Equity is back on the menu, but the IPO options remain slim

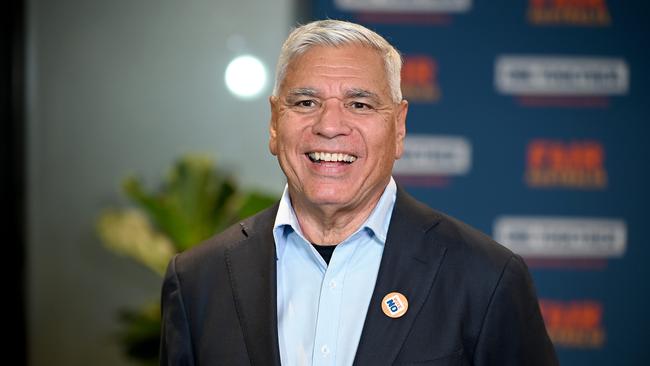

A minerals explorer chaired by Warren Mundine and a financial services firm whose director includes former AFL champion player and ex-AFL chair Mike Fitzpatrick are some of the IPO hopefuls for 2024.

A sharp decline in sharemarket float activity this year looks set to persist into 2024 with bankers saying a choppy economy and equity markets may dim the appetite for new initial public offerings.

It comes as Australia’s funds managers and superannuation funds are being inundated with cash and as interest rates look to level out, or possibly retreat, equity is back on the menu. But the options to put that cash to work into initial public offerings on the Australian market remains slim.

According to the ASX, its upcoming floats scheduled for early 2024 number only around a dozen with the usual heavy weighting towards mining and resources which traditionally dominates the IPO market in Australia, especially for smaller raisings.

Among the hopefuls for 2024 include Fuse Minerals, a mining explorer that is looking to raise as much as $10m and whose executive chairman is political figure and businessman Warren Mundine AO, and financial services company Australian Wealth Advisors Group which owns funds manager Armytage Private and whose directors include veteran funds manager, former Rio Tinto director and ex-AFL chairman Mike Fitzpatrick.

Other companies looking to test the waters for a float in early 2024 include Ashby Mining, Far Northern Resources, Kali Metals and Western Australia Energy Resources.

But big ‘blockbuster’ IPOs next year are yet to be confirmed, with the float market robbed of a Chemist Warehouse IPO following a deal just before Christmas to backdoor into the ASX-listed Sigma Pharma. But all eyes will be on private equity firm Bain Capital after its move earlier this year to shelve the listing of its airline Virgin Australia until 2024. Provided volatility remains in check, other mooted candidates that could jump the gun in the new year include the Macquarie-backed data centre operator AirTrunk, Mexican food chain Guzman Y Gomez, mining services company Molycop, and logistics group Mondiale VGL.

Citi investment banking managing director Jack Groom told The Australian that uncertainty has been playing out in the minds of asset buyers and sellers over the period, which is impacting the IPO market.

However, there was cash to invest in good opportunities, but those opportunities have not been overwhelming institutional investors.

“There’s lots of money around. All of the fund managers and the super funds continue to receive cash that they need to invest. So it’s not an ability to invest. It’s more, frankly, on the supply side, in my view,” Mr Groom said.

“And I think two things are playing out. Again, this point around uncertainty. Equity investors like businesses that they know and that they can track for a long period of time, particularly in this environment. An IPO is a new business coming to market that they don’t know particularly well.

“There is an element of conservatism or cautiousness that they would put on that business. And look, the track record of the last cycle of IPOs hasn’t been great. And that adds another layer of cautiousness on top.

“So I think the issue has not been the want of fund managers to invest in an IPO. It’s getting an asset that sort of fits the bill, with respect to asset quality, size, and appropriate price expectations to meet the market. They just haven’t been there.”

Mr Groom said he believed that the IPO market is “theoretically open” but investors were waiting for the right IPO to come along that will “get fund managers going and have a good experience for everyone”.

He said many businesses and their owners were going down the path of a trade sale or merger, a much more clean transaction, than an IPO and this was constricting the supply of new floats.

“And under that situation, it’s a 100 per cent exit, it’s clean, there isn’t the same level of rigour that goes along with respect to an IPO process. So we’ve seen vendors typically go down that route.

So I think the IPO market is there, the fund managers have the money. The issue is they’ve had bad experiences in the past, and they don’t have a long history with these businesses, so they have a level of conservatism built into how they approach valuation. I think that’s the challenge here, and until a business comes along and changes that dynamic, I think the IPO market is going to continue to be an option that people think about, but probably not the first one.”

Mr Mundine AO, executive chairman of Fuse Minerals, is looking to place 50m shares at 20c each for his minerals explorer to then deploy into two projects in Western Australia and one in central Queensland.

“It is a tough market at the moment, it’s a strange market and there is a lot of money around and people are holding on to it at the moment, leading into the new year until they see the economy shifting,” Mr Mundine AO told The Australian.

“At the same time there are still people who want to take advantage of the market at the moment and where they’re investing, but it is not like a while ago, even pre-Covid, it’s just tough, but we are going along smoothly at the moment.”

Mr Mundine said he was getting good feedback from investors as Fuse Minerals explained its strategy and its pathway to go from an explorer to producer.

Veteran Melbourne fund manager Lee IaFrate has sold his small-cap and activist funds management business Armytage Private, founded in 1995, into a new vehicle called The Australian Wealth Advisors Group, which also owns Melbourne-based financial adviser dealer group CHPW Financial.

Mr IaFrate said rising interest rates had pushed many investors into risk-free asset classes, and away from equities, but with interest rates looking to stabilise – or even come back this year – there was a renewed interest in equities and especially the micro-cap, small-cap financial and wealth space.

This was good timing for the planned IPO of Australian Wealth Advisors Group, he added, which is offering 20 million new shares at an issue price of 25c a share to raise $5m.

“From around April or May 2022 through to June or July this year, interest rates went up and took the focus of investors away from markets and to risk-free assets like bonds and terms deposits.

“Markets as we know move on expectations rather than realisation, and as the theatre for interest rates is now on the way down going into 2024 the spectre of the markets going into 2024 is industrials will be seeking to grow their earnings per share and the quickest and best way will be through merger and acquisitions.

“And at the back end of 2023 we have seen no less than half a dozen takeovers, including Boart Longyear today. It tells you that markets and investors are scouring through investment opportunities.”

Mr IaFrate believes his new investment vehicle can participate in a fresh wave of corporate activity next year.

He has a strong track record in this area. Mr IaFrate is the founder and former chairman of Treasury Group, now known as Pacific Group, founder and former director of Prime Financial and founder and former chairman of Easton Investments, now known as Diverger.

Joining him on the Australian Wealth Advisors Group board of directors is Mr Fitzpatrick, the founder of Hastings Funds Management, formerly the chairman of Victorian Funds Management, Australian Football League and the Australian Sports Commission. He was also a champion player and captain of the Carlton Football Club.

Other directors include Paul Young, a former divisional director of merchant bank Morgan Grenfell.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout