Dividend woes fail to dent market

The S&P/ASX 200 share index surged 1.5 per cent to a four-day high of 5321.4 points on Monday — its best rise in two weeks.

Shrinking earnings and dividends remain a risk for shares, even as unprecedented stimulus and plans to lessen coronavirus restrictions fuel hope that an expected sharp recession will be short-lived.

The S&P/ASX 200 share index surged 1.5 per cent to a four-day high of 5321.4 points to start the week — its best rise in two weeks — and the Australian dollar also rose 1.5 per cent, hitting to a seven-week high of US64.69c, even as US crude oil prices dropped back below $US15 a barrel again.

Remarkably, the Australian market brushed off a fresh round of share issuance from companies including NAB, Charter Hall REIT, Qube Holdings and Monash IVF, as well as more dividend cuts.

NAB tapped the market for $3.5bn and slashed its interim dividend 64 per cent to 30c a share as its profit dropped 51 per cent to $1.44bn, with an additional $1.2bn provision for bad debts, including $807m for the impact of coronavirus, on top of $1.1bn in charges announced last week.

That NAB front-loaded its interim results by almost two weeks suggests its advisers saw a strong chance of the other banks raising capital in the coming weeks, although traders say Westpac is more likely to raise again than ANZ and CBA. No doubt some will also trim their dividends.

Of course investors are betting that the GFC experience, when equity capital raisings by the major banks over a period of months coincided with the end of the bear market, but how rapidly the global economy can reopen without reigniting the pandemic and extending a recession is unknown.

As for dividends, JP Morgan’s head of research Jason Steed argues that the consensus has actually priced in enough cuts for banks, but even dividend cuts in some other sectors have further to go.

“Despite the banks being in a far stronger capital position than in the GFC, DPS (dividend per share) revisions and expected cuts are already deeper than 2008-09,” Steed notes.

Whereas the one-year forecast decline in the depths of the GFC troughed at minus 25.7 per cent, he says current projection is already for a deeper downdraft of minus 35.1 per cent.

“The pall over the sector’s dividend outlook has been fuelled partly by APRA’s strident guidance on capital distributions. Even so, it seems incongruous to us that current expectations are more bearish than the GFC.”

He also has some confidence that what has in the past decade become the other big dividend-paying sector in Australia — materials (particularly iron ore) — justifies what have been very modest downward revisions on China’s incipient recovery, due to a resilient iron ore price and low gearing.

Materials outlook brighter

With considerable stimulus driving infrastructure fixed-asset investment in China, he’s positive on the outlook for the iron ore names, with Fortescue Metals and BHP in his top dividend picks.

The fact that banks and materials account for nearly 75 per cent of Australia’s annual dividend flow of $31bn could lead to a view that as far as the index is concerned, their dividends are what matters. Still, the percentage cut in materials sector dividend estimates is some way off 2016 or 2009 levels.

More broadly Australia’s higher payout ratio and lower coverage leave dividends more vulnerable as boards shift to capital preservation mode amid the global COVID-19 crisis. Looking to the GFC as a rough parallel, Steed argues that we’re only two-thirds of the way through the descent in consensus estimates for dividends.

Energy sector dividend cuts have gone much further than they did in the GFC, though the situation now is arguably worse for oil.

Health care was the only sector that saw upward revisions in dividend estimates through the GFC, and perhaps that could happen again in the current crisis.

Other “high conviction overweight” stocks where average dividend yields exceed 5 per cent and JP Morgan has a high confidence in the company’s ability to sustain payouts include GPT, Origin, Macquarie, Amcor, Telstra and IRESS.

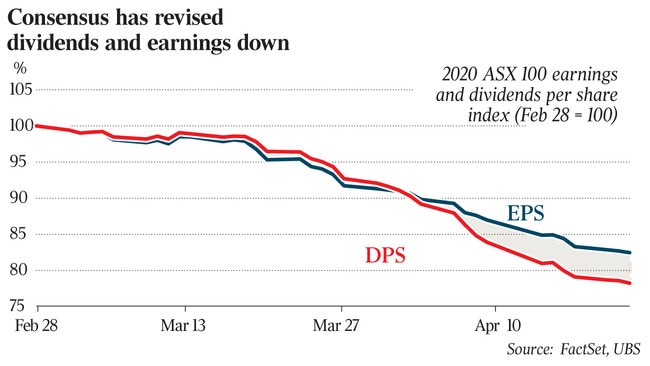

UBS equity strategist Pieter Stoltz estimates a greater impact for COVID-19 on EPS and DPS than the consensus now expects for calendar 2020.

Whereas the consensus has fallen 18 per cent for EPS and 22 per cent for DPS since the end of February, he has revised his estimates down 23 per cent and 30 per cent respectively.

So on a 12-month forward basis, the consensus has the market trading on an above-average PE ratio of average 15.6 times, while UBS estimates that it’s a bit more expensive at 16.6 times. Similarly, the consensus view has the market dividend yield of 4.3 per cent while UBS has it at 4 per cent.

“Based on UBS analyst forecasts, market EPS will not return to financial year 2019 levels until FY23, while DPS will not return to FY19 levels until well after FY23,” Stoltz says.

“Notably, after the GFC, it took more than a decade for EPS to recover to their prior highs due to a combination of weak earnings growth and large equity dilution.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout