Earnings season, surveys likely to subdue the start of trading week

Australia’s share market is expected to open flat on Monday as investors brace for a deluge of companies’ earnings results and confidence surveys.

Companies’ earnings season begins in earnest this week, providing a glimpse of whether the Reserve Bank’s most aggressive interest rate rises in 30 years are starting to bite the economy.

Commonwealth Bank, National Australia Bank, Suncorp, Insurance Australia Group, AMP, Telstra and Woodside are set to report financial results this week, interspersed with a flurry of business and consumer confidence surveys.

The benchmark ASX 200 is expected to open flat on Monday, based on futures trading and the performance of US shares on Friday night – which closed stagnant after surprisingly strong jobs data cast doubt the Federal Reserve would ease interest rates soon.

Investors were betting that central banks will switch to cutting interest rates as early as the first half of next year. But in the US, the labour market added 528,000 jobs in July – more than double expectations – returning payrolls to pre-pandemic levels.

Meanwhile, the unemployment rate fell to a near record low of 3.5 per cent – the same level as Australia – signalling rapid rate increases were doing little to cool the economy and rein in inflation.

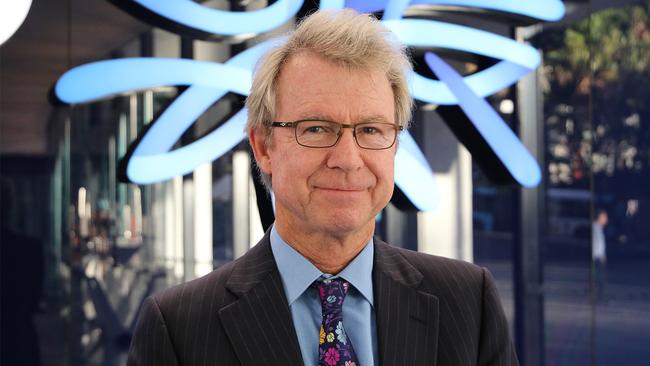

AMP Capital chief economist Shane Oliver said Australian shares were vulnerable to a pullback in the months ahead, as recession risks heighten and central bankers remain hawkish.

This follows the ASX 200 rebounding 5.5 per cent in the past month, while the S&P 500 has had a 6.2 per cent bounce.

“Central banks are still a way off from peaking and actually cutting rates, recession risk is still rising and this runs the risk of significant earnings downgrades, and geopolitical risk is still on the rise as highlighted by China/US tensions in the last week and the upcoming November US mid-terms,” Dr Oliver said.

“However, the continuing strength of the rebound – with the direction-setting US share market now up 13 per cent from its low – raises the possibility that we may have seen the bear market low and any pullback may just be a partial retracement of the rally since mid-June.

“On a 12-month horizon we remain optimistic on shares as inflation recedes, central banks become less hawkish and a deep recession is likely to be avoided.”

Last week, the RBA lifted interest rates another 50 basis points, taking the official cash rate to 1.85 per cent.

Its latest monetary policy statement forecasts consumer price growth to climb from the 30-year high of 6.1 per cent in June to a peak of 7.75 per cent by December, before moderating over the next two years to 3 per cent as higher interest rates drag on growth and spending, and as pandemic supply bottlenecks ease.

RBA governor Philip Lowe has said the “neutral” cash rate – at which point monetary policy is neither stimulatory or contractionary – was probably 2.5 per cent, and Friday’s monetary policy statement noted investors and analysts believe rates would rise to 3 per cent by the end of this year.

Dr Oliver said while Dr Lowe continued to be hawkish, he was “starting to leave a bit of wiggle room”.

“Given (the RBA’s) upwards revision to its inflation forecast for this year to 7.75 per cent and the very tight labour market, it rightly remains focused on slowing demand and keeping inflation expectations down, and so is still flagging more rate hikes ahead,” Dr Oliver said.

CBA will on Tuesday release its Household Spending Intentions Index for July, coinciding with the Australian Bureau of Statistics reporting similar data and ANZ and Roy Morgan issuing its consumer confidence survey.

CommSec economist Ryan Felsman said: “The sentiment surveys will highlight consumer worries about rising borrowing costs and interest rates. The main positive is the strength of the job market”.

The ABS also this week releases its business turnover indicator for June, while NAB issues its July business survey.

“The NAB measure of business sentiment hit a six-month low in June, with record-high costs and rising borrowing costs both major drags on the outlook,” Mr Felsman said.

“That said, business conditions remained solid in June, despite an easing of the key profitability, trading and employment subindexes.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout