Lower interest rates and quantitative easing — bond buying — by the Reserve Bank, faster fiscal stimulus from the federal government, or some major new monetary or fiscal initiatives overseas are possible if economic growth doesn’t pick up as central banks and most economists expect.

But after all the policy stimulus, including rate cuts and renewed balance sheet expansion this year, central banks would probably need some justification — like a growth shock and market meltdown — to abandon their recent optimism and take further action on the scale that markets have priced in.

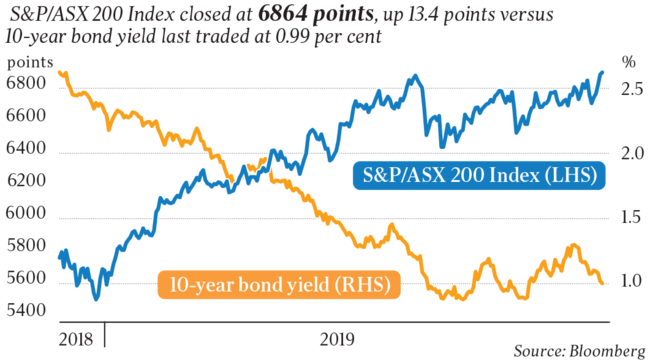

The S&P/ASX 200 index rose for a fifth-straight day, reaching an all-time record high of 6879.5 points, even as global markets faltered after US President Donald Trump signed the Hong Kong Human Rights & Democracy Bill — something that may annoy China.

The Australian market has risen as much as 3.7 per cent in the past week amid new highs on Wall Street and tumbling yields on Australian Commonwealth Government securities after RBA Governor Philip Lowe’s landmark speech on “unconventional monetary policy” laid out the circumstances under which the central bank would adopt unconventional policies including quantitative easing.

After bouncing off a record low of 0.85 per cent in August to a three-month high of 1.34 per cent early this month, the benchmark 10-year Australian government bond yield has now fallen back to 1 per cent, anchoring most deposit rates below the rate of inflation.

Despite sideways trading in equivalent US Treasury bonds, Australia’s benchmark bond yield has fallen 10 basis points this week, helping keep the Australian dollar mostly below US68.00c.

Of course a record high on the index isn’t necessarily a problem — valuation is what matters.

And on that subject, the index is now valued at a record 17.5 times expected 12-month forward earnings per share and a decade-low prospective dividend yield of 4.1 per cent.

That would be fine if major monetary or fiscal stimulus and an associated rise in the equity risk premium versus bonds and upturn in earnings per share were imminent, but are they?

“There is no alternative”, or TINA, only works to a point and can leave markets vulnerable.

The rolling 12-month forward earnings per share estimate of the S&P/ASX 200 has fallen to $388 from $400 in January and is down 6 per cent from $412 at the start of the August reporting season.

So the trend in forecast earnings per share has been deteriorating for four months — with no sign of a bottom that might support the view of the optimists who have been saying this is just a “mid-cycle slowdown” — yet index investors are effectively 12 per cent more for that declining earnings stream.

As with global markets which have risen by a similar magnitude, the S&P/ASX 200 is up 22 per cent for the year to date, and it’s entirely due to global policy stimulus and expectations of more to come.

Central banks have effectively shielded global markets from the economic fallout of US trade policy. The scale of their change in policy direction not been seen since the global financial crisis.

But they can’t repeat 2019 every year or they will risk losing credibility.

Now it’s up to economy to deliver growth, but in Australia that looks particularly elusive.

Equipment investment — the only component of the capital expenditure survey included in the national accounts — dived 3.5 per cent in the September quarter, the biggest fall since 2015.

It suggests business investment will subtract from growth in third quarter data next Wednesday.

After the weakest year of retail sales volume growth since the GFC and tepid construction data this week, economists are expecting economic growth to rise just 0.5 per cent on quarter and 1.7 per cent on year, near the June quarter result of 1.4 per cent, which was the worst since the GFC.

“We highlight that, on our numbers, domestic demand is weak, up only 0.2 per cent on quarter and 0.8 per cent on year and private demand has hit the wall,” Westpac senior economist Andrew Hanlan warned. “Private demand last expanded in the June quarter 2018.”

Further, the business investment outlook has deteriorated, led by the service sectors.

“The challenging backdrop is beginning to bite,” Mr Hanlan said.

Mining capex is in emerging uptrend following six years of decline, but that “one bright spot” in capital expenditure is already “widely recognised” by economists.

Meanwhile, the fourth estimate of capex plans for 2019-20 came in at $116.7bn versus $120bn expected, representing a “downside surprise”.

Considering that the third estimate for 2019-20 was 10.7 per cent more than the third estimate for 2018-20, the fact that the fourth estimate was just 2.5 per cent above the same estimate a year ago represents a “material downgrade from three months earlier”.

Record highs in the Australian sharemarket will be hard to sustain in the absence of major stimulus.