Bitcoin rebounds after 25 per cent rout

The cryptocurrency has had a double-digit rebound, underscoring the volatility of the hi-tech sector.

The price of bitcoin has recovered following Friday’s pre-Christmas rout when it lost 25 per cent of its market value in a day, prompting a wave of selling across the broader cryptocurrency market.

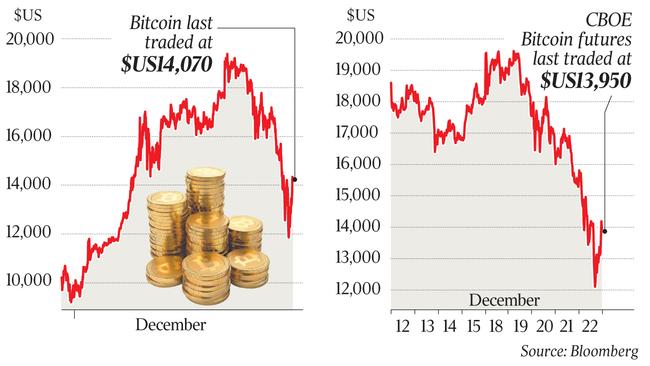

Bitcoin jumped 21 per cent by Sunday to $US15,530 ($20,100), underscoring the volatility of the cryptocurrency. This marks a sharp turnaround from Friday where bitcoin traded as low as $US10,835, capping off its biggest four-day sell-off since 2015.

By Christmas day had dropped back again to $US14,070.

The notoriously volatile digital currency started December at about $US10,000 and shot up to nearly $US20,000 last week, but has been in retreat since.

The latest jolts to the already fragile market came on Friday morning when one of the biggest hedge-fund supporters of cryptocurrencies, Michael Novogratz, tweeted that bitcoin could slide another $US4000 before resuming its bull-market run.

Meanwhile, one of the largest bitcoin trading platforms, Coinbase, announced a little after 11am New York time that “all buys and sells have been temporarily disabled”. Twenty-five minutes later, it announced that some “buys and sells may be temporarily offline”.

From its recent peak, the virtual currency has lost more than $US120 billion of its total market value in less than a week.

It wasn’t the only cryptocurrency feeling the pain. Many so-called “altcoins” — shorthand for alternative versions of bitcoin — also declined. And of the 31 digital currencies that have at least a $US1bn market value, 29 were recently down, according to data provider CoinMarketCap.

While bitcoin has been volatile in the past, the timing of Friday’s sharp sell-off caught many investors by surprise.

Jani Hartikainen, a 30-year-old software developer in Finland who owns bitcoin and other digital currencies, was working early on Friday morning when a message from a friend in a private group chat at 4am alerted him to bitcoin’s sudden drop.

After receiving that message, Mr Hartikainen, who said he first bought bitcoin in March, sold almost all of his position.

“There’s been a lot of talk about how bitcoin is in a bubble,” he said, adding that he had been worried about how sharply bitcoin had rallied recently.

“If I keep holding this, how long is it going to keep going up in value, and if it starts crashing, am I going to have enough time to get out of it?”

Ether, the second-biggest digital currency by market value, dropped 26 per cent. Another currency called litecoin was down 32 per cent. Its creator, Charlie Lee, said last week that he was selling all his holdings of the currency. Litecoin, whose price hit a record high of $US375 on Tuesday, recently traded at $US229.

Mr Lee, a former Google engineer who created litecoin in 2011, also warned on Twitter that litecoin was getting “so much mainstream exposure” and that “every crypto bull run I’ve seen has been followed by a bear cycle”.

Meanwhile, a German central banker over the weekend added to warnings about the recent sharp run in cryptocurrencies.

“We are seeing a rapid rise in value, which hides the risk of rapid losses,” Bundesbank board member Carl-Ludwig Thiele told a German newspaper.

Digital currencies exploded into the mainstream this year, garnering attention for huge price gains as well as significant swings and attracting scores of investors around the world.

The price moves starkly contrast with how most traditional asset classes, such as stocks and bonds, have fared so far this year, with volatility relatively low.

Bitcoin trading volumes in recent months have been driven to a large extent by investors in South Korea, Japan and other parts of Asia, where digital currencies have gained greater recognition. Rising interest from institutional investors and Wall Street firms helped legitimise the currency and contributed to bitcoin’s big gains. Bitcoin futures prices on Cboe Global Markets, which started trading the contracts earlier this month, were more than 10 per cent lower. The January contract was recently pricing in a lower value for the digital currency in the first quarter of 2018 than its current value, a potentially bearish sign.

A popular alternative currency called bitcoin cash had also fallen 40 per cent on Friday, according to CoinMarketCap. The bitcoin offshoot climbed in value earlier in the week after Coinbase, which operates one of the world’s largest cryptocurrency trading platforms, said its users would be able to trade the currency on its systems.

Coinbase has so far had to intermittently halt trading because of insufficient liquidity. The company is also investigating allegations that some of its insiders or their family and friends could have traded bitcoin cash ahead of its launch plans.

One outlier is ripple, the third largest digital currency by market value. It rose 7 per cent on Friday while other crytocurrencies were crashing.

The explosive growth in cryptocurrencies has drawn plenty of sceptics, including central banks, government officials, top bankers and others who think bitcoin is in a bubble that won’t end well.

Brandon Hilde, a 23-year-old software engineer in Oregon, said he sold his bitcoin position this month after the US bitcoin futures contracts launched, but then bought more bitcoin at a lower price during the recent sell-off.

He said he has been able to live off the profits from trading cryptocurrencies for the past six months.

“I bought back in just now,” he said. “I see a future where bitcoin is the currency for trading international assets.”

Dow Jones Newswires, agencies

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout