ASX gains on glimmers of optimism with gold miners higher

A potential boost to the US stimulus package was one factor helping to fuel a last-minute ASX 200 surge.

Negotiations on the US government’s coronavirus stimulus package and a pledge for infinite monetary stimulus were key drivers of the market on Tuesday, helping the benchmark S&P/ASX 200 bounce from its 2012 lows despite warnings the local economy was sinking into a deeper recession.

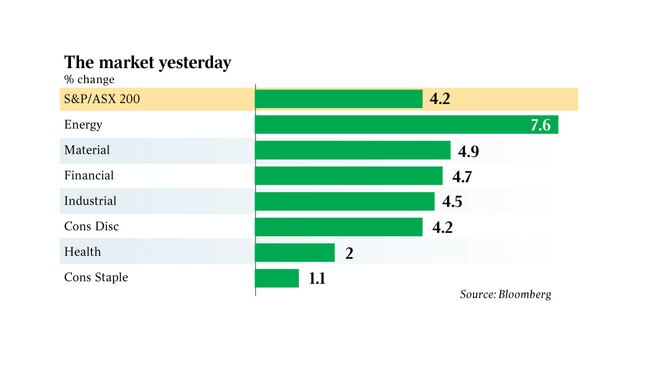

Glimmers of optimism, and a potential boost to the US package, helped to fuel a 125 point surge in the final thirty minutes of trade, to send the index to daily highs of 4735.7 at the close – that's a 190 point, or 4.17 per cent, lift for the session.

Meanwhile, the All Ords added 189 points, or 4.15 per cent, to 4753.3.

By the close, US politicians conceded they were yet to make a deal on the planned $US2.5 trillion in stimulus, but that a deal was “very close”. That was after the US Federal Reserve said it was expanding its bond buying program to unlimited stimulus, and as the RBA injected a further $7bn of liquidity into the local market.

In another day of long queues at Centrelink, as more workers were laid off, Westpac chief economist Bill Evans ratcheted up his dour assessment on the economy, tipping the unemployment rate to reach 11 per cent by June – from 7 per cent just last week – with a sustained recovery not expected until the fourth quarter.

“Economic disruptions are set to be larger as the government moves to address the enormous health challenge which the nation now faces,” Mr Evans said.

“That challenge is probably best summarised by a potential shortage of ICU beds in coming weeks if we do not significantly slow the rate of infection immediately.”

Adding to that, ANZ’s latest read on consumer confidence showed the biggest plunge on record as fears grow the increasingly draconian measures to control the spread of the coronavirus will spark a “depression-like” economic contraction

Still, the Aussie dollar ticked higher by 1.42 per cent to US59.10c at the local close as the US dollar came under pressure from the Fed’s pledge.

Similarly, that helped the Hang Seng higher by 3.5 per cent, as China’s Shanghai Composite put on 0.9 per cent, South Korea’s KOSPI lifted by 6.3 per cent and Japan’s Nikkei soared by 6.2 per cent.

The New Zealand bourse bounced back by 7 per cent after its biggest drop on record on Monday, following moves to shut down the country to stem the spread of coronavirus.

To equities, and banks rebounded as Citi analysts put a buy rating on the sector, saying the 40 per cent plunge in the sector since February was “well overdone”.

Commonwealth Bank ticked higher by 5 per cent to $57, Westpac put on 2.9 per cent to $14.51, NAB rose by 3.75 per cent to $14.40 and ANZ outperformed with 5.3 per cent lift to $14.85.

Macquarie also was a standout, adding 10.9 per cent to $79.90 while Bank of Queensland lost 3.1 per cent to $4.70 and Bendigo and Adelaide Bank lost 3.5 per cent to $5.47 while lender Mortgage Choice added 3.7 per cent to 56c.

The major supermarket chains took a step back after solid performance amid the pandemic panic, and despite ANZ spending data showing supermarket spend had jumped by 40 per cent so far this month.

Woolworths dragged most, down 0.7 per cent to $36.18 as it called off its $10bn Endeavour drinks group spin-off and announced it was standing down more than 8000 staff across its ALH pubs arm.

Coles spend the day in the red but in the late rally pushed higher to finish up 3.6 per cent at $16.14 while former parent Wesfarmers rose by 2.1 per cent to $31.68 and Metcash lost 2.1 per cent to $3.22.

To the major miners and BHP lifted by 5.1 per cent to $28.40, Rio Tinto ticked higher by 1.1 per cent to $79.55 and Fortescue rose by 1.9 per cent to $9.73.

Gold miners outperformed – Newcrest added 6.5 per cent to $24.21, Evolution got a 9 per cent boost to $3.98, Northern Star jumped by 16.9 per cent to $12.82 and Saracen Minerals surged by 17.9 per cent to $3.50.

GrainCorp came under pressure as it completed the demerger of its Malt business, finishing down 55.6 per cent to $3.07.

In the latest spate of earnings withdrawals, Michael Hill suspended the operation its retail stores, sending shares lower by 14.6 per cent to 24c while Shaver Shop stepped back by 23.3 per cent to 23c as it said like-for-like sales were taking a hit amid the pandemic.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout