ASIC warns ASX over trading meltdown

Corporate regulator puts ASX on notice over technology meltdown that knocked out the market operator for almost an entire trading session.

The corporate regulator has put the ASX on notice over the technology meltdown that knocked out the market operator for almost an entire trading session, putting billions of dollars worth of transactions on hold.

The ASX was forced to apologise for its worst outage in recent decades, caused by a software issue relating to a system update over the weekend that crippled its entire trading platform. It said it expected trading to begin at the normal time on Tuesday.

The Australian Securities & Investments Commission, which has oversight of the ASX, has demanded a full incident report on the outage and warned it would be reviewing whether the exchange was in line with its obligations under its market licence.

“ASIC views outages of this nature with significant concern,” the regulator said.

“It has had a significant impact on the market, including market participants and investors.

“Well-functioning financial market infrastructure is critical to the integrity of the Australian equity market and the trust and confidence investors have in it.

“Market licensees are required to operate a market that, to the extent reasonably practicable, is fair, orderly and transparent, and to have sufficient resources — financial, technological and human — to operate the market, including for any outsourced services.

“Following the reopening of the market, ASIC will determine whether ASX followed the relevant regulatory requirements under the Corporations Act and met its obligations under its Australian Market Licence.”

ASX Limited chief executive Dominic Stevens said the outage “falls short of the high standards we set ourselves and the standards others expect of us”.

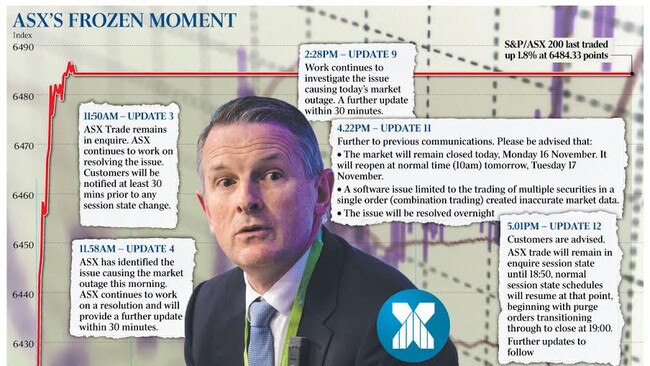

After a strong open, during which the S&P/ASX 200 index surged 1.3 per cent to an eight-month high of 6484.3 points after Friday’s strong gains on Wall Street and an early jump in US futures amid coronavirus vaccine optimism, the ASX ominously warned that it was “investigating” after becoming aware of a “market data issue affecting partition 3 securities”.

But a few minutes later all trading was halted by the exchange operator after it discovered a “critical operational impact” from “ongoing market issues”.

What followed was one of the biggest ever unplanned outages of Australia’s stock exchange.

By midday, the ASX said it had “identified the issue causing the market outage” and was working on a resolution. That gave some hope to stockbrokers hopeful that the market would soon reopen, allowing them to claw back revenue lost by the halting of billions of dollars of turnover that drives the lion’s share of their revenue.

But just before 3pm, the ASX said the market “will not open for the remainder of the day”, and said a “resolution path was in place to allow trading to commence tomorrow at 10am”.

Fund managers said it would have been a much quieter than usual day in any case due to the two-day Australasia Virtual Conference 2020, hosted by UBS, and that as long as there was nothing “sinister” behind the outage investors would look through the disruption.

But traders said they were counting on a “normal day” on Tuesday.

“As all would know the ASX did an upgrade on the weekend and something happened — someone said a trade that went through may have done it — that saw the ASX crash and they never got it back up,” said Richard Coppleson, head of institutional sales and trading at Bell Potter. “We have seen this before — but not for a while. The test will be tomorrow when it comes back on.”

The latest outage adds to hurdles facing the main operator of Australia’s $2 trillion sharemarket.

The ASX has come under pressure in recent months from regulators including the Reserve Bank to upgrade its ageing CHESS clearance system after a string of delays.

In a media alert on Monday afternoon, the ASX said it “sincerely apologises and deeply regrets the disruption to the market caused by the outage of the ASX Trade system”.

It also pointed the finger at technology supplied by Nasdaq, the US and trans-Atlantic multinational financial services group that owns and operates the Nasdaq stockmarket and eight European stock exchanges globally.

“Today was the go-live for the refreshed ASX Trade system, which is the trading platform for ASX’s equity market,” ASX said.

“ASX, our technology provider Nasdaq, customers and independent specialist third parties conducted extensive testing for over a year, including four dress rehearsals, in preparation for today’s go-live. The refresh is the latest generation of a Nasdaq-developed trading system used around the world.

“A software issue limited to the trading of multiple securities in a single order — combination trading — created inaccurate market data”, but the ASX said the issue would be resolved in time for the market to reopen as usual at 10am on Tuesday.

ASX’s Mr Stevens said: “ASX is very disappointed with today’s outage and sorry for the disruption caused to investors, customers and other market users.”

And while highlighting the “extensive testing and rehearsals” for the refreshed ASX Trade system, and the “involvement of our technology provider”, Mr Stevens said ASX accepted responsibility.

“The outage falls short of the high standards we set ourselves and the standards others expect of us,” he said.

“The obligation to get this right and provide a reliable and resilient trading system for the market rests with us. While I am disappointed with today’s outage, we are determined to continue our program of contemporising ASX’s technology stack from top to bottom.

“This initiative is critical to ASX building an exchange for the future and ensuring we best serve the needs of our customers and the Australian market.”

An active session in Wall Street on Friday saw the global flagship S&P 500 rise 1.4 per cent to a record high close of 3585 points.

S&P 500 futures surged 0.8 per cent in early Asia-Pacific trading, pointing to another strong session ahead on Wall Street overnight.

ThinkMarkets market analyst Carl Capolingua also said it was particularly frustrating for clients who were actively trading the Australian sharemarkets after the opening surge.

“Obviously, we’ve got clients that have positions,” he said.

“They want to take profits on certain holdings, and they want to buy others. We’re all in the same boat though, so we just have to wait it out.”

Monday’s outage was the fourth such incident for the ASX in the past 14 years.

“It’s the longest outage in well over a decade,” an ASX spokesman told The Australian.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout