‘Earnings recession’ on the cards as jobless numbers rise

Australian shares rose for a third day on Wednesday, but rising unemployment and a looming ‘earnings recession’ is a worry.

Australian shares rose for a third day as US lawmakers passed a massive stimulus plan to offset the coronavirus pandemic but most risk assets faltered before an update on US jobless claims.

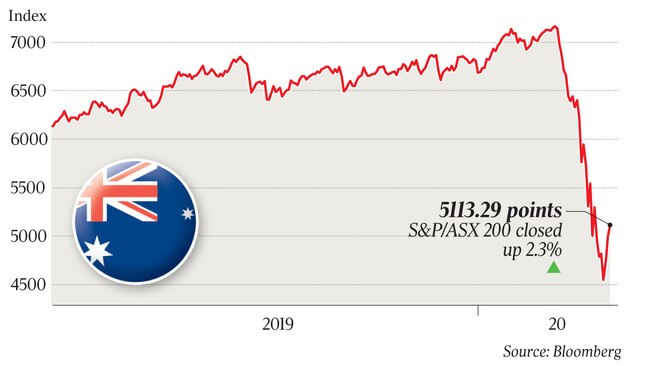

In its first three-day rise in six weeks, Australia’s S&P/ASX 200 share index rose 115.2 points or 2.3 per cent to 5113.3 — its best close in seven days — after global markets rose in anticipation of a $US2 trillion ($3.3 trillion) stimulus package which was passed by the US Senate as expected.

CSL rose 6.2 per cent and Afterpay surged 29 per cent, but the major banks and miners were mixed, with CBA down 1 per cent, NAB up 2.2 per cent, BHP down 2pc and Rio Tinto up 5 per cent.

From a record high of 7197.2 on February 20, the local sharemarket fell 39 per cent in six weeks, hitting a seven-year low of 4402.5 on Monday amid expectations that widespread lockdowns to curb the coronavirus pandemic will cause the worst recession since the 1930s.

By Thursday it had recovered 16 per cent, mainly because of the Fed’s move to unlimited quantitative easing and expectations of US fiscal stimulus equivalent to 10 per cent of GDP. But companies continued to withdraw their earnings guidance at an unprecedented rate, with AMP, Dexus, GUD Holdings, Northern Star, Growthpoint Properties and Genworth the latest to do so.

“In previous bear markets you needed to see clearly accommodative policy and clearly attractive valuations before investors were enticed back into the asset class,” says Hasan Tevfik, senior research analyst at MST Marquee.

“The unique feature is the virus which has caused a healthcare crisis which has morphed into an economic crisis, so having authorities control the healthcare crisis will provide some perspective on when the economic and profits downturn will bottom out.

“Much of severity of the bear market depends on the brutality of the associated profits recession.”

He predicts a 25 per cent decline in aggregate earnings per share for the ASX 200.

Investors were more circumspect in other markets before US initial jobless gains data overnight.

S&P 500 futures fell 1.8 per cent, Japan’s Nikkei 225 dived 4.5 per cent, Brent crude oil tumbled 3 per cent to $US26.53 a barrel and COMEX copper dived 1.6 per cent to $US2.165 a pound.

The Australian dollar fell back below US60c after hitting a one-week high of US60.87c.

RBC Capital Markets chief US economist Tom Porcelli warns of “massive upside” risk to the US weekly jobless claims data versus Bloomberg’s consensus estimate of 1.64 million. Indeed the range of estimates is exceptionally wide at 360,000 to 4.4 million.

“We noted early last week that jobless claims could be well north of 1 million in the upcoming print,” Porcelli says. “With layoffs of hourly workers accelerating sharply, it is now poised to be multiples of that.”

US stocks pared most of a 5 per cent rise on Wednesday as California governor Gavin Newsom said a million workers in the state applied for unemployment benefits this month, whereas only 100,000 jobless claims were made in that state in the past two weeks.

Porcelli says that implied California alone had 900,000 claims this week, and many other states had already reported at least 100,000 claims each by early last week. “Thus, something in the 5-10 million range for initial jobless claims is quite likely,” he warns.

With increasingly strict lockdowns taking effect in Australia, the coronavirus crisis will leave few firms unscathed, with a special survey by the Bureau of Statistics revealing that nine out of 10 businesses expect to feel the impact from the pandemic and measures taken to control its spread.

The survey also showed the extent of the damage to corporate Australia even before the shutdown of non-essential services, with half the firms saying they were already suffering fallout from the virus.

The ABS report showed the impact of the virus was being most felt in the food and accommodation services sector, where 78 per cent of respondents said they were feeling an impact. Almost all of these firms – 96 per cent – expected to be affected in the coming months.

In contrast, businesses in professional, scientific and technical services (21 per cent), electricity, gas and water supply (34 per cent) and mining (37 per cent) sectors were the least likely to have been adversely affected by COVID-19 in the previous two weeks, the ABS said.

In a pointer to the potential economic damage in the Asia-Pacific region, Singapore’s March quarter GDP fell 10.6 per cent in annualised terms undershooting Bloomberg’s consensus estimate of 8.2 per cent in the city-state’s biggest growth contraction in a decade. That prompted Singapore’s government to slash its 2020 full-year growth estimate to minus 1 to minus 4 per cent versus minus 0.5 to minus 1.5 per cent previously forecast.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout