Here we go again: stocks set for big fall as oil dives

Investors are bracing for another volatile day on the local sharemarket amid heightened panic over the COVID-19 virus.

Investors are bracing for another volatile day on the local sharemarket, with futures pointing to heavy falls on Monday amid heightened panic over the COVID-19 virus and a rush to safety.

The local sharemarket is tipped to drop 1.5 per cent, or 93 points, at the open after data showed China’s exports collapsed in the first two months of the year due to the coronavirus outbreak, with business activity grinding to a halt, triggering a supply shock.

A plunge in oil prices, meanwhile, brought about by the failure of oil-producing nations to come to an agreement on limiting supply amid a slump in demand, will add to the selling pressure and negative sentiment.

Brent crude, the global benchmark, on Friday fell more than 9 per cent to $US45.27 a barrel, in what was its biggest one-day drop since 2008. US oil prices slumped more than 10 per cent to $US41.28, the biggest one-day drop since late 2014.

Oil prices have collapsed 33 per cent since the start of the year due to the COVID-19 outbreak.

Underscoring the fear gripping markets around the globe, Australian and US government bond yields are skirting record lows, with the Australian 10-year bond yield last week falling to 0.675 per cent as investors seek out safe-haven assets.

Similarly, investors have rushed to US Treasuries, pushing the yield on the 10-year bond to a record-low 0.676 per cent on Friday.

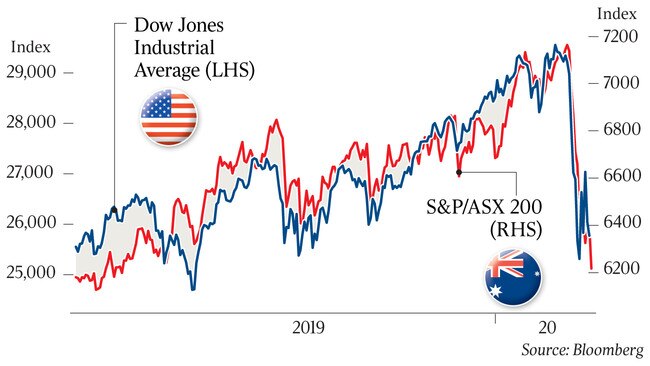

The local sharemarket, meanwhile, has plunged more than 13 per cent in just two weeks as investors shun risky assets, erasing most of its gains for the past year.

Cyan Investment Management director Dean Fergie believes it has a lot further to fall.

“I think we could easily see the broader market fall another 15 per cent,” Mr Fergie told The Australian.

“It could fall that far and then it could bounce back quickly. On a historical basis ... the market has had a very good run. It’s fallen back a lot in the last few weeks but it’s still only back to where it was mid-last year.”

Just over two weeks ago, before the latest market rout, Cyan sold out of any companies it deemed were at risk from COVID-19, including online travel company Webjet. It has since been “opportunistically” buying companies that offered good value, Mr Fergie said.

“We’re not piling all of our money in but we think a bit of selective buying, certainly in stocks that are providing a bit of yield and are looking good value, is probably not a bad place to be.”

Service Stream, McMillan Shakespeare and Kelly Partners are among the companies it has been buying.

“These are companies that we think have a good structural business and are not likely to be impacted too much by these (virus) concerns,” Mr Fergie said.

Other fund managers, including Armytage’s Bradley King, are taking a more cautious approach.

“It’s been a broad-brush sell-off and we haven’t put our ammunition (cash) to use just yet,” Mr King told The Australian.

“We’d like to see how (the virus) goes through the US, since it looks like it’s just getting started there. So we’ll see how it gets contained in that market before we put too much money to work,” he said.

Rather than “panicking and selling everything”, the fund has been tweaking the portfolio to shift around some holdings and increasing its positions in companies it thinks will recover quickest from the sell-off.

Healthcare and banks are among the sectors Mr King favours right now.

“Healthcare will definitely find a little bit more resilience. I think when people fear a virus they tend to hold on to healthcare stocks ... and with the banks, eventually people will look to them and say, yes they’ve cut rates and even if they cut their dividends they’re still paying out a pretty chunky yield,” he said.

Treasury Wines is another company King is taking a positive view on, partly because it has already been sold off quite heavily. It also has the ability to catch up on revenue quite quickly, he said.

The recent market ructions come as the federal government is widely expected in the coming days to unveil a stimulus package aimed at staving off a recession.

“I think a recession is a real possibility, just because we’re linked with the Asian economies,” Mr King said.

“I know Josh Frydenberg wants to keep his budget surplus but I think maybe he needs to spend some of that money.”

The key to any government spending boost would be deploying money into the right areas, he said.

“Historically, I think we’ve spent too much on infrastructure and building, which is kind of pushing the economy into one spot only. I think we need to diversify with some R&D credits for companies such as CSL … Hopefully we can get a bit of a balance,” he said.

Former BCA chairman and company director Tony Shepherd, meanwhile, urged the government not to rely on a “sugar hit” to jump start the economy.

“We have had three simultaneous economic hits — drought, bushfires and coronavirus. The economic impact of the coronavirus cannot be determined in terms of its size and duration.

“A stimulus should not be a quick sugar hit. We need more sustained assistance to business and the community which can be switched off when the time is right,” he told The Australian.

“We should focus on tax relief and investment incentives for all business. As it is private investment was at a long-term low before the crises hit.”

Perpetual head of investment strategy Matt Sherwood said the government needed to do more than just rely on the Reserve Bank to cut rates. The RBA last Tuesday slashed the official cash rate to a record-low 0.5 per cent.

“Fear is not only gripping the economy, it is gripping markets, so therefore it is morphing a supply problem into a demand problem and therefore the government needs a more comprehensive strategy than the RBA cutting rates to zero” Mr Sherwood told Business Weekend on Sky News.

“I do believe the panic is real but we haven’t seen it in the economic data … so it’s really the unknown of the coronavirus almost fighting the central bank policy… and at the moment I’d say it’s the coronavirus way ahead on points.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout