GameStop shares crater as free trading apps block trades, triggering class action calls

Trading platforms which pulled trades in GameStop and other short seller targets face class actions and a federal investigation as the company’s share price falls off a cliff.

The GameStop trading frenzy has gone from Wall Street, to main street, and perhaps soon to Capitol Hill, as class actions and a federal investigation into the trading app Robinhood emerged overnight.

The popular app, which many of the wallstreetbets community on Reddit have been using to execute commission-free trades in GameStop, with a view to crunching Wall Street short sellers, said in its blog overnight it made the “tough decision today to temporarily limit buying for certain securities’’.

These included GameStop, AMC Entertainment, and about a dozen other short seller targets.

The wallstreebets community, now numbering more than five million - up by one million in one day - erupted with fury, and a class action led by Rosen Law Firm has already been announced.

GameStop shares tanked by 44 per cent to $US193.60 overnight, after more than doubling

to $US347.51 the previous day.

The shares were changing hands for $US4.21 a year ago, and with GameStop’s business in the doldrums, the valuations are generally accepted to be a factor of the wallstreetbets short squeeze.

That strategy has already cost one Wall Street hedge fund Melvin Capital dearly, with the Wall Street Journal reporting it was given a $US2.5 billion emergency capital injection earlier this week, even before the midweek share price surge.

Robinhood, which claims its mission is to “democratize finance”, is facing at least one potential class action led by Rosen, which has called for traders who “suffered losses as a result of Robinhood’s actions to curb trading and increase margin requirements for certain of these securities on January 28, 2021’’ to contact it.

The GameStop frenzy, and the rights and wrongs of millions of retail investors banding together to flog Wall Street hedge funds for fun and profit, has attracted commentary from everyone from a former labour secretary in the Clinton administration to Elon Musk.

“If Redditors rallying GameStop is unacceptable market manipulation, what would you call it when greedy Wall Street bankers gambled away our entire economy in 2008 and faced no consequences?’’ Robert Reich, a Berkeley professor and former secretary of Labor in the Clinton administration tweeted.

“When hedge fund billionaires move markets, they get huge bonuses. When ordinary Americans move market, they get shut down by Wall Street. The system is rigged.

“Call me crazy, but I’m beginning to think that Republicans in Congress only care about free markets when it comes to protecting their wealthy donors...’’

Elon Musk, whose company Tesla has also been the target of short seller interest, was unequivocal.

“Here come the shorty apologists

Give them no respect

Get Shorty”

And he made his opinions on the legality of short selling itself clear.

“u can’t sell houses u don’t own

“u can’t sell cars u don’t own

“but

“u *can* sell stock u don’t own!?

“this is bs – shorting is a scam

“legal only for vestigial reasons”

Reddit founder Alexis Ohanian, in Australia to watch his wife Serena Williams play tennis, said ordinary Americans were making themselves heard.

“Americans vote two ways: with votes & dollars. The internet has democratized access to the public markets, financial data, and knowledge sharing....

“This feels like people voting with their dollars, to support one another to send a message about how broken Big Finance is and it’s got @AOC agreeing with @TuckerCarlson

“-- this makes me pay attention. Reading the commentary from the WSB community...

“this feels really personal for a LOT of people, tracing back to the 2008 crisis & recession in particular. I believe this has snowballed into something bigger and unprecedented. As I’ve said for over a decade now: Community is still vastly undervalued.’’

AOC - New York congresswoman Alexandria Ocasio-Cortez - has called for a House Financial Services Committee hearing on Robinhood’s decision to halt trading in GameStop stock.

“This is unacceptable. We now need to know more about @RobinhoodApp’s decision to block retail investors from purchasing stock while hedge funds are freely able to trade the stock as they see fit.

“As a member of the Financial Services Cmte, I’d support a hearing if necessary.’’

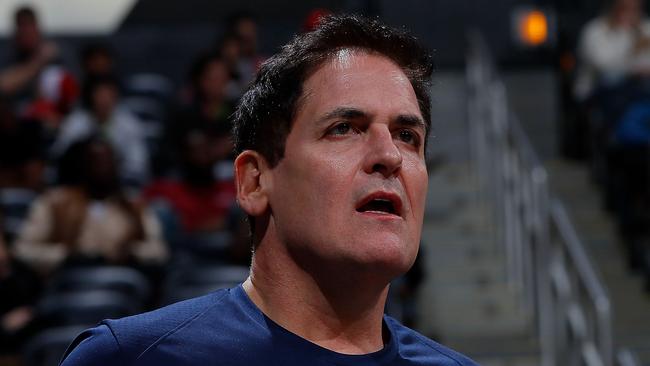

Billionaire investor Mark Cuban also weighed in, saying Wall Street traders were getting their comeuppance.

“I got to say I LOVE LOVE what is going on with #wallstreetbets. All of those years of High Frequency Traders front running retail traders, now speed and density of information and retail trading is giving the little guy an edge. Even my 11 yr old traded w them and made $’’

Robinhood does intend to restart trade in the stock its limited overnight, but not completely.

“Starting tomorrow, we plan to allow limited buys of these securities,’’ it said in its blog.

“We’ll continue to monitor the situation and may make adjustments as needed. To be clear, this was a risk-management decision, and was not made on the direction of the market makers we route to.’’

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout