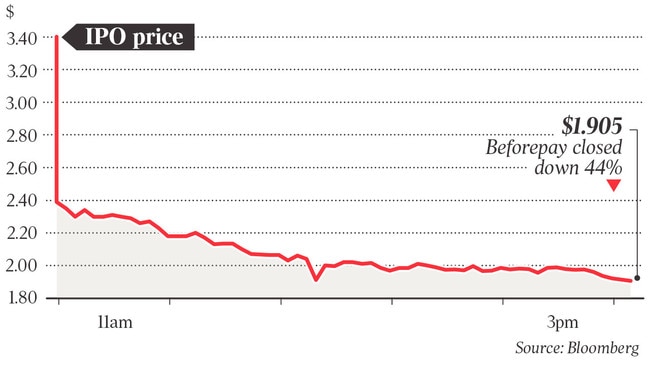

Pay-on-demand lender Beforepay dives 44 per cent per cent on ASX debut

Investors in the next-generation pay-on-demand lender Beforepay shrugged off a buoyant business update to dump shares on its first day of ASX trade.

Investors in the next-generation pay-on-demand lender Beforepay shrugged off a buoyant business update to dump shares on its first day of ASX trade, sending its market value crashing 44 per cent.

The company, chaired by former Westpac managing director Brian Hartzer, lends money against its customers’ next pay.

Despite the steep share price fall – from $3.10 to $1.90 – Beforepay chief executive Jamie Twiss said he was “focused on executing our strategy going forward”.

“Markets will go up and down,” he said, adding the public offering had been priced in November when “trading conditions were quite different”.

The company was eyeing international expansion, leaning towards the US, he said.

But Beforepay was yet to decide whether to chart its own course through the US system of state-based financial regulation or look for a local partner to help navigate it, Mr Twiss said.

“The US is probably the market we’re most seriously looking at. It’s an emerging category in the US,” he said. “We’d like to see growth that’s rapid but we don’t want to be reckless with our investors’ funds or the money we’re lending out to customers.”

However, Mr Twiss said the company was prepared to face higher lending losses in the US.

“Over the long term we’d like to have a consistent standard in the riskiness we have in different markets,” he said. “I wouldn’t want the default rate in the US to be substantially different.”

Beforepay told investors on Monday that pay advances had risen 361 per cent to $77m in the three months to December 31, compared to the previous corresponding period.

The average advance was up 108 per cent to $260 but the company reported its monthly default rate had fallen from 7 per cent to 3 per cent between October and late 2020.

Beforepay now has 139,100 active users, compared to 46,500 at the end of 2020.

Mr Twiss said Beforepay had been able to bring down default rates while increasing limits thanks to changes in its lending.

“As we get more data and we sharpen up our response, that enables us to be sharper about our limits we offer people,” he said. “Some of our most creditworthy customers, we’ve increased those limits. We’re attracting increasingly creditworthy and affluent customers who can manage a $200 pay advance the first time rather than $100.”

Customers’ borrowing limits can grow if they successfully repay loans, allowing them to borrow more against future earnings to a cap. However, Beforepay’s default rates have remained around the 3 per cent range since mid-2021.

Mr Twiss is the former chief strategy officer at Westpac, and the company has former Pepper Group executive Patrick Tuttle on its board of directors. The listing was overseen by Shaw & Partners and Evans & Partners.

The company co-founders – Tarek Ayoub and Gup Fang Mao – will have their holdings in the company diluted, with the former sliding from 15.2 per cent of the company to 11.8 per cent while the latter will own 9.7 per cent, down from 12.4 per cent.

The $35m raised from investors as part of Beforepay’s IPO is set to be used to bolster the company’s loan book.

The sell-off in Beforepay’s shares follows a difficult period for the fintech sector including Afterpay and Zip Co.

AMP Capital chief economist Shane Oliver said Beforepay may have been caught in a “rolling loss of interest in tech stocks” in the face of interest rate rise expectations. “There were a lot of ‘peccy’ tech stocks where investors were prepared to give them the benefit of the doubt; that sentiment seems to have turned,” Dr Oliver said on Monday.

But Beforepay’s business model has also been the focus of specific criticism from some consumer rights activists who have long worried about the broader buy now, pay later sector.

Financial Counselling Australia chief executive Fiona Guthrie has pushed for regulation of the sector, warning that wage lenders such as Beforepay risked lending money to those least able to afford it. “All we want to see in financial counselling is lending provided in a safe way,” she said. “It’s better for the economy when everyone plays by the same rules.”

In its prospectus, Beforepay acknowledged there were risks that customers would not be able to repay loans, and that the business could be affected by new regulations in the sector.