Chinese AI interloper DeepSeek’s arrival up-ends tech sector but not everyone is pessimistic

Markets are grappling with the potential ramifications of China’s DeepSeek breakthrough but the initial response of fund managers and analysts has been surprisingly constructive.

As markets grapple with the potential ramifications of China’s DeepSeek breakthrough, the initial response from fund managers and analysts is surprisingly constructive for stocks.

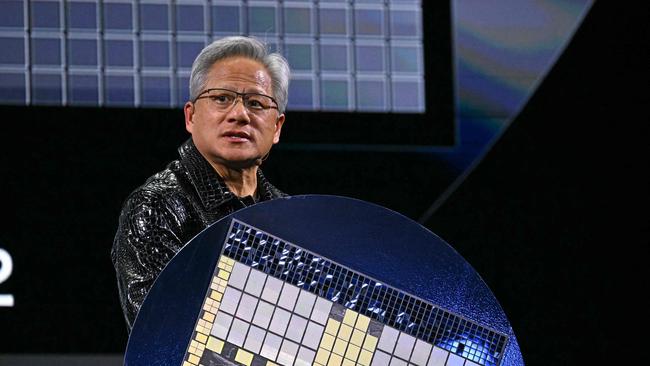

DeepSeek is a competitive threat to Nvidia and the early success of its low-cost AI model raises questions about the amounts that hyperscalers are paying for advanced chips.

But notwithstanding some safe-haven demand for US Treasuries amid a sell-off in chips and data centre stocks, investors were happy to buy other stocks in the US and Australia.

Reflecting their confidence in the overall market, investors immediately began to buy the dip in US stocks and 351 of the 500 in the US benchmark rose on Monday.

It was a similar story in Australia where the ASX 200 closed flat.

Goodman Group, NEXTDC and DigiCo Infrastructure REIT were pummeled as investors questioned their earnings forecasts from data centres. But investors switched to Aristocrat, Wesfarmers, Breville, Telstra, REA Group, CAR Group, Seek, ResMed, Woolworths, Coles and the four major banks.

Still, the market will be on tenterhooks this week after Nvidia dropped 17 per cent to a near four-month low of $US117 in its biggest one-day fall since March 2020.

Nvidia also closed below its 200-day moving average for the first time in two years.

Still, the rise of DeepSeek’s cheap but effective AI model is a welcome disruption to

the tech sector, according to the head of Australia’s biggest super fund.

The chief executive of the $355bn AustralianSuper, Paul Schroder, sees it as a “mid-cycle efficiency gain” for AI that should be welcomed by investors. AustSuper had about $2bn of Nvidia shares in its balanced investment option, where the majority of members have their retirement savings, at the end of June.

It is also a big investor in other US technology stocks like Meta and Google owner Alphabet.

“Somebody’s come along and said we can do that much more cheaply, and I was very interested in President Trump’s remarks that it’s a wake-up call. But we welcome competition, we welcome efficiency,” Schroder told Bloomberg Television on Tuesday.

“We think there’s tremendous opportunity for investing in technology, because technology will underpin – and AI in particular will have really material impacts on people’s lives.

“If something’s valuable and people are prepared to pay for it, then you can make money out of investing in it.

“There’s no doubt that tech stocks have been a powerful driver of returns for members, and it’s true that American exceptionalism and tech come together very well to be a source of income for retirees and to build people’s balances in retirement.”

However, others said the rise of DeepSeek marked a potential shift in the competitive landscape.

Janus Henderson International portfolio manager Richard Clode said it plays into the growing debate about AI scaling challenges as well as the return on equity of AI capex spending, and ultimately, the sustainability of AI capex beneficiary earnings and the prices the stock market is willing to pay.

“We continue to expect ongoing strong spending on AI capex as seen recently from announcements by Meta and the Stargate AI project announced by US President Donald Trump,” he said.

“But we also think we need to be more selective in those AI capex beneficiaries, as well as think about the next phases of AI investment opportunity as this new tech wave develops.”

Mr Clode said the market had rapidly shifted from concerns on AI capex spending being too high to now worrying that AI capex was going to collapse.

“Both can’t happen simultaneously, and the truth likely lies in between,” he said.

“Ultimately, we think these developments are positive for the long-term health and development of AI. We continue to identify selective AI infrastructure beneficiaries and build our exposure to platforms that will benefit from more efficient AI compute, training models and inferencing.”

Some analysts went further, saying that the competitive landscape may need rethinking.

“The paradigm of large language model ‘moats’ may have to be rethought,” said RBC analyst Brad Erikson. “Maybe there actually is a point of too much investment after all and this is that point.”

However, he said that DeepSeek’s efficiency breakthroughs may ultimately wind up somewhat less disruptive than it might initially seem as the US tech titans were unlikely to go quietly into the night.

“We find this generally positive for those with their own AI applications and more mixed for infrastructure on lower compute intensity partly offset by lower capex.”

Betashares senior investment strategist Cameron Gleeson said the development of more efficient AI training was overall negative for chipmakers but a very strong positive for software makers like Meta and Salesforce, shares of which rose strongly on Monday.

“End-user AI application development becomes cheaper and therefore has wider applications, so anyone who owns the customer by providing AI embedded solutions wins,” Mr Gleeson said.

Meanwhile, tariff threats by Trump continued to weigh on the Aussie dollar. It his a week low as the US dollar rose.

The currency fell as much as 0.7 per cent to US62.46c amid a rise in the US dollar index.

Trump has warned of tariffs on foreign-made semiconductor chips, pharmaceuticals and steel in order to compel producers to manufacture in the country,

“We’re going to look at pharmaceuticals – drugs – we’re going to look at chips, semiconductors, and we’re going to look at steel and some other industries,” he said.

Trump also threatened tariffs on copper and aluminium produced overseas.

“If you want to stop paying the taxes or tariffs, you will have to build your plant right here in America,” he said.

Treasury Secretary Scott Bessent wants universal tariffs on imports starting at 2.5 per cent and rising by the same amount each month, however Trump wanted “much bigger” tariffs.

At the weekend he threatened to impose a 25 per cent tariff on Colombia over its failure to accept his deportation demands under – and the South American nation accepted his demands within 24 hours.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout