Australian shares set to fall amid China tensions

Australian shares are expected to continue their downward drift on opening as rising tension with China.

Australian shares are expected to continue their downward drift on opening as rising tension with China and ongoing concern over coronavirus case numbers weigh on investors.

Investors remain on a cautious footing ahead of earnings season, with a clutch of major companies to deliver interim or full financial year results in coming days.

ASX SPI 200 futures were last trading down 27 points, or 0.5 per cent, indicating a weaker Monday opening for the benchmark S&P/ASX 200 index.

“After a strong rally from March lows shares remain vulnerable to short-term setbacks given uncertainties around coronavirus, economic recovery and US-China tensions,” AMP Capital chief economist Shane Oliver said.

Adding to concerns is Australia’s decision to raise the stakes in its worsening relationship with China after late last week formally declaring disputed Chinese claims in the South China Sea had “no legal basis”.

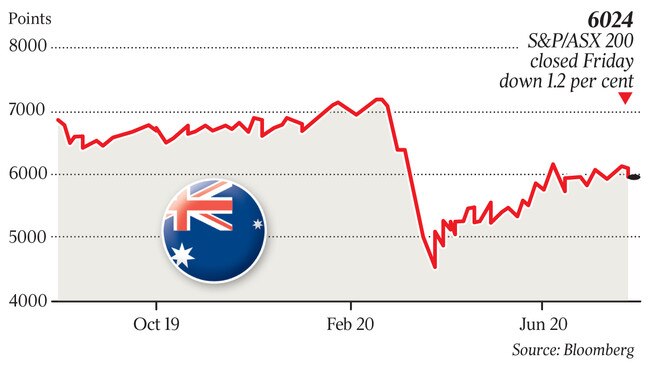

Australian shares finished lower on Friday amid a global technology sell-off, leaving the benchmark index slightly lower for the week.

At the close of trade, the S&P/ASX 200 was down 70.5 points, or 1.16 per cent, at 6024 points.

On Friday night the Wall Street benchmark, the S&P 500, lost 0.6 per cent to 3215.63. The Dow Jones Industrial Average shed 0.7 per cent.

The tech-heavy Nasdaq Composite dropped 0.9 per cent, finishing its second consecutive week of declines.

On Monday the nation’s biggest listed fund, the Australian Foundation Investment Company, releases its annual results. Following this on Wednesday is mining major Rio Tinto with its first half results.

Also on Wednesday AACo and auto dealer AP Eagers are expected to deliver earnings updates at their respective annual meetings, while investment bank Macquarie holds its AGM on Thursday.

Others with results this week include GUD, which is scheduled to deliver full year accounts, while engineering interest CIMIC is scheduled to deliver interim results on Thursday.

Morgan Stanley said this earnings season, which will be handed down in the shadow of the COVID-19 crisis, is shaping up to being the most important for some time. “In a world where guidance has been withdrawn, earnings estimates are stale and earnings dispersion is very wide, the looming refresh will provide much-needed context and depth to what have typically been updates that have been narrow in focus and scant on detail,” the brokerage said in a note to its clients.

Morgan Stanley said the lack of earnings guidance and generally “low visibility” had pushed the focus for the earnings recovery for Australian corporates into next financial year.

Elsewhere this week the release of key data is expected to provide a better snapshot into the health of the domestic economy.

June quarter inflation figures are scheduled for Wednesday, with the figures expected to report a record drop in prices across the board as Australia falls into a period of deflation. This comes on the back of Treasury forecasts last week which said the COVID-19 pandemic hads pushed the Australian economy into recession — the first since 1991.

The federal government is forecasting the economy to contract by 0.25 per cent in financial year 2020, factoring in a 7 per cent decline in the June quarter.

“The COVID-19 shutdown will hit the (Consumer Price Index) hard via a direct impact from the significant loss in demand which government support (subsidies) for critical services will magnify, driving record-breaking quarterly declines in both the headline and core measures of inflation,” Westpac economics said in a note to its clients.

Westpac is tipping inflation to come in at minus 2.4 per cent, with the annual pace dropping to -0.9 per cent from 2.2 per cent in the March quarter.

Other figures this week include ABS building approvals for June and private sector credit figures also for June.