Dollar joins the party as shares continue surge

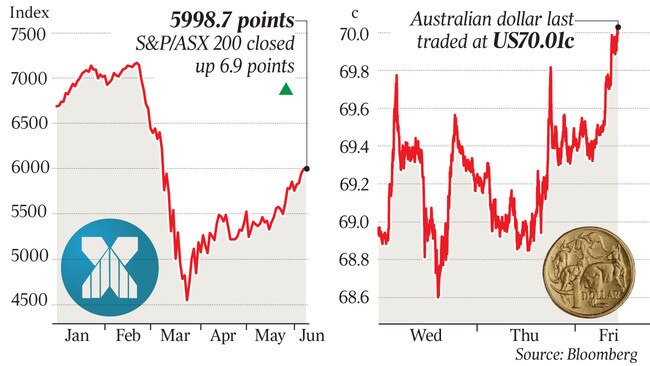

The dollar burst through the US70c barrier on Friday, marking a five-month high.

An extraordinary rise in the Australian dollar and shares in recent days is prompting some fund managers to lock in protection for their portfolios as unprecedented monetary and fiscal stimulus puts markets further out of touch with economic reality.

The Australian dollar burst through the US70c barrier on Friday, marking a five-month high, while local shares are up 32 per cent since the depth of the COVID-19 crisis in mid-March, putting valuations into lofty levels.

The S&P/ASX 200 share index on Friday drifted up a further 6.9 points to end at 5998.7 on Friday after hitting a three-month high of 6040.2 points on Thursday.

This means Australian shares are trading at a record 12-month forward price-to-earnings multiple of 19.55 and record low dividend yield of 3.4 per cent, increasing the sharemarket’s vulnerability to any rise in interest rates, which have so far been anchored by central banks around the world.

A renewed switch away from expensive growth and defensive stocks in the health care, technology and utilities sectors, into cheaper “value” or unloved stocks in the financials, energy and real estate sectors was evident, with much of the support coming from the banking sector.

The banks index rose a stunning 22 per cent in two weeks, after UBS analyst Jonathan Mott turned “more optimistic” on the banks amid a string of positive news and economic reopening.

On Friday Mr Mott took his new found optimism a step further, upgrading NAB and Westpac to “buy”, while also lifting his 12-month target prices by 24 per cent and 11 per cent respectively.

With the economic outlook “less bleak than anticipated even a few weeks ago” the likelihood of a further rise in bad debts and capital raisings has reduced materially, Mr Mott said. Moreover a lower reliance on JobKeeper wage subsidies than the government previously expected also “provides some flexibility for further targeted stimulus” as current packages, loan deferrals and rental relief expires in October.

Canberra also announced a $680m “HomeBuilder” housing stimulus package this week.

Building materials surge

“We reiterate that we do not believe we are out of the woods from an economic or health perspective, especially if a vaccine rollout is delayed,” Mr Mott said.

“However, we believe the market is likely to factor in a recovery in bank returns unless we see further economic deterioration.”

Geoff Wilson, chair of Wilson Asset Management, said he delved back into the market to take advantage of capital raisings and buy previously unloved sectors, including building materials.

Building materials and home builder stocks surged after Seven Group bought 10 per cent of Boral and the government announced the HomeBuilder stimulus.

In the US, the S&P 500 is trading on PE ratio of 22, its highest valuation since the tech bubble in the early 2000s, after hitting a three-month high this week.

S&P 500 futures rose 1.1 per cent ahead of the release of US non-farm payrolls data for May, suggesting investors will “look through” an expected rise in the US unemployment rate to 19.1 per cent.

The Australian dollar hit a five-month high of US70.13c, having risen 5 per cent this week. It has bounced 27 per cent from an 18-year low of US55.05c in March, amid easing safe-haven demand, rising commodity prices and unlimited quantitative easing by the US Federal Reserve.

At the same time, Australia’s 10-year government bond yield surged 8 basis points to an 11-week high of 1.1 per cent on Friday from 0.89 per cent a week ago, as US Treasury yields also surged.

“We understand that investors will celebrate higher bond yields as a sign that growth is returning amid stimulus and reopening efforts,” said Credit Suisse macro strategist Damien Boey. “Some might even be tempted to interpret curve steepening as a signal for value, financial and cyclical recovery in earnest within the equity market.

“However, we also note that US equities are trading on such stretched valuations on a through-the-cycle basis, that they are priced for negative returns on a 10-year horizon, and vastly inferior returns to bonds. In other words, the equity risk premium is effectively negative, meaning that valuation is a major constraint on the market, notwithstanding recovering growth expectations.

“Beyond near-term optimism, they cannot absorb higher interest rates.”

Mr Boey worries that if inflation does becomes a threat central bankers will at some point have to upset the applecart by tapering or tightening, wrong-footing anyone positioned for lower-for-longer rates and volatility.

“We are also concerned that more shocks or higher uncertainty could tip the balance anyway, causing passive and risk parity investors to liquidate in a potentially broad and disorderly fashion,” he said.

“In the circumstances, we want protection against a passive unwind, from both factor and asset allocation perspectives. The usual suspects — bonds and bond proxy equities — may not do.”

But Macquarie Equities strategist Matthew Brooks was more focused on which Australian stocks to buy in order to “participate in the current value rally”.

He singled out those that have underperformed the most since the February high and also screen as value across multiple value metrics looking out to fiscal 2022.

Downer and GPT Group were seen as offering value opportunities in the ASX 100, while Karoon Energy, GrainCorp, Dacian Gold, Nickel Mines and Aurelia Metals were his picks in the Small Ords.

He said a global rotation to value had “already begun”, with stocks that had been underperforming since the March lows starting to outperform, a pattern consistent with the steeper yield curve.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout