Weak economic data would normally be bad for shares, but when US jobs data came in at less than half the expected rise early this month the S&P 500 rose 1.1 per cent on the day.

By Tuesday this week it had risen as much as 2 per cent to a record high of 3950.4.

The US sharemarket’s rise in the past two weeks was helped by the assumption that signs of economic weakness would lock in President Joe Biden’s $US1.9 trillion ($2.5 trillion) fiscal stimulus plan and push out the time when the Federal Reserve starts to “taper” its asset purchases which are pumping $US120bn ($155bn) per month into the US financial system.

So when US retail sales and PPI data for January came in more than twice market expectations on Wednesday – with incredibly strong month-on-month gains of 5.3 per cent and 1.2 per cent respectively – the S&P 500 dipped 0.8 per cent in early trading amid fear of less stimulus.

It might have been worse, except that the market pre-empted – correctly – that the minutes from the Federal Reserve’s January board meeting would come in uber dovish.

“Participants judged that it was likely to take some time for substantial further progress to be achieved,” the Fed minutes say.

“Participants noted that economic conditions were currently far from the committee’s longer-run goals and that the stance for policy would need to remain accommodative until those goals were achieved.”

The minutes note that the “possibility that a larger-than-anticipated fiscal package would be enacted in coming months” was a “modest upside risk to the baseline economic outlook”.

But the further rise in COVID-19 cases in the US, albeit slowing, coupled with developments such as the emergence of more-contagious strains, led the staff to continue to judge that the “risks to the baseline projection were skewed to the downside and that the uncertainty around the forecast was elevated”.

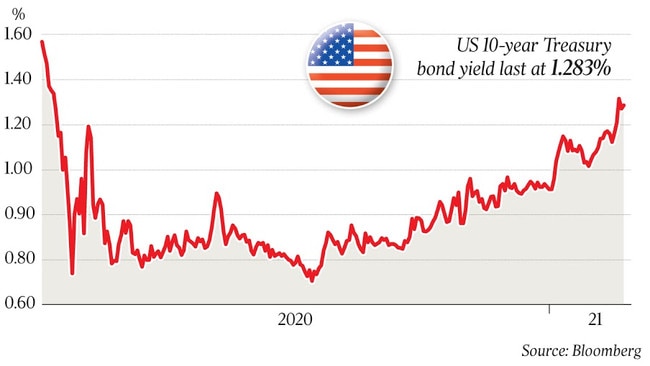

That suggested that QE tapering is some way off and that the sharemarket doesn’t need to worry about a “taper tantrum” like the 82 basis-point rise in the US 10-year yield over about 2½ months that followed such a warning from then Fed president Ben Bernanke in June 2013.

It’s worth noting though that the S&P 500 only fell 5.5 per cent during the taper tantrum before rebounding strongly – it was more of an issue for the bond market – although it might be argued that the sharemarket predicted it to some extent when it peaked in May that year.

Importantly, all of the Fed’s board members reaffirmed that “in accordance with the committee’s goals to achieve maximum employment and inflation at the rate of 2 per cent over the longer run and with inflation running persistently below this longer-run goal, they would aim to achieve inflation moderately above 2 per cent for some time so that inflation averages 2 per cent over time and longer-term inflation expectations remain … at 2 per cent”.

They agreed that the “pandemic continued to pose considerable risks to the outlook”.

“Nonetheless, in light of the expected progress on vaccinations and the change in the outlook for fiscal policy, the medium-term prospects for the economy had improved enough that members decided that the reference in previous post-meeting statements to risks to the economic outlook over the medium term was no longer warranted,” the minutes say.

But while the Fed was clearly expecting stronger economic data, it’s less clear that it was expecting economic data as strong as the January retail sales and PPI – even if they were just for one month.

After an 80 per cent rise in the S&P 500 and a 114 per cent rise in the Nasdaq from the March 2020 low, is it still a case of “bad news is good news and good news is also good news” for shares?

The US 10-year bond yield hit a 12-month high of 1.33 per cent immediately after Wednesday’s strong economic data but later dipped to 1.267 per cent as it anticipated the dovish FOMC minutes and a number of US banks called time on the sell-off/curve steepening that has taken place.

For the global economy, Credit Suisse Australia macro strategist Damien Boey notes that because the US consumer is the buyer of last-resort of goods and services produced globally, US retail data is a strong leading indicator for world industrial production.

If year-ended growth in US real retail sales has accelerated to 6.1 per cent as he now expects, that’s historically consistent with world industrial production rising to an above-trend pace this year.

The acceleration in world IP growth could be even sharper than that of US retail sales, if firms choose to restock, but the key swing factor in over or undershooting dynamics is the strength of the US dollar since a weaker or stronger US dollar tends to go hand-in-hand with greater or lesser availability of US dollar funding to the rest of the world from US banks, Mr Boey explains.

“In turn, greater or lesser US funding availability supports lengthening or shortening of global supply chains via the extension or reduction of trade financing and capital inflows or outflows from emerging market economies pegged to the US dollar,” he says.

While it’s a consensus view that the US dollar should weaken further, supporting a global restocking cycle, he cautions that it’s also possible that stronger US activity and inflation data pushes the tapering debate to another level, triggering higher US real yields and a stronger US dollar, and taking the edge off economic recovery, which is why equity investors are now “a little cautious”.

Is good news on the US economy now bad news for the sharemarket?