China.

Also, the sharemarket continued its habit of anticipating better times, as Australia and New Zealand, and select parts of the US and Europe, said they would gradually restart their economies.

Local futures edged up only 3 points, or 0.1 per cent, in response to the stronger US market.

AMP Capital head of investment strategy and chief economist Shane Oliver said the muted response suggested investors had factored in the 0.5 per cent advance in local shares on Friday that snapped a two-day losing streak, and the 2.8 per cent gain for the week.

“We’re looking at a flat to slightly positive opening on Monday,” Dr Oliver said.

On Friday, Scott Morrison and state and territory leaders agreed to a three-stage plan to restart business and community activities.

However, the states and territories will move through the stages at varying speeds, depending on local conditions.

Treasury said it was possible to restore 851,000 jobs in coming months if things went to plan.

While NSW Premier Gladys Berejiklian and Victorian counterpart Daniel Andrews initially signalled they would not be rushed, Ms Berejiklian said on Sunday that restrictions would be eased on Friday in line with stage one.

Mr Andrews said he would announce his recovery plan on Monday.

Dr Oliver said markets were likely to welcome NSW’s reopening plan.

“There were also positive signs over the weekend that people were out and about in shopping centres,” he said.

Australian Retailers Association chief executive Paul Zahra said the activity was a “really great sign” for the hard-pressed retail sector, and a natural response to easing the lockdown around the country.

“At the same time we want a safe restart, not a false start,” Mr Zahra told the ABC.

“And we are still waiting on a green light from some state governments before the full reopening of retail.”

The outcome of the national cabinet meeting came ahead of an economic statement to parliament by Josh Frydenberg.

The statement will be delivered on Tuesday, replacing the scheduled announcement of the federal budget, which has been delayed until October due to the pandemic.

The main data release this week will be the national jobs figure on Thursday, which is expected to show a record 750,000 drop in employment.

This is consistent with the Reserve Bank’s baseline economic forecast of a 10 per cent hit to gross domestic product in the first half of the year, or 6 per cent through 2020.

Unemployment is expected to peak at about 10 per cent in the coming months before falling to 7.5 per cent by the end of the year.

Dr Oliver said economic data globally, and in Australia, had continued to worsen, but there were early signs that actual economic activity might have bottomed.

“Given the lagged nature of most data, we will likely be seeing bad news for a while yet, with June quarter GDP data, which is expected to show a 10 per cent slump in the US, Europe and Australia, not due for another three months and not due until early September in Australia,” he said.

“However, there are early signs from high frequency data that activity may have hit bottom and markets will mostly focus on this.

“Provided we are right and shutdowns ease from now, resulting in April or May proving to be the low point in economic activity, then given the massive policy stimulus already seen, shares should be higher on a 12-month outlook.”

On the downside, there were three significant risks to consider. First, there could be a second wave of COVID-19, with the US most at risk. Second, collateral damage from the shutdowns could include permanent company closures and rising default defaults on debts; and finally, economic recovery could be knocked off course by an escalation in US-China tensions.

Taken together, 21.4 million US jobs were destroyed in March and April, nearly equal to the 23 million positions created in the economy’s long expansion from February 2010 to February 2020.

The share of the population working fell to a record low of 51.3 per cent in April after steadily rising from about 58 per cent since the last recession to just above 61 per cent in February.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout