Coronavirus crisis Pendal’s time to shine

Emilio Gonzalez hasn’t seen anything quite like the uncertainty brought by the COVID-19 pandemic and associated lockdowns.

Like most wealth managers, Emilio Gonzalez hasn’t seen anything quite like the uncertainty brought by the COVID-19 pandemic and associated lockdowns, which are slowly being unwound.

But the Pendal Group chief executive has seen enough market cycles to know that this period of heightened uncertainty is exactly the time for active fund managers to shine.

It was true of Pendal’s predecessor BT Investment Management when it launched in 1987 and produced positive returns while most were negative in a difficult time for investors.

Gonzalez now sees a similar opportunity for proven active managers to add value.

“This is another one of those events where people will look back and wish they had stuck to their guns in the face of something that seems very ‘Doomsday’ at the time,” he tells The Australian.

“It’s critical that we have momentum coming out of this, rather than pressing the restart button, but also being sensible and ensuring that our discretionary spending is put under the microscope.”

Most of Pendal’s clients are super planners or platforms who’ve been busy ensuring their customers have enough liquidity and reweight their portfolios to maintain their strategic asset allocations.

“Naturally our revenue will be impacted going forward, because markets are down and we’re leveraged to that, so it’s prudent to ensure that we’re managing costs appropriately,” Gonzales says. “But what we’re not doing is sacrificing any long-term initiative around growth.”

Some of Pendal’s funds — such as its fixed income and its offshore opportunities funds, which can have up to 20 per cent in cash — are naturally defensive and have done well in the downturn.

Other style-agnostic funds in its stable have been able to move nimbly between sectors and adjust.

But its British equity income fund, which has a great 15-year track record of delivering above-market income to investors, suffered in the recent bear market because it aims to deliver income through dividends, and dividends are certainly being “cut in areas we thought would never be cut”.

“So there’s a benefit in our business being diversified across different strategies and philosophies,” Gonzalez says. “For those strategies that are defensive and those that can move around, this is the time to shine, and it may well be a pivotal moment for active management.”

Pendal’s clients seem to agree, with funds under management somewhat “sticky” in the downturn.

FUM fell 14 per cent to $98.9bn in the latest half while key equity indexes lost 25 per cent.

“Clients have been very calm in terms of their activity,” Gonzalez says.

“Normally flows respond to quite negative bear markets, but this bear market happened very quickly and recovery has been quick.’’

He says clients have “kept their nerve” partly because they see the virus as a temporary issue.

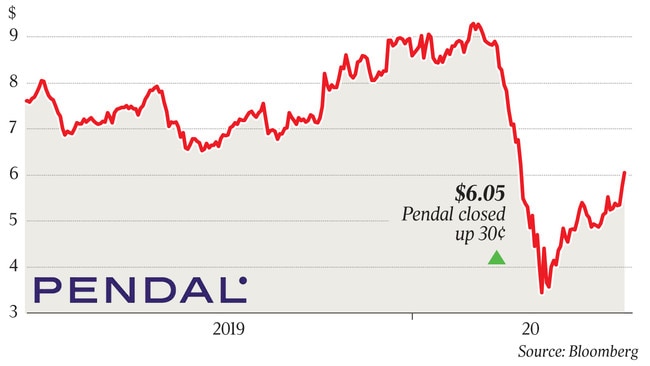

Pendal shares surged 5 per cent and hit a two-month high of $6.28 on Monday despite a decision to cut the interim dividend to 15c from 20c a year ago.

“Pendal stress-tested its business against a range of financial scenarios, and while the board is confident in the company’s ability to weather the impacts of the COVID-19 pandemic, it believes it is prudent and sensible to reduce the interim dividend,” Gonzales says in his results presentation.

Dividend cut

Cash net profit of $86.6m rose 2.2 per cent from a year ago due to higher markets and a positive foreign exchange impact on its earnings, 85 per cent of which comes from offshore.

“The dividend cut is more reflective of where we are, and balancing the last six months with what the next six months may well bring,” Gonzalez adds.

“Our dividend level tends to be in line with cash profit. Cash profit was up 2 per cent so in the absence of COVID, the dividend would be similar.

“But the outlook has changed and revenue has been under pressure for the last six months, so we’re being cautious, and will make another judgment call at the end of the year.”

Still, Pendal is always looking for strategic opportunities, particularly when markets are down.

“Markets like these throw up opportunities, and I always prefer to buy when things are down,” Gonzales says.

Serious disarray

“The last time markets were in serious disarray was in 2010-11 — a credit crisis — and we bought JO Hambro in London, which was probably the only M&A transaction at the time.”

Pendal will also launch its Global Equities Impact Fund in the December quarter under the Regnan brand, which already includes its Credit Impact Strategy that launched in February.

Impact investing means investing in companies for a measurable gain in ESG (environmental, social, governance) criteria. It’s the fastest-growing part of the market globally, particularly in Europe.

And Gonzalez has no doubt that these products can become a major driver for the company.

“If I think five to seven years ahead, they can be transformational,” he says.

“You can’t have a discussion with clients without talking about how you’re incorporating ESG factors in your investment decision making process these days. It’s the new black, so I think it can be transformational. And we’ve got the ingredients for that transformation.”

The fund may be completely new, but the team has a strong track record. “With Regnan, because it’s a specialised field, we deliberately looked for a specialised strategy,” Gonzalez says.

“While there’s a lot of direct investment in impact, there aren’t a lot of strategies available.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout