Coronavirus, Saudi Arabia price war smash oil

Oil stocks have been smashed, caught between the coronavirus crisis and Saudi Arabia’s declaration of an all-in price war.

Listed oil stocks were smashed on Monday, caught between the coronavirus crisis and Saudi Arabia’s declaration of an all-in price war on Russia’s failure to toe the line with OPEC’s demands for production cuts.

Australian oil shares tanked after panicked energy investors were caught on one side by projections of falling demand from the impact of the coronavirus, and on the other by a tumbling oil price as Saudi Arabia said it would open the taps on its oil wells after the collapse of the so-called OPEC+ agreement with Russia.

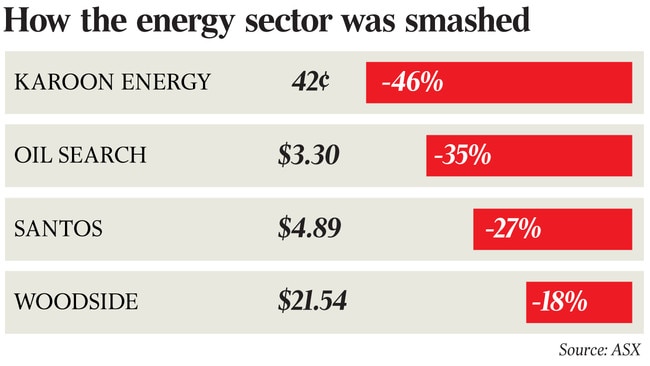

Brent crude futures were trading below $US33.50 a barrel on Monday evening as oil prices hit their worst slump since the first Gulf War in 1991, according to Bloomberg. And Australian stocks went with them, with Karoon Energy the worst hit with its shares almost halving in value on Monday, closing down 37c at 42c. Oil Search shed $1.79, or 35 per cent, with Santos off 27 per cent at $4.89 and Kerry Stokes-backed Beach Energy down 32c, or 19.4 per cent, at $1.33. Australia’s biggest oil company, Woodside, shed $4.84 to $21.54, losing 18.4 per cent. The company was trading at $36.14 on January 8.

And although the big diversified miners all took a hit on another day of market chaos, with Fortescue Metals down 10.6 per cent at $8.58 and Rio Tinto off 5.5 per cent at $80.77, BHP — which includes oil in its asset portfolio — took an out-sized blow, shedding $4.64, or 14.4 per cent, to close at $27.55.

The bloodshed was sparked after the partnership between OPEC and Russia fractured on Friday, after Russia baulked at a fresh round of production cuts, and the warring parties failed to extend current production limits past the end of March.

On Saturday newly listed Saudi state oil giant Aramco told buyers it was cutting prices, and Saudi Arabia flagged a substantial increase in output in April, seen as a play to win Russian market share.

The last time OPEC nations cut prices and turned on the taps was 2014, when oil-rich nations combined to try to keep US shale producers out of the market. That plot failed, but if a resolution is not found shortly, analysts say it could put shale producers, or high-cost output in oil producers such as Iran and Venezuela, out of business.

Fidelity International analyst James Trafford said a number of factors would weigh on medium-term prices, including whether a political solution could be found to resolve the stand-off, and how quickly virus-hit areas recovered.

“In the near term, it looks entirely possible we could drop to cash costs of production, of Brent at around $US30 per barrel, or even test the lows of around $US27 per barrel seen in 2016,” he said.

Stocks were tracking the oil price lower, but would probably bottom out before commodity prices. “But that … will require some stabilisation in the coronavirus datapoints, or signs of a policy rapprochement among oil producers. In the meantime, investors should brace for volatility,” he said.

ANZ strategist Daniel Hynes said it appeared Saudi Arabia may be prepared to live with low prices for the foreseeable future.

“Saudi Arabia can produce oil relatively cheaply, with cost of production below $US20 a barrel,” Mr Hynes said. “However, its reliance on oil revenue to fund government spending means its break-even price is even higher.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout