Global shares routed as commodities soar

Global markets face another volatile week as investors shun risk and commodities soar amid the intensifying war in Ukraine and increasing sanctions on Russia.

Global markets face another volatile week as investors shun risk and commodities soar amid the intensifying war in Ukraine and increasing sanctions on Russia.

After a risk-averse end to last week as tensions escalated, surging oil prices triggered another sell-off in shares, supporting safe havens like US Treasury bonds and gold, and boosting the commodity-sensitive Australian dollar to its highest in four months.

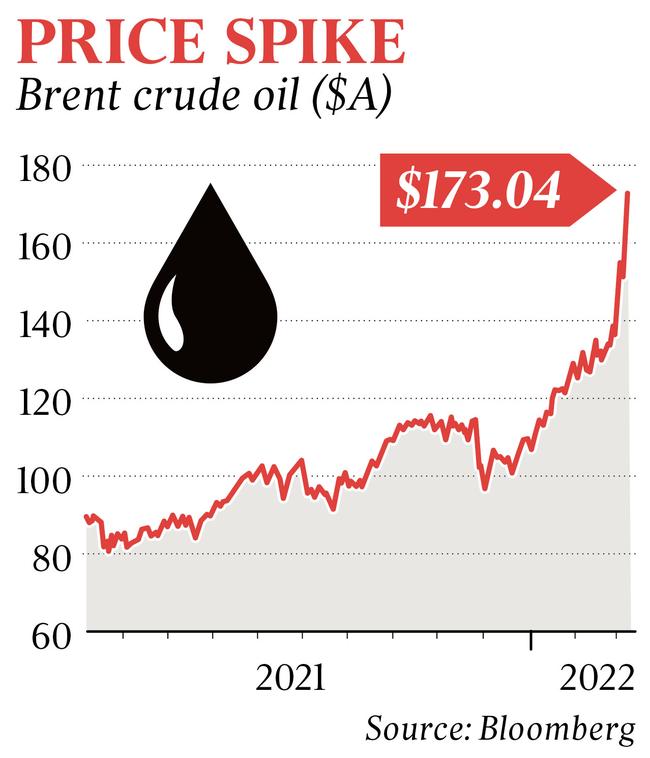

Weekend news that the US was discussing with its European allies a ban on Russian oil imports triggered a record-breaking 18 per cent surge in Brent crude oil futures to $US139.13 a barrel when the market reopened in Asia. The global benchmark was up 9 per cent before the European open.

The jump in oil sent European and US equity futures into a spin and pummelled the oil-dependent Asian sharemarkets. S&P 500 futures were down more than 1 per cent and Euro Stoxx 50 futures were down almost 3 per cent before the European open after bigger falls in Asia. Japan’s Nikkei 225 dived 2.9 per cent, China’s CSI 300 dropped 3.2 per cent and the Hang Seng index lost 3.4 per cent, while South Korea’s KOSPI fell 2.3 per cent and Taiwan’s TAIEX dived 3.2 per cent.

At its peak, the price of oil had doubled in the past three months, fuelling fear of 1970s-style stagflation. “For the US economy, we now see stagflation, with persistently higher inflation and less economic growth than expected before the war,” said Ed Yardeni, chief investment strategist at Yardeni Research.

“For stock investors, we think 2022 will be one of this bull market’s toughest years.”

The Australian dollar gained as Singapore iron ore futures leapt 7.7 per cent to an eight-month high of $US168.90 a tonne and Comex copper futures rose 1.2 per cent to a record $US4.99 a pound.

But while outperforming regional markets as the energy and materials sectors soared on commodity price gains, the S&P/ASX 200 share index fell 1 per cent at 7038.6, its lowest close this month.

Woodside Petroleum soared 11 per cent, Santos rose 5.3 per cent and Newcrest gained 5.2 per cent as spot gold hit an 18-month high of $US2000.86 per ounce on safe-haven demand.

But Macquarie sagged 2.7 per cent, Westpac fell 2 per cent and travel stocks were hit by the prospect of surging costs, with Qantas down 7.9 per cent and Flight Centre down 4.2 per cent.

Magellan Financial dived 7.3 per cent to a record low of $14.32 amid pressure to reduce fees amid failing performance, sustained outflows and sagging markets.

“The longer the war in the Ukraine goes, the more uncertain the markets are about how it plays out,” said Bell Potter’s head of institutional sales and trading, Richard Coppleson. “There are just too many different scenarios that could prevail (and) the market is concerned with how the sanctions could reverberate back through the Western economies via higher commodity prices and potential flow-on to even higher inflation expectations.”

Mr Coppleson said markets also feared tighter financial conditions, a potential escalation of the war and a global growth slowdown as Russian sanctions hit and potentially worsen just as the Fed starts to lift interest rates from record lows. The interest rate decision comes next week.

On the weekend, the International Monetary Fund warned that the war, as well as the sanctions imposed upon Russia, would have a “severe impact” on the global economy.

“While the situation remains highly fluid and the outlook is subject to extraordinary uncertainty, the economic consequences are already very serious,” the IMF said.

The US Congress was exploring a bill that would ban the import of Russian oil and energy products, Speaker Nancy Pelosi said in a letter to politicians.

The bill would ban the import of Russian oil and energy products into the US, repeal normal trade relations with Russia and Belarus and take a first step to deny Russia access to the WTO.

The Biden administration was also considering whether to prohibit Russian oil imports into the US without the participation of allies in Europe, at least initially, Bloomberg said. Administration officials had been in close contact with allies on a possible ban while preparing for the domestic impact, Bloomberg reported.

RBC head of commodity strategy Helima Croft said a “scramble for additional barrels to fill what could balloon to a 3-4 million barrels a day Russian export deficit will undoubtedly move into warp speed this week with the White House signalling a willingness to embargo Russian oil and key energy market participants continuing to head for the exit lest they stand accused of war profiteering.

“This could prove to be a tall order as immediate OPEC spare capacity currently rests with Saudi Arabia, UAE, Kuwait and Iraq, and we estimate that these four countries could only bring on between 2-2.5 million barrels a day in the next 30-60 days.

“Hence, the White House’s new outreach to Venezuela and the ongoing effort to secure an Iran nuclear agreement that would lead to lifting of sanctions.”

As for reports that the US was considering sending another high-level delegation to Riyadh to appeal for more production assistance, she said that while Saudi officials continued to publicly endorse the OPEC+ easing arrangement and partnership with Russia, Riyadh could “resume its central banker role and attempt to avert a calamitous global economic crisis”.

“The world will experience an energy shock – it’s just now a question of how big it is and how long it lasts,” said IG market analyst Kyle Rodda.

On Sunday, Russian President Vladimir Putin said the war would continue until Ukraine demilitarised and halted resistance.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout