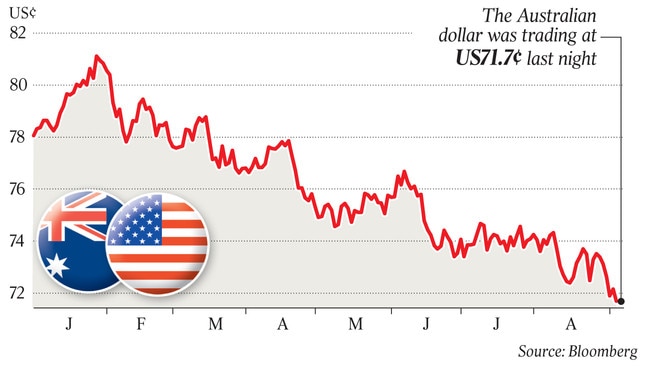

Dollar at two-year low as metals prices fall

The Aussie dollar consolidated after tumbling to its lowest point in more than two years, amid commodity weakness.

The Australian dollar last night tumbled to its lowest point in more than two years as sustained falls in emerging markets spilt over to commodity prices, with base metals tanking.

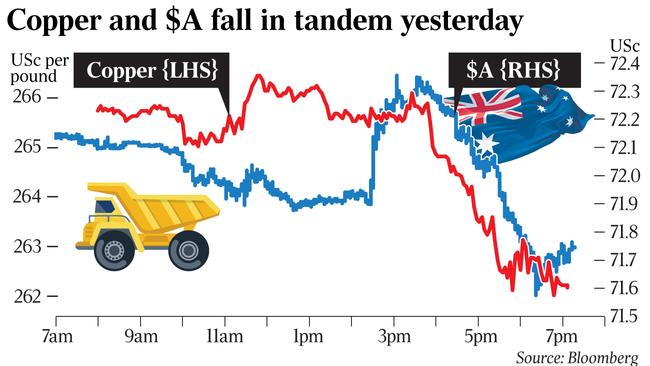

After briefly rebounding to above US72c after the Reserve Bank was silent over concerns that higher mortgage rates could hurt the housing market, the Aussie dived to a 27-month low of US71.57c in European trading as the price of base metals including copper and nickel fell as much as 2 per cent.

The Aussie dollar this morning consolidated around US71.80c after having ticked up to US71.97c overnight..

Base metals also remained weak overnight with the London’s Metal Exchange index down over 2 percent.

It came as a recent meltdown in emerging market currencies threatened to continue, with the Argentine peso and Brazilian real falling sharply against a strengthening US dollar yesterday.

Emerging market jitters had increased, Reserve Bank governor Philip Lowe said.

In a speech at in Perth last night, Dr Lowe said the RBA was monitoring problems in a number of emerging market economies with structural or institutional weaknesses, including Turkey, Brazil and Argentina.

“If these problems were to escalate, they could put strains on parts of the global financial system,” he said.

Dr Lowe also warned that an escalation of trade wars “would materially affect trade flows and investment plans around the world” and “as a country that has benefited greatly from an open, rules-based international system, Australia has a strong interest in this not happening”.

Another “uncertainty” was the possibility of a material lift in US inflation as America experienced a large fiscal stimulus at a time when the economy was at full employment and growing quickly.

“This is an unusual combination, to say the very least,” Dr Lowe said. “Past experience suggests that it could lead to inflation increasing significantly. Financial markets are, however, heavily discounting this possibility, which means that if it did take place it would come as quite a surprise, with repercussions for markets and the real economy.”

But despite a mortgage rate hike from Westpac last week, the Reserve Bank reused to validate market expectations that such out-of-cycle rate hikes from the major banks could delay the start of official interest rate rises in Australia until 2020, and thereby leave the dollar vulnerable to widening negative rate differentials as the Fed continues to hike.

The RBA yesterday left rates at a record low of 1.5 per cent for the 25th consecutive month, saying progress in reducing unemployment and having inflation return to target was expected, although “this is likely to be gradual”.

But the outlook for the dollar remained “incredibly dour” as the US dollar continued to soar against emerging markets currencies, said Stephen Innes, head of APAC trading at OANDA.

Capital Economics chief economist Paul Dales said the upbeat tone of the RBA was “starting to grate more obviously with the incoming economic news”, even though it didn’t sound more worried about a fall in house prices in August or last week’s news that Westpac was raising rates.

“Apparently the phrase ‘some lenders have increased mortgage rates by small amounts’ used at August’s meeting still stands even when banks with a big share of the mortgage market have joined banks with a small share in raising interest rates,” he said.

In his view the RBA was “glossing over” weaker domestic news that could hurt the currency.

“The upbeat tone of the comments by the RBA after it left interest rates at the record low of 1.5 per cent for the 25th month is starting to grate more obviously with the incoming economic news,” he said.

“Our view that the economy won’t live up to the RBA’s high hopes is consistent with interest rates staying at 1.5 per cent until late in 2019 if not until sometime in 2020.”

Mr Dales said the RBA hadn’t placed enough weight on weak data since its August meeting.

“Admittedly, the RBA did respond to the fall in employment in July by dropping its previous positive comments about indicators pointing to ‘solid growth in employment’. However, it ignored the stagnation in retail sales in July and the second quarter’s weak capex survey.”

Despite signs that the economy has lost a bit of momentum, the RBA’s expectation that the economy would grow by 3.25 per cent in 2018 even though the full effect of tighter lending, falling house prices and a weaker global backdrop were yet to be felt, “looks like a pipe dream” so wages and inflation were unlikely to rise as the RBA is hoping.

“That would make it very challenging for the RBA to raise rates before the end of 2019,” Mr Dales said. “It’s more likely that the RBA won’t be able to raise rates until sometime in 2020.”

Westpac’s head of financial market strategy, Robert Rennie, said the RBA’s acknowledgment that the dollar had “depreciated against the US dollar along with most other currencies” since its last board meeting — having fallen almost 3 per cent — briefly helped the currency yesterday.

And while Australian interest rate differentials have turned negative versus the US this year and measures of risk aversion were “slightly elevated”, resilient prices for Australia’s commodity exports have seen “fair value” remain fairly stable near US75c.

“The lower end of the fair value band has tended to remain fairly stable around US72c, meaning the Australian dollar has been hitting levels we consider cheap,” he said. “The Aussie should thus continue to find support on dips below US72c for the moment.”