Active fund managers lead the way amid sharemarket boom

The outperformance of active fund managers in a booming sharemarket was a feature of Mercer’s performance survey for the June quarter.

The outperformance of active fund managers in a booming sharemarket was a feature of Mercer’s Australian Shares Investment Manager Performance Survey for the June quarter.

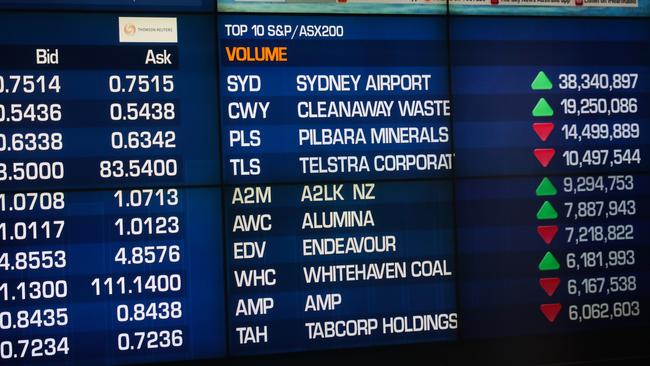

While the market surged 28.5 per cent on unprecedented stimulus and Covid vaccine developments, the median long-only fund returned 30.5 per cent before fees and the upper quartile beat the benchmark S&P/ASX 300 index by almost 5 per cent.

But with a five-year return of 12.3 per cent versus 11.3 per cent for the benchmark, the median long-only fund still faces an uphill battle to justify fees of about 100 basis points.

While the upper quartile long-only fund returned an annualised 180 basis points above the benchmark over five years, nine long-only managers generated a return more than 5 per cent above the benchmark over that more important time frame.

First Sentier (formerly Colonial First State Global Asset Management) Australian Equities Geared – Growth fund stood out with an annualised 26.7 per cent return before fees over five years.

Speaking to The Australian, the fund manager’s deputy head of Australian equities, growth, David Wilson, credits First Sentier’s investment process that allowed his team to turn down the noise when markets were panicked by the Covid “Black Swan” and focus on the companies that they knew would withstand what might have been a potentially long-lasting economic downturn.

“I know it sounds a bit ‘motherhood’ but when we go through these periods of extreme volatility, we are able to lean on our process to help us come up with the right decisions,” Mr Wilson said.

While his team kept an eye on the macroeconomic environment, it didn’t bet on macroeconomic trades that were dependent on the V-shaped recovery that subsequently emerged last year.

The focus was more on business models and balance sheets.

“As an example, we tended to have a preference for iron ore mining companies rather than oil and gas companies – despite the fact that we’re growth investors,” Mr Wilson said.

“It’s a lot easier for Rio Tinto, BHP and Fortescue to make money in the Pilbara than it is for Woodside, Santos and Oil Search to make money out of Australia’s oil and gas provinces.”

The fund owned shares in all three of the iron ore majors over the past financial year, during which they not only remained profitable but received a massive tailwind from the boom in iron ore prices.

Afterpay is another case in point. The team was convinced it had a big future even before Tencent waded in with a well-timed stake in May last year. Emerging competition in the “buy now, pay later” sector from Apple and PayPal this month is now seen as a “validation” of the business model. “Afterpay has an excellent business model and we’re entirely comfortable with it,” Mr Wilson said.

The need for liquidity to meet debt repayments in the event of sharemarket falls kept the geared fund in the top 100 ASX companies. It’s a strategy that served it well in the March 2020 sell-off.

“Investors in our geared fund are quite sophisticated in that they understand the risks and returns associated with that gearing,” Mr Wilson said.

“In March-April 2020 we saw applications increase, because the market had fallen, and when the market rallies hard, we often see redemptions. So they’re using the gearing in the right way.”

Looking ahead, Mr Wilson said “it can’t be turbo-charged like it was last year, but we’re still satisfied that there’s sufficient macroeconomic support and corporate balance sheets are in good order”.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout