Note too we have reached new records in the month of January. It’s the month the market will often run hard, as New Year optimism rules. The last few trading days have been the strongest stretch since a similar period exactly a year ago.

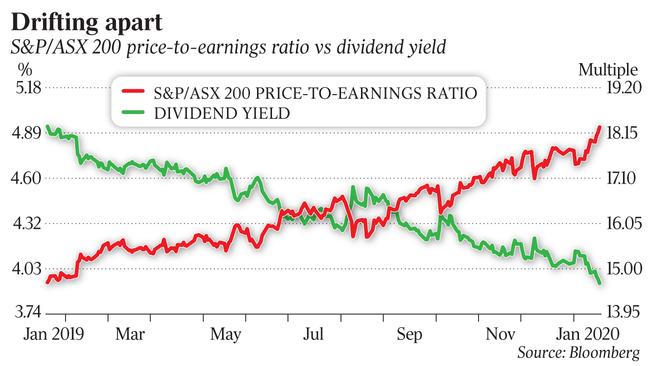

But this is a very late stage bull run fraught with danger, as the latest upswing comes on the back of a share market that is already highly priced and signalling classic indications of overheating.

Moreover, our market is surfing on the back of better earnings and stronger economic signals offshore. Should Wall Street reverse we will have no safety net.

For now though, such fears will take a back seat as the US economy shows renewed strength and any sign – even temporary - of an easing in trade wars will make share markets comparatively attractive in an era of rock-bottom interest rates.

This phase of the bull market is going to be dominated by companies that offer the prospect of price growth rather than income.

So it is entirely fitting that blood products group CSL, the flag-bearer of the growth stock sector, finally hit the $300 mark on Thursday morning.

Unlike their peers in the US, few of our local companies can offer strong price growth prospects. Those that do get bid up dramatically. CSL was $198 a year ago.

Similarly buy now, pay later finance group Afterpay was $16 this time last year and $33 now, while software star Xero was $42 and is $85 now.

In contrast, many of the so-called bond proxies which offer income (dividends) as their key attraction are languishing – leading banks such as ANZ and NAB to offer share prices which are virtually unchanged compared to this time last year.

Despite these deep divisions in the market, every investor will gain to some degree as a rising tide lifts all boats.

Underpinned by strong sharemarkets in the run up to Christmas, calendar 2019 offered 13.8 per cent for “median balanced” superfunds, which was the best return since 2013.

Research house SuperRatings says investors can expect more “solid” returns this year.

A broad market lift which carries almost all stocks with it will also be exceptionally useful to the new generation of investors who have been pouring into exchange traded funds (listed index funds) which are designed to reflect the fortunes of the wider market.

But this “hot” market will be toughest on those who are most conservative.

Self-managed super funds with 10 to 20 per cent in cash will have their overall returns diluted despite the strong share markets. In a similar fashion “value investors” who have been hoarding cash and waiting for bargains are going to look very ordinary against those who are “fully invested”.

How long will it last?

As we know, January is often a bullish month and gains made through the month can be neutralised later in the year. In some years past the gain in January was not much different than the gains for entire year.

Most analysts are predicting high single digits for share market returns in 2020 and we have put on about 5 per cent already this month, so should we gain more than 4 per cent by the end of the month.

From that point onwards we will be in trading in very thin air.

Ring the bell! This is a big moment for the Australian sharemarket as we smash through the crucial ASX 200 7000 mark, fuelled not by local news but America’s new trade deal with China, which pushed Wall Street to new heights.