Afterpay, Evolution Mining, Northern Star big winners in MSCI index shake-up

A shake-up in the influential global indices operated by MSCI has triggered a flurry of share moves on the ASX.

One of the biggest shake-ups in the influential global indices operated by MSCI in years has triggered a flurry of share moves on the ASX as fund managers in Australia and offshore scramble to readjust their portfolio.

The index shake-up is being blamed for the massive volume of shares changing hands on Friday with nearly 10 per cent of companies including Boral and Incitec Pivot changing hands in the last few minutes of trade. The changes, which has seen buy now pay later company Afterpay and gold miners Evolution Mining and Northern Star emerge as the biggest winners, is expected to be felt over coming days.

The index changes, which occur twice a year, took effect from the close of trade on Friday.

The MSCI “is one of the most followed indexes in the world and billions of dollars follows what they do”, said Bell Potter director of institutional sales Richard Coppleson. He noted that with over $US1.6 trillion benchmarked on MSCI indexes by global fund managers, small changes could often have a significant effect.

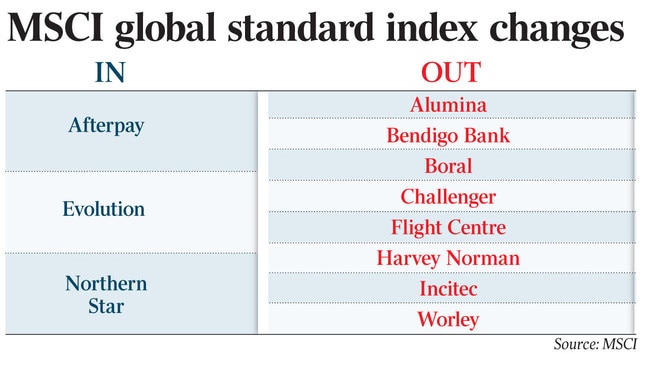

Under the changes outlined by MSCI last month, three stocks were added to the key MSCI Australia index and eight were removed.

Afterpay, Evolution and Northern Star were added to the main country index. Key removals were Alumina, Bendigo and Adelaide Bank, Boral, Challenger, Flight Centre, Harvey Norman, Incitec Pivot and Worley.

Even as those companies were removed from the global index, it still prompted a scramble for their shares as they were moved into the MSCI Global Small Cap index.

Passive funds, including hundreds of billions of dollars in funds operated by BlackRock and Fidelity, automatically adjust when the MSCI event occurs.

Financial services group Challenger saw five times the daily trading volume on the closing bell on Friday, while Harvey Norman saw six times the daily trading volume.

Boral and Incitec experienced the biggest turnover in shares with more than 10 per cent of the registry being reallocated.

Shares in both Afterpay and Northern Star have climbed more than 12 per cent since MSCI said it was including the companies in the global standard index. Shares in Evolution Mining have climbed 10 per cent.

AMP Capital chief economist Shane Oliver said the changes in the MSCI index could be significant in the short term and would begin to be felt on Monday when the market opened. “These things can have an impact around the time of the benchmark reweighting before or after it occurs depending on how fast fund managers adjust their portfolios, but over time it’s going to move more in line with what the average investor thinks the true value is,” Dr Oliver said.

He said while the index changes were not so relevant for an Australian investor, “it did form a benchmark for global investors when investing in Australia”.

“It doesn’t cover all Australian shares, but a foreign investor trying to get exposure to Australia might choose MSCI as a benchmark to do that,” Dr Oliver said.

Outlining the index changes mid-last month, MSCI Research executive director Abhishek Gupta cautioned there would be volatility associated with the latest round of index changes.

“While equity markets have partially recovered from their lows of March, the impact of the pandemic across the underlying universe of securities has varied — there have been changes to company market capitalisation and stock liquidity, among other company attributes,” Mr Gupta said.

“While we believe these changes warrant proceeding with our scheduled refresh of equity indexes so they best reflect the current opportunity set, some investors may be wary of higher index turnover during a relatively volatile market.”

Bell Potter’s Mr Coppleson said the index changes had long-term implications given that other fund managers who did not directly follow the MSCI index saw what stocks had been endorsed and that “creates a secondary interest” for the shares over time.

The proforma results of the rebalancing were outlined by MSCI on May 12 to prepare the market for the changes.

There were 62 additions to and 93 deletions from the MSCI World Index.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout