ASX 200: Bear market rally gives investors a chance to reshape portfolios

Macquarie says the current rebound in the sharemarket gives investors a chance to prepare for a deeper fall.

Macquarie says the sharemarket rebound gives investors a chance to prepare for a deeper fall.

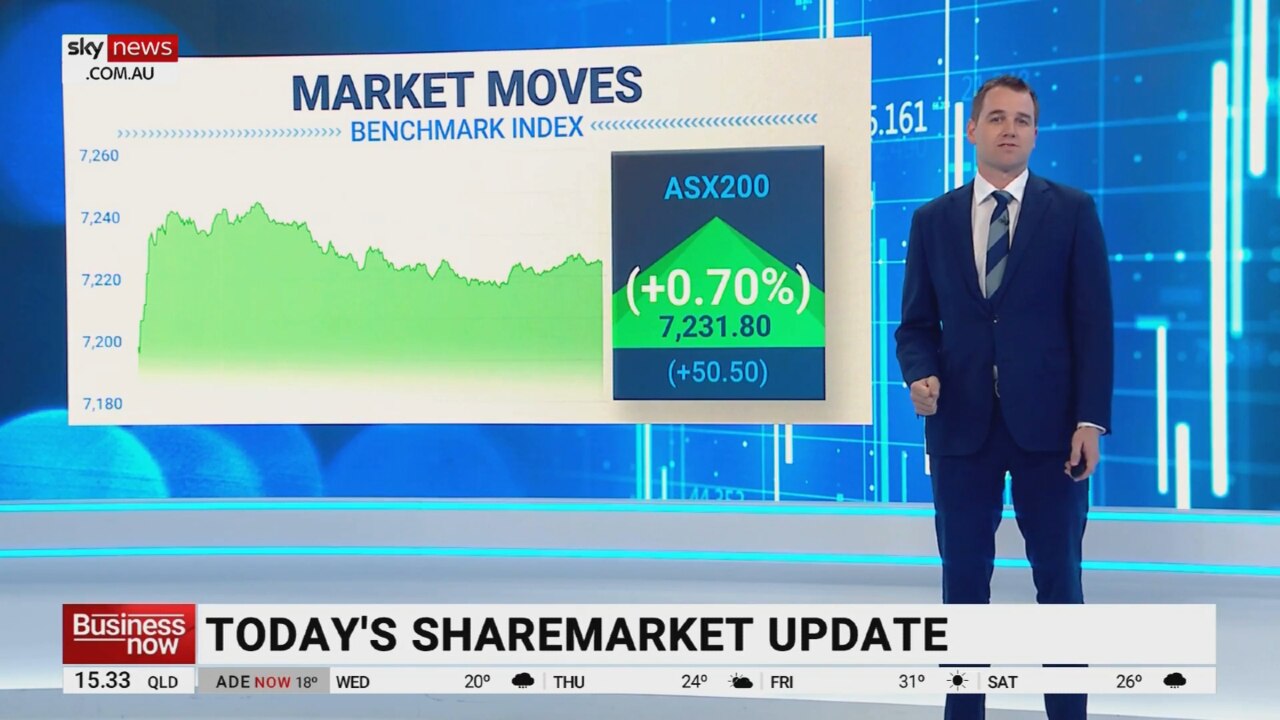

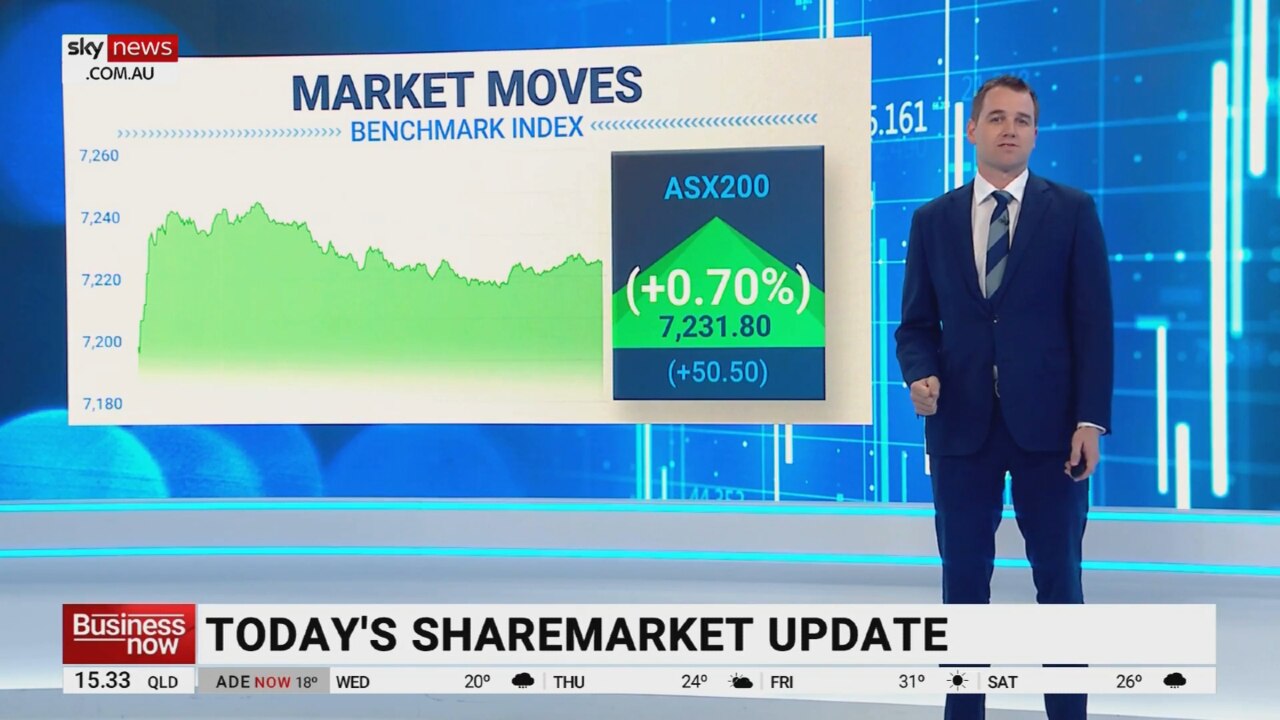

From a record high near 7630 points in August 2021, Australia’s ASX 200 index has fallen as much as 16 per cent amid volatility associated with Covid lockdowns, pandemic stimulus and the subsequent inflation and rate hikes.

The local bourse hasn’t fallen as much as global markets this year, but in every practical sense it has been a bear market, albeit cushioned by the high energy prices and a lower exchange rate.

In the past two months, the ASX 200 has rebounded about 13 per cent in what may prove to be another “bear market rally” similar to the February-April and June-August rebounds.

The latest rebound came after the Reserve Bank slowed the pace of rate hikes and the Fed indicated that it may do the same next month, fuelling hopes that inflation will cool enough to allow central banks to cut interest rates in late 2023, thereby offsetting an expected slump in profits.

After exceeding its 200-day moving average and forming a major double-bottom pattern, the index may have started a new bull market, which may be backed by favourable seasonal and post-midterm election impacts on the US market, as well as a slower pace of US rate hikes.

A US recession is thought likely, with the US yield curve in its most “inverted” state in four decades. A US recession would arguably trump the seasonal and midterm election effects, and touch off a damaging wage of profit downgrades.

In the latter scenario, the rebound would almost certainly be just another bear market rally.

Global fund manager sentiment is quite bearish, the CBOE equity put-to-call options ratio hit a record last week, and it’s certainly hard to find any raging bulls among equity strategists.

But the consensus seems to be that the ASX 200 will display resilience on a 12-month view.

Macquarie’s Australian equity strategist Matthew Brooks is in the bearish camp. In early October, he said that month “may have started with a bear market rally”.

But he cautioned at the time that “a sustainable low in equities requires central banks easing”.

His central bank indicator suggested the interest rate raising cycle won’t end until mid-2023.

Brooks now says investors should prepare for a “downturn” phase of the economic cycle. He maintains that rate cuts – not just a pause in hikes – will be needed to drive recovery in shares.

Defensive equities with less cyclical earnings – like Orora, Woolworths, Coles, CSL and Ramsay – are favoured, together with bond proxies that benefit from lower bond yields, like Transurban, APA and ASX.

Investors should look to reduce their exposure to cyclical companies like Qantas (even as it continues to upgrade is profit outlook), Flight Centre, Seven Group, Tabcorp, South32, James Hardie, BHP and Woodside. They should also trim exposures to stocks that gain on higher rates, like Computershare, as well as the nation’s banks and insurers.

In Brooks’s view, the global inflation fight by central banks in 2022 has cast a long shadow over 2023. His leading indicators suggest that the US is near the start of a recession.

Central bank rate hikes may be “closer to the end than the beginning” but “until unemployment rises, rate hikes continue at slower pace to fight inflation”, he says.

Inflation may be persistent, but “cyclical downside risks” are set to rise in 2023.

To be sure, the forward-looking indicators of inflation are already starting to slow, and lower commodity prices will “slow inflation, but also signal demand weakness”.

Bond yields are now 200-300 basis points too high relative to the Conference Board leading indicator, says Brooks. He sees downside risk to yields, with a fall in nominal yields likely to be driven by break-evens, then real yields.

Meanwhile, Australian market indicators are yet to signal that the market has hit its bear market low (that will only be known in hindsight), and the price-to-earnings valuation is “not cheap enough to get excited about given recession risks”.

Australian corporate earnings growth forecasts are unchanged since the last reporting season.

But they’re potentially quite stale, due to the fact that fewer companies than usual have been giving earning guidance since the pandemic.

The Australian market is now just 5 per cent below its record highs and only down about 3 per cent year to date, as investors look past high rates and inflation.

RBA Governor Philip Lowe warned on Tuesday that Australians should brace for a lift in inflationary pressures and slow growth in the years ahead.

CommSec chief economist Craig James says investors are placing significant trust in central banks to get it right. A wage-price spiral could not only spell trouble for the economy but would see investors flock back to defensive assets.

“The RBA has let investors know what could go wrong, so the central bank can’t be accused of being too upbeat and not representing the risks, but investors are indeed placing significant trust in central banks to get it right – notably in the US and Australia,” James says.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout