ASIC takes brakes off share trading

The securities regulator will take the brakes off share trading volumes, to the relief of stockbrokers and institutional investors.

The securities regulator will take the brakes off share trading volumes, to the relief of stockbrokers and institutional investors, after a massive spike last month fuelled by the coronavirus pandemic saw the local sharemarket strain under a $18.1bn trading day — about three times the daily average.

Publicly supportive but privately disgruntled to have their trading and trading commissions crimped due to fears of a collapse of the system as panic swept through global markets, brokers and dealers can now buy and sell without volume restrictions after a directive from the Australian Securities & Investments Commission late on Thursday.

On March 13, as global sharemarket slumped, ASIC took the view that the Australian equities market exceeded the number of trades that could be reliably processed on a single day. To manage the risk to the market system, ASIC issued directions to nine large market participants, the nation’s biggest brokers, requiring them to limit the number of trades executed each day.

Heads of equities from firms including UBS, Morgan Stanley, Credit Suisse, JPMorgan and Macquarie Group took the call from ASIC, with the nine firms accounting for about 75 per cent of Australia’s equities market trading.

The ASIC memo imposed a legal requirement to cut volumes by 25 per cent from bumper levels traded on the Friday and required these firms to confirm their participation in writing before the market’s open on Monday.

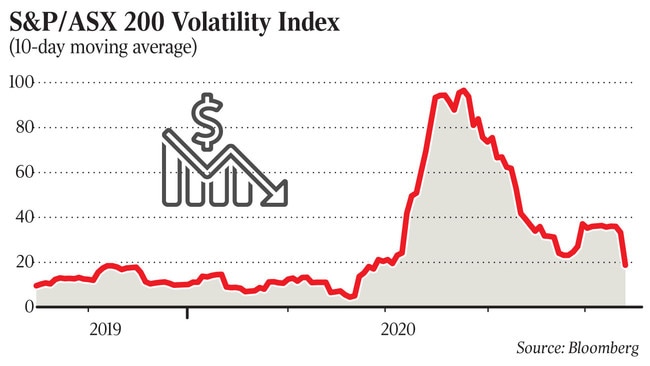

ASIC justified the unusual directive by arguing that during March and April Australian equity markets experienced significant volatility and record trade numbers, at a time when most firms were operating under business continuity arrangements. While the markets remained orderly, this strained the trade-processing capabilities of market infrastructure, market participants and other service providers, ASIC believed.

The flood of trading that week pushed ASIC to act as trades executed across the ASX and Chi-X rocketed to about 7.1 million on a single day, eclipsing a daily average of about 2 million.

On Thursday, ASIC said it understood that ASX, Chi-X and many market participants had taken steps to lift their ability to manage large trade days.

“This is important because while the levels of 13 March have not been exceeded since, there remains a real risk, particularly if equity markets experience further days of elevated trading volumes.”

ASIC said it had now revoked the directions issued to the nine participants and instead outlined expectations for all equity market participants.

“We expect all equity market participants to take reasonable steps to ensure the number of trades matched from their orders are capable of being handled by their internal processing and risk management systems, and if applicable, their clearing and settlement operations, and support the fair and orderly operation of Australian equity markets.”

ASIC said the measures should include adjustments to algorithms, such as minimising any excessive use of very small orders, intraday monitoring of trade count, “having regard to market-wide capacity constraints in the context of your market share and taking other actions that reflect and support their awareness of market-wide capacity constraints”.

A statement from the ASX said it was fully supportive of ASIC’s measures to maintain market resilience.

“ASX supports the latest action from ASIC to ensure operational resilience in Australia’s equity market,’’ it said on Thursday.

“Now is the appropriate time to lift the trade execution limits given the reduction in extreme market volatility.

“ASX will continue to work closely with ASIC and the industry in the interests of the Australian market overall.

“Throughout this extraordinary period, ASX systems and markets have remained open and reliable — there’s been no downtime, no outages, no closures.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout