Investors brace for worst financial year since the GFC

Australia’s sharemarket is heading for its worst financial year in over a decade as the coronavirus pandemic casts a long shadow.

Australia’s sharemarket is heading for its worst financial year in over a decade as the coronavirus pandemic casts a long shadow over the outlook for economic growth and corporate earnings.

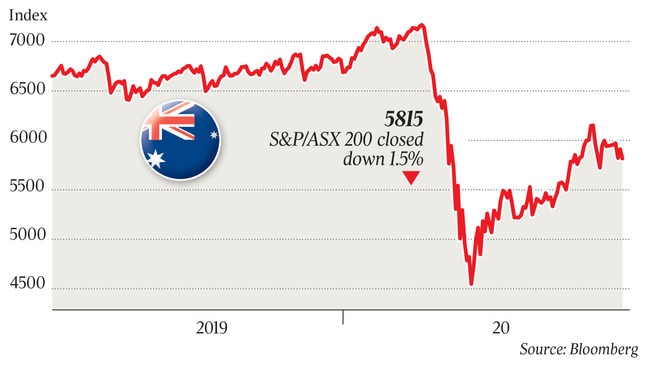

Even after the fastest rebound on record, the local bourse is still 24 per cent below its peak.

For superannuation investors, this could be the first negative since the global financial crisis.

The benchmark S&P/ASX 200 share index was down 12 per cent for the financial year to date after diving 1.5 per cent to a two-week low of 5815 points on Monday as the worsening pandemic in the US and Australia outweighed news of China’s first rise in industrial profits since November.

The index hasn’t had a negative financial year since 2015-16 when it fell 5.1 per cent after a near meltdown in China’s financial markets and collapse in oil prices at that time.

Barring a rise of more than 1 per cent on Tuesday, this will be the worst financial year since a 25 per cent fall in 2008-09 — the financial year that encompassed the global financial crisis of 2008.

For superannuation fund investors, the median growth fund, with a 61 to 80 per cent exposure to growth assets such as equities, was on track for a return of minus 1.6 per cent, including dividends reinvested.

Four months after the COVID-19 coronavirus pandemic triggered the fastest-ever bear markets in US and Australian shares, superannuation funds are counting the cost in terms of lost performance.

But it’s not a bad result considering the unprecedented public health crisis, quarantines and forced shutdowns of economic activity, as well as the early withdrawal of superannuation in Australia.

“Of course members will never be happy to see their superannuation balance go backwards,” said Chant West senior investment research manager Mano Mohankumar.

“But to contain the loss to such a small figure has to be considered a pretty good outcome in the context of the unprecedented chaos the world has faced from COVID-19.”

The prospect of a negative return comes after a record stretch of positive returns since the GFC.

“It’s important to remember that super funds have had an unprecedented run in terms of the magnitude and consistency of gains over more than 10 years,” Mr Mohankumar told The Australian.

The average return of super funds in the growth category since the GFC low point in March 2009 has been 8.4 per cent per annum, which is well ahead of the typical return objective of the consumer price index plus 3.5 per cent — or about 5.5 per cent per annum — over the same period.

It would also be just the fourth negative year since the start of compulsory super in 1992.

Mr Mohankumar said it was important to remember that super was a long-term investment.

“There are going to be some good times as well as some more challenging periods along the way, so it’s important for members to stay focused and not be distracted by short-term noise.

“Of course not everyone has the same tolerance in terms of seeing their balances go backwards … and older members who are closer to retirement would obviously be more concerned, but timing the market is a really risky proposition and you need to be careful.

“If for example you switch to a lower-risk option or cash, after a period of sharp sharemarket falls, not only do you crystallise those losses, but you miss out on part or all of any subsequent rebound. It depends when you need your money.

“Many older members remain in the system after retirement and move into the pension phase. Many don’t take their money as a lump sum.”

Notwithstanding the ongoing challenges posed by COVID-19 and geopolitical risks from heightened tensions between China and the US and Australia, superannuation has weathered bigger setbacks like the global financial crisis of 2008, when the median growth fund lost 26 per cent.

And investors can take comfort from the fact that growth funds are typically invested in well-diversified portfolios spread across a wide range of growth and defensive asset classes.

“What’s has really helped is diversification,” Mr Mohankumar said.

Australian shares are down, but global shares ex-Australia in local currency have fully recovered, and gains in other asset classes like government bonds have cushioned the blow for weaker local shares.

“Over the long term, the median growth fund has delivered on its risk and return objectives,” Mr Mohankumar said. “Even if we do finish in negative territory, it will be small, and that would still be only the fourth negative return from super over the 28 years since compulsory super began.”

The typical risk objective of super is to have a down year only once in five years.

“You can see that the risk objective has been comfortably met,” he said.

It comes after industry super funds comfortably absorbed the COVID-19 early release of super balances.

Members were allowed to withdraw up to $10,000 in the past three months and will be able to withdraw another $10,000 in the next three months.

“Super funds for the most part managed that very well and were able to stay close to their desired asset allocations,” said Mr Mohankumar.

“I think people underestimated their liquidity levels and the diversity of their member base.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout