Fund managers count the cost of coronavirus

What began as the best year since the early 1980s has turned into the worst since the 1987 crash.

Bloodied sharemarket investors are counting the cost of a horrific start to the year.

What began as the best year since the early 1980s soon turned into the worst since the 1987 crash as the COVID-19 outbreak went global, forcing damaging shutdowns worldwide, and the oil price plunged about 60 per cent as Saudi Arabia and Russia started a price war amid slumping demand.

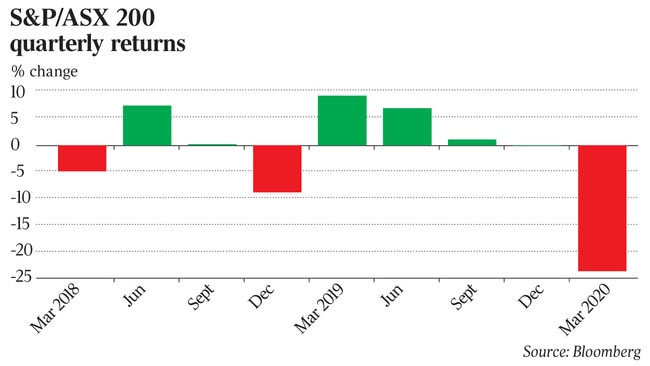

After rising 7.9 per cent to a record high of 7197.2 points in the first seven weeks, Australia’s benchmark S&P/ASX 200 share index collapsed 39 per cent in the next five, suffering its biggest fall since the global financial crisis and its fastest move from bull to bear market in history.

Even after a 15 per cent bounce at the month’s end as major central banks and governments launched unprecedented monetary and fiscal stimulus and balanced funds bought shares to maintain portfolio weights after shares slumped versus bonds, the S&P/ASX 200 lost 24 per cent in March.

The All Ordinaries lost almost 22 per cent last month and 25 per cent in the March quarter, its worst performance in those time frames since the crash of 1987.

For long-only funds it’s been an exercise in damage control via hedging, raising cash, avoiding the worst-affected companies and shifting to high-quality companies at cheaper prices while waiting for the crisis to peak in the US and Europe.

“Never before have we seen the stockmarket and, indeed, the world change so quickly in such a short period,” said Cyan Investment Management portfolio manager Dean Fergie.

His Cyan C3G Fund fell about 20 per cent in March, but that wasn’t as bad as a 31 per cent fall in its benchmark S&P/ASX Emerging Companies Accumulation Index in the month.

“However, the market is moving so quickly and the volatility has been so extreme — like nothing we have ever experienced before — that the relative performance can literally change 5 per cent or more in a couple of hours,” Mr Fergie said. “Since the second week of March, when the virus panic really took hold, the average intraday change between the All Ords’ high and low has been 6.8 per cent.

“These are moves one might ordinarily expect over the course of a month or a year, never in a couple of hours, but that is the world we find ourselves in.”

Mr Fergie has been divesting stocks directly exposed to the fallout, holding those with solid balance sheets, defensive revenue and pricing power, adding favourites that have become cheap enough or will benefit from the crisis, while also keeping “ample cash available for upcoming opportunities”.

Contact Asset Management portfolio manager Tom Millner described the COVID-19 pandemic as a “black swan” event that has “had a significant global impact, created an immense amount of uncertainty and ended the longest-running bull market in history”.

“The level of uncertainty is resulting in record market movements, reminding us that markets in the short term are irrational,” he said. “It is during times of uncertainty that the qualitative factors we consider paramount when investing become increasingly important to investors.”

While noting that the severity and duration of the COVID-19 pandemic was currently unknown and knock-on effects could not be reliably quantified, he saw a “striking resemblance” between the current sharemarket decline and a 32 per cent fall in the S&P 500 after the Spanish flu of 1918-1920.

“By October 1922, the market reversed all previous losses and more with a gain of 44 per cent from August 1921,” he said. “The yearly growth rate of industrial production fell 31 per cent by March 1921 but afterwards the momentum of industrial production followed a visible strengthening.”

But the unprecedented abrupt, synchronised and global shutdowns meant that bailouts, rate cuts and massive stimulus “may not be enough to prevent damage to the global economy”.

In comparison to the GFC and previous recessions, when central banks lowered rates rapidly by about 5 per cent to stimulate the economy, the low interest rates predating COVID-19 mean that “this does not appear to be a feasible option”, Mr Millner cautioned.

Still, in the last 60 years “we find market corrections create opportunities for patient investors,” he said.

“On average, the stockmarket decline during the corrections … was around 29 per cent, with a subsequent return of 110 per cent over the following five years,” Mr Millner added.

Magellan Financial chairman and co-founder Hamish Douglass — who boosted the cash reserve of the Magellan Global Fund in mid-March — said a “mild recession” or a “prolonged and deep recession” were “the most likely outcomes” depending on the length of the shutdowns, the policy response and the effect of the health and economic crisis on consumer behaviour.

“It is difficult to predict how the next two to 12 months will play out,” he said in a portfolio update.

“We believe that for many major economies a V-shaped recovery and a depression appear the least likely scenarios. Outside of a few countries, a mild recession to a deep-and-prolonged recession appear the most likely outcomes at this point in time. The good news is that governments and central banks are calibrating their responses to attempt to mitigate the economic fallout.

Clime Asset Management chief executive Rod Bristow said the March quarter was “particularly challenging” and the fund manager had responded by cutting expenses to shore up its balance sheet, leaving it “well positioned to continue to grow and diversify the group’s revenue”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout