ASX at lowest closing level since 2016

The latest measures to curb the coronavirus outbreak have fed recession fears.

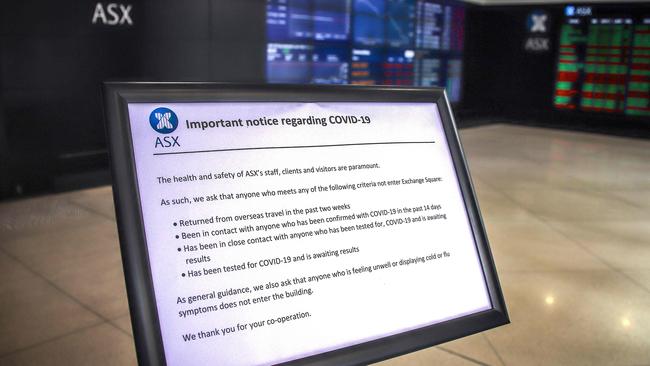

A broad market drop erased all of the previous day’s gains to send the ASX to its lowest closing levels since 2016 as fears of a local recession were stoked by further restrictions on travel and a rising local coronavirus case count.

The latest measures to curb the coronavirus outbreak have fed recession fears, sparking the unwinding of Tuesday’s 5.9 per cent lift - the market’s biggest since 1997.

By the close on Wednesday, shares were down 340.2 points, or 6.43 per cent, to 4953.2 – a 31 per cent drop from February’s record high.

The All Ordinaries gave up 334 points, or 6.26 per cent, to 4998.8.

The share sell-off came despite the latest round of fiscal stimulus announced from the US government, with the White House seeking approval for a $US1.2 trillion package, including direct payments to households.

Further fiscal and monetary stimulus locally is set to be announced on Thursday, but still Australian shares were sold off – underperforming the rest of the Asia Pacific.

China’s Shanghai Composite was down by a more moderate 0.22 per cent at the local close while Japan’s Nikkei was down by 1.1 per cent, the Hang Seng by 1.98 per cent and South Korea’s KOSPI by 2 per cent.

OANDA’s Jeffrey Halley noted that the make-up of the local market could be the key factor in its relative underperformance.

“Australia seems to be playing its own game at the moment, with a much higher correlation to the aftermarket US index futures than the rest of the region,” he said.

“The Australian market is heavily weighted towards banks and resource companies. With the RBA slashing rates and about to start QE, interest margins will be under pressure. Add in a country effectively in lockdown and a sagging corporate sector, and it’s hard to be positive on the big four in the near-term.”

Accordingly, banks were the biggest weight in Wednesday’s trade – Commonwealth Bank shed 5.5 per cent to $63.95, Westpac took a 7.8 per cent hit to $15.90, NAB wound back by 7 per cent to $16.01 and ANZ lost 9.7 per cent to $16.62. Macquarie dropped 12.8 per cent to $91.05.

To the miners, and heavyweight BHP lost 3.8 per cent to $27.14, Rio Tinto ticked lower by 3.7 per cent to $79.91 and Fortescue gave up 3.2 per cent to $10.35.

Gold miners were the key standout, as a weak Aussie dollar sent the local gold price soaring to new records of $2650 an ounce. The Aussie dollar hit 17-year lows of US59.59c in the overnight session, and edged mildly higher to trade at US60.01c at the local close.

St Barbara put on 9 per cent to $2.13, Evolution lifted by 8.8 per cent to $3.95, Northern Star added 7.8 per cent to $11.86 and Newcrest put on a more moderate 1.6 per cent to $24.39.

Travel names took another hit from the extension of travel restrictions both locally and abroad, despite a $715m bailout for airlines. Qantas fell by 11.5 per cent to $2.53 and Air New Zealand remained halted at $1.57 pending its response to the wide-ranging capacity cuts while Virgin ticked higher by 6.4 per cent to 6.7c as it suspended all international flights.

A swath of companies threw out their guidance amid the uncertainty – Kathmandu said store closures in Europe were squeezing sales, sending its shares lower by 10.9 per cent to $1.52.

National Storage slumped by 28 per cent to $1.30 as US suitor Public Storage abandoned its $1.9bn takeover bid for the REIT.

Aristocrat dropped 10.8 per cent to $19.01 as it said social distancing was affecting demand, while Ardent Leisure shed 8.9 per cent to 20.5c on the announcement it was closing its Main Event centres in the US.

Flight Centre finished lower by 4.7 per cent to $14.80 as it entered crisis talks while Ramsay Health shed 8.6 per cent to $54.44 as it scrapped its guidance.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout