ASX rockets up in record 7pc rebound

Australian shares rose by the most on record as the government signalled it would do whatever it takes to save the economy.

Australian shares rose by the most on record on Monday as the Morrison government signalled it would do whatever it takes to save the economy from the worst effects of lockdowns to fight the COVID-19 pandemic.

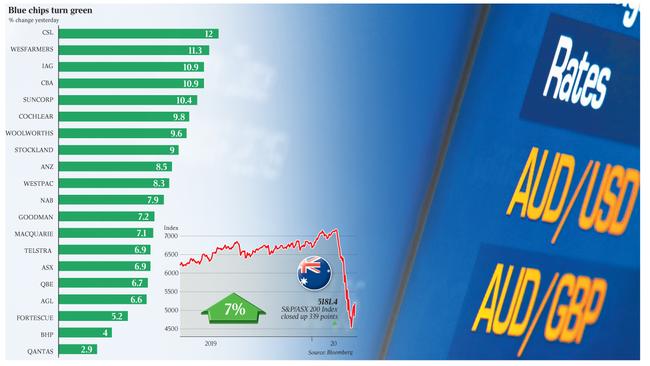

In the best day since the index began in 2000, the S&P/ASX 200 surged 338.95 points or 7 per cent to 5181.38 points — while the All Ordinaries index rose 6.6 per cent, its biggest rise at least 1970 — as Prime Minister Scott Morrison announced $130bn in wage support for six months.

After falling as much as 39 per cent in the past five weeks as the outbreak went global, the benchmark S&P/ASX 200 share index has bounced 18 per cent from a seven-year low a week ago, putting it close to returning to a bull market.

The four major banks outperformed with gains of 7.9-8.5 per cent, while CSL soared 12 per cent, Wesfarmers jumped 11 per cent and Woolworths rose almost 10 per cent. The Australian dollar consolidated near US61.50c after hitting a two-week high of 62c on Friday night.

Helping sentiment in the local sharemarket, Australia’s biggest banks said they would extend repayment deferrals to businesses with loans up to $10m and lenders agreed not to enforce terms for non-financial breaches of loan contracts during the six-month deferral period.

The Australian Prudential Regulation Authority pushed back its scheduled implementation of the Basel 3 reforms by a year, giving banks relief against being forced to hold more capital, while a slowing of Australia’s daily infection rate gave some hope that tough lockdowns are working.

The third tranche of fiscal stimulus, which will see the government pay wage subsidies of $1500 a fortnight per employee to eligible businesses to help keep people in jobs, brings the total fiscal and monetary policy stimulus to a staggering $320bn or 16.4 per cent of the Australian economy.

EY chief economist Jo Masters said the job-keeper payment should be welcomed, even though it would “add significantly to the debt pile” and would cushion rather than fully offset the expected hit to consumption from weakness in the labour market.

“It is expected it may also provide some support for consumer confidence.

“Being stood down and paid some income — as opposed to losing your job — implies there is a job on the other side, that there will be a job ready and waiting rather than having to hunt and compete for one,” she said.

Mr Masters added that it was unclear how quickly the stimulus could flow to the economy, with the jobseeker subsidy due to start reimbursing employers in late April/early May.

“Timing is particularly important given the Grattan Institute found that one-quarter of working households have less than one week’s income in savings at the bank (and) half of working households have 5.6 weeks or less.”

Even with the policy stimulus packages, the nation’s economic outlook remained “incredibly challenging” because there was “still considerable uncertainty about the health crisis as well as the economic fallout, and confidence has evaporated”.

“Policy support will cushion the blow, and in time, support recovery,” she said.

“Nonetheless, economic conditions are likely to get worse before they get better.”

Before the job-keeper announcement, Australia’s unemployment was expected to hit double digits in coming months, but the peak is now likely to be somewhat lower, although underemployment would remain an issue, Ms Masters said.

Similarly, Credit Suisse macro strategist Damien Boey said the job keeper program — which takes the total fiscal stimulus announced in Australia to $213.6bn, an amount equivalent to 10.6 per cent of the economy — was an “unprecedented amount of deficit spending”.

“All of this is very significant,” Mr Boey said.

“When combined with easier monetary policy, the size of stimulus starts to get closer to the shutdown cost” but announced fiscal stimulus measures alone “will not be enough to prevent an outright contraction in the economy”.

“For as long as the shutdown period is indeterminate, there will be uncertainty about how adequate the stimulus package will be, but we think that the government is actually making a reasonable fist of the situation,” he said.

AMP Capital chief economist Shane Oliver noted that the proposed $1500 a fortnight subsidy was about 70 per cent of the median wage.

However, it was about 100 per cent of the median wage in industries like hospitality and retail that were being heavily hit by coronavirus shutdowns.

“It’s a far preferable approach to relying on supporting incomes via enhanced unemployment benefits through Centrelink/Services Australia as it keeps people employed, takes pressure off businesses, takes pressure off Centrelink, minimises a confidence-sapping surge in unemployment and keeps workers connected to their employer, which will aid a speedier start-up of businesses and the economy once the virus is under control,” Dr Oliver said.

The government has also announced that the partner income threshold for receiving JobSeeker payments will be increased from $48,000 to $80,000.

The $130bn estimate cost of the wage subsidy will be partly offset by reduced access to unemployment benefits, but it will still take total federal budgetary and state budgetary measures to protect and ultimately stimulate the economy to around $200bn, or 10 per cent of GDP.

“This of course is before allowing for federal government loan guarantees and cheap RBA funding for the banks, which bring total fiscal and monetary support to around 16 per cent of GDP.

“This fiscal stimulus will now swamp that seen at the time of the GFC,” Dr Oliver added.

“This is necessary given that the threat to economic activity is bigger than anything seen in the whole post World War II period with a potential hit to June quarter GDP of 10 per cent.”

Nomura’s Andrew Ticehurst noted that central banks and governments were working together even more closely — which is “an interesting and potentially globally relevant development”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout