Earnings pain will test investors with a sting in the tail

Corporate Australia has so far defied the worst of the hit to the economy from the coronavirus, but investors are bracing for disappointment.

Corporate Australia has so far defied the worst of the hit to the economy from the coronavirus, but investors are bracing for disappointment when it comes to profit guidance as earnings season hits top gear in coming days.

More than two-thirds of S&P/ASX 300 companies are scheduled to release accounts this week, including BHP, Coles, CSL, Lendlease, Suncorp and Wesfarmers.

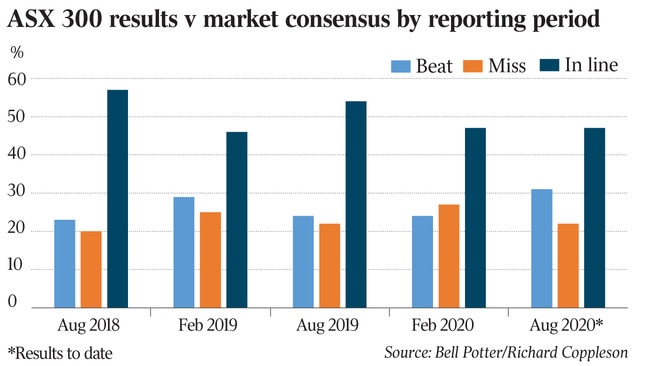

Of the string of profit results over the past two weeks some 31 per cent of earnings have beaten expectations, 46 per cent have matched earnings estimates, while just 22 per cent have disappointed the market, according to calculations by Richard Coppleson, an institutional trader with Bell Potter.

The earnings result comes against a backdrop of a rising Australian sharemarket and stronger global markets, improving Victorian coronavirus trends and a better-than-expected start to the August reporting season. The S&P/ASX 200 share index is just 22 points off its post-March closing peak of 6148 points.

However there’s a sting in the tail, with brokerage Macquarie Equities seeing more downgrades than upgrades.

With Wall Street remaining buoyant on Friday — despite the S&P 500 stalling near its record high as retail sales disappointed and fiscal stimulus talks were effectively halted until US Congress returns from recess on September 8 — the Australian market is set to push higher as underweight investors trickle back into the market, particularly if the earnings outlook improves.

It is still early days in the reporting season, and it arguably needs to be better than expected to justify current high price-to-earnings valuations — unless interest rates go negative, which hasn’t been ruled out by the Reserve Bank but remains “extraordinarily unlikely”, according to RBA governor Philip Lowe.

On Friday Dr Lowe told a parliamentary committee that the June quarter was likely to produce a 7 per cent contraction in GDP, which would be the biggest fall in “many decades”.

On top of that, the challenges faced by Victoria would cut GDP growth by at least two percentage points in the September quarter, so that growth would not resume until the final three months of the year.

Macquarie Equities Australian equity strategist Matthew Brooks has analysed the reporting season to date, based on results from the 40 companies in the ASX 200 that have reported so far.

While noting that results have been better than expected, with 14 of the 40 companies in the ASX 300 that have reported half-year earnings reports (35 per cent) beating Macquarie’s estimates by more than 5 per cent, there have actually been more downgrades of forward earnings than upgrades so far.

Of the 40 reporting companies that Mr Brooks looked at, only 20 per cent fell short of Macquarie’s earnings estimates by more than 5 per cent.

But the outlook disappointed, with earnings estimates being downgraded for 10 companies, whereas only 7 were upgraded.

More concerning as far as the direction of the overall market goes, all the upgrades were outside the biggest 100 companies.

“While there were more beats than misses, when it comes earnings revisions of more than 5 per cent for the year ahead, our team downgraded slightly more than they upgraded,” Mr Brooks said. “All the upgrades were for stocks outside the ASX 100, though there were two ex-100 downgrades.”

ASX 100 downgrade stocks included such heavyweights as AGL Energy, Evolution Mining and Sydney Airport, as well as Transurban, Telstra and Woodside.

Guidance has been rare, as expected, due to the unprecedented mobility restrictions in Victoria following the coronavirus pandemic.

“Only 11 companies have provided earnings guidance, and more than half expect earnings to decline in 2020-21,” Mr Brooks said. He said there were six ASX 100 stocks that forecast a decline, with drivers including low interest rates in the case of Challenger and Computershare, bad debts for AGL and Telstra, and a low coal price in the case of AGL and Aurizon.

Property interest Goodman has been the only large company guiding to growth, supported by an e-commerce tailwind.

Reflecting the current reality where “there is no alternative” to shares in terms of other alternatives for decent yield potential, Mr Brooks has developed a “TINA Score” — stocks with a higher TINA Score may be better targets for investors’ equity allocation.

A good result includes having share price outperformance, its June half-year earnings beating Macquarie’s estimate, next year’s earnings per share estimate being upgraded, management guiding to growth, the dividend lifted, and sales growing more than 10 per cent. “We give a company a point for each hurdle that is passed,” Mr Brooks says.

The best results so far on that basis have been Nick Scali at 5 points and Charter Hall Long-WALE REIT.

“Our bottom-up earnings per share growth forecast for 2019-20 a decline of 19 per cent. But 2020-21 forecasts continue to be downgraded,” Mr Brooks said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout