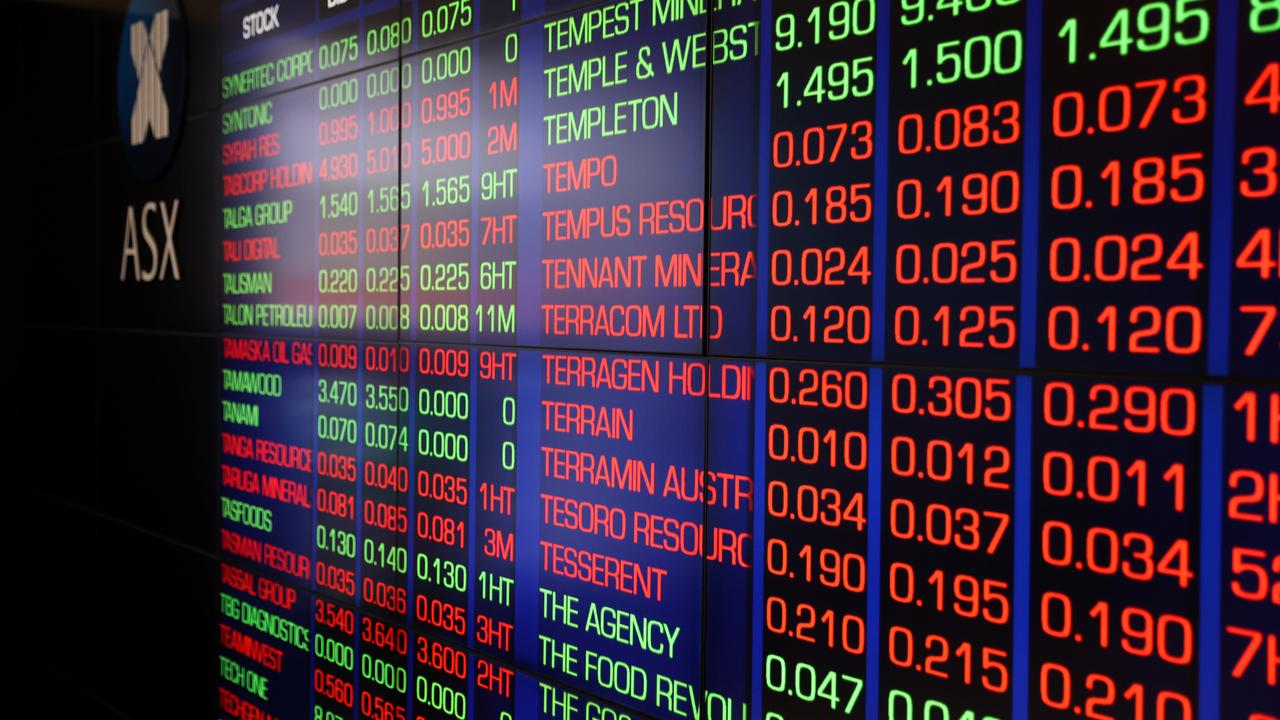

ASX 200: Stocks tipped to dip after a horror week

The Australian sharemarket is expected to open lower on Monday, following a torrid run in which the ASX 200 fell 6.6 per cent in its worst week since March 2020.

The Australian sharemarket is expected to open lower on Monday, following a torrid run in which the ASX 200 fell 6.6 per cent in its worst week since March 2020.

Futures point to an open 0.3 per cent lower than Friday’s close of 6474.8 points, despite a slight uptick in Friday trade on the S&P 500 – up 0.2 per cent – and the Nasdaq, which rose 1.4 per cent. The Dow, however, fell 0.1 per cent to close at 29888.78.

Both the Bank of England and the Swiss National Bank raised interest rates late last week – following a move from the US Federal Reserve.

This leaves the Bank of Japan the only global player to maintain near-zero interest rates.

Reserve Bank governor Philip Lowe will speak about the economic outlook and monetary policy at an AmCham event on Tuesday, shortly before the central bank releases the minutes of its June board meeting, where it raised rates 50 basis points.

Dr Lowe is also participating in a panel discussion at the Global Monetary Policy Challenges forum in Switzerland on Friday. Fed Reserve chairman Jerome Powell faces a congressional banking committee in Washington on Wednesday.

“A more aggressive approach from global central banks to tame rampant inflation has seen markets reprice interest rate and inflation expectations,” said CommSec senior economist Ryan Felsman.

“We expect that aggressive rate hikes by central banks will contribute to further volatility in global sharemarkets over the coming months.

“In the current environment of elevated inflation and rising interest rates, investors are likely to pay even closer attention to company valuations and earnings growth, with a likely contraction in price to earnings ratios.

“While share prices have already declined, earnings have further room to fall as economic growth slows.”

Cryptocurrency assets were volatility over the weekend.

Bitcoin continued its lengthy downward slide, shedding more than 4 per cent on Sunday to trade under $US20,000 ($28,800) for the first time since late 2020.

It has lost almost a third of its value in the last seven days alone.

Ethereum was also down about 4 per cent and was trading at $US965 on Sunday.