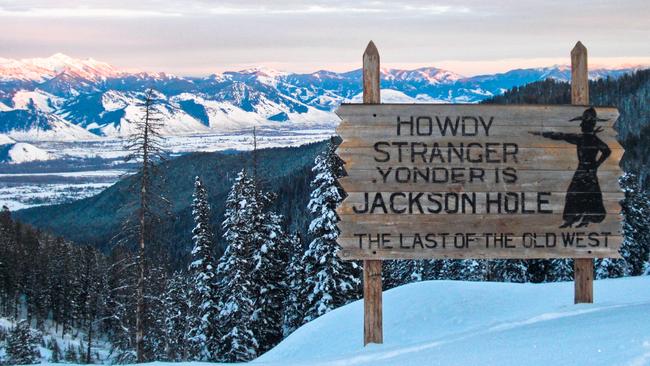

Two major events this week – quarterly results from Nvidia on Wednesday, and Federal Reserve chairman Jerome Powell’s Jackson Hole Wyoming speech – could reverberate for some time.

With Nvidia taking the role of AI bellwether, it must deliver on projections of booming AI-related sales if the US sharemarket is to avoid a renewed sell-off, with the yield on “risk-free” US 10-year bonds having surged 60 basis points to a 16-year high around 4.35 per cent over the past five weeks.

Possibly reflecting some switching out of Chinese shares by global investors amid increasing worries about China’s economic and property-sector woes, Nvidia shares surged 8.5 per cent, Tesla shares jumped 7.3 per cent and the rest of the “Magnificent Seven” also rose on Monday.

The S&P 500 chart now shows potential for a rebound to the closely watched 50-day moving average around 4455 after it broke amid soaring bond yields and China’s economic worries last week, but a head & shoulders top pattern may also be forming on the US shares benchmark.

Investors will also look at EU and US PMI data on Wednesday, but the Jackson Hole Economic Policy Symposium that runs from Thursday to Saturday is by far the most important “known unknown”.

Jackson Hole speeches often cause big moves in financial markets, and not all of them are positive. Last year’s speech on “Monetary Policy and Price Stability” caused sharp falls in shares.

Powell said restoring price stability would “require using our tools forcefully to bring demand and supply into better balance”, and was “likely to require a sustained period of below-trend growth” that would “bring some pain to households and businesses”.

History showed the Fed “must keep at it until the job is done” and it aimed to avoid a “lengthy period of very restrictive monetary policy” by “acting with resolve now”, Powell added last August.

Of course, US inflation has fallen a long way since last August, but it remains above target, and measures of services inflation are proving “sticky”. In recent weeks US PPI inflation, retail sales and industrial production have exceeded estimates and the labour market has remained tight.

The Atlanta Fed’s “Nowcast” estimate of September quarter economic growth reached a surprisingly strong annualised rate of 5.8 per cent and this is expected to come down with incoming data. Citi has upgraded its growth estimate to 2.3 per cent, with “upside risks”.

The downside of US economic resilience is that Powell emphasises the need for a higher “neutral” policy rate. That’s part of the reason why the US bond yield curve has “bear steepened”.

Thus Powell is likely to reiterate the need to finish the “job” by keeping rates high for some time.

Strong US economic activity data was probably in part responsible for the move higher in bond yields, but the steepening of the yield curve also reflects a “repricing of ‘higher for longer’ policy rates and expectations of slightly hawkish neutral rate discussions at next week’s Jackson Hole symposium”, according to Citi economist Veronica Clark.

“Minutes of the Fed’s July meeting outlined both upside and downside risks to inflation, but developments of the last month have tilted risks towards the higher inflation scenario,” she said.

For much of the last year and a half, spending on goods, while still elevated even in real terms, moved largely sideways as demand shifted back towards services post-pandemic.

But in the last couple months, this rotation seems to have reached an end and, with a strong labour market supporting demand broadly, both goods and services spending are rising in tandem again.

US housing demand has also continued to recover, with single family starts and permits still rising in July, although at a somewhat slower pace, possibly given high and rising mortgage rates.

This year’s Jackson Hole theme, “Structural Shifts in the Global Economy”, may sound less ominous than last year’s theme of “Reassessing Constraints on the Economy and Policy”.

But it leaves plenty of scope to discuss topics pertinent to inflation, including potential growth, underlying inflation, patterns in consumption, de-globalisation and decarbonisation, larger fiscal deficits, as well as the neutral policy rate known as “R*”, although artificial intelligence and remote working might be touted as a deflationary forces.

“R* discussion has the potential to sound somewhat hawkish, especially as recent resilience of activity in sectors like housing would suggest, if anything, a short-term neutral rate could be somewhat higher,” Ms Clark said.

“But we would caution that even acknowledging that the neutral rate, at least in the short term, may be higher and would likely have limited near-term implication for policy beyond leaving policy rates higher for longer, has already come to be more widely expected in markets.

“Any comments that echo recent conclusions from NY Fed president (John C) Williams that the long-term neutral rate has not risen since the pre-pandemic period could be surprisingly dovish for investors.”

Investors should buckle up as soaring bond yields and the prospect of higher-for-longer central bank policy rates outside China means sharemarkets will be even more dependent on earnings growth.