$10bn hit as Sydney, Melbourne lockdowns drag on the economy

The blow to the economy from Covid lockdowns across Australia’s two largest cities is forecast to escalate to $10bn.

The hit to the economy from Covid lockdowns across Australia’s two largest cities is forecast to escalate to $10bn, as economists warn that low vaccination rates and an “elimination” strategy mean that the start-stop cycle may well continue into 2022.

While the global experience was that regions quickly made up for lost growth once they reopened, there was a risk of long-term damage from extended lockdowns, notwithstanding record-low interest rates and the renewed financial support from state and federal governments this week, HSBC Australia chief economist Paul Bloxham said.

NSW recorded 97 new locally acquired cases of Covid-19 on Friday, while Victoria – which went to a snap five-day lockdown on Thursday night – reported 10 cases.

Mr Bloxham expects that herd immunity, with some 80 per cent of adults fully vaccinated, would not be reached until the March quarter of next year. A “key challenge” was that Australia had a slow Covid-19 vaccine rollout by global standards.

“There is large uncertainty here, with a downside risk of slow vaccine supply, but an upside risk of a renewed push from the government for citizens to get vaccinated,” Mr Bloxham said.

His forecasts assume the vaccine rollout will accelerate from its June pace of 0.18 per cent of the population being fully vaccinated each day, to 0.3 per cent – more in line with the increased pace of initial vaccinations under way – before slowing from October, in keeping with the US experience once its rollout hit 50 per cent of the population.

“Given the vaccine delivery timeline and current pace, there is a risk that Sydney could see some form of lockdown maintained until herd immunity is reached,” Mr Bloxham said.

Based on NSW Treasury estimates that every week of lockdown in Greater Sydney reduces GDP by $850m, a six-week lockdown of the region would cut annual GDP by 0.25 per cent, and shave 1 per cent from quarterly GDP.

“These same estimates would suggest a 16-week lockdown, therefore, would be 0.7 per cent off annual GDP, or 2.8 per cent off in the quarter,” said HSBC’s Mr Bloxham.

Prime Minister Scott Morrison on Friday confirmed that the nation’s Covid strategy remained focused on elimination, stating that the goal for the lockdown states was zero cases in the community.

“This is the focus of national cabinet, that the cases, the target here is to reduce as far as possible to zero the cases that are infectious in the community,” the Prime Minister said after Friday’s national cabinet meeting.

Westpac chief executive Peter King on Friday said vaccination was the key to getting life back to normal. He said the bank was providing employees additional paid leave so they could be vaccinated.

“We’re also working with the government on how we can help to distribute the vaccine through a corporate workplace vaccination program, which Westpac will be extending to immediate family members of employees,” he said.

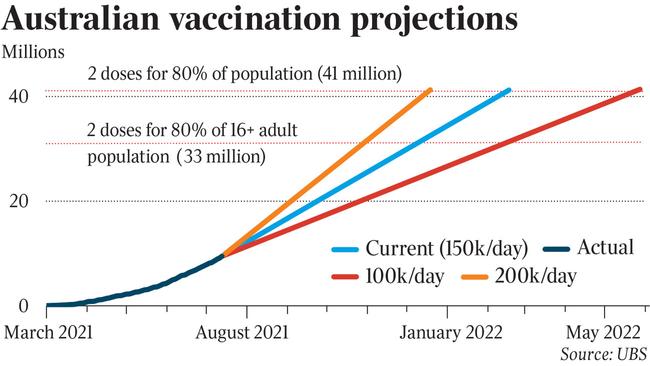

UBS economist George Tharenou said his “bullish case” for vaccinations in Australia would see 80 per cent of the adult population fully vaccinated as early as the end of this calendar year, if the recent spike of 150,000 doses a day continued.

“If this trend continues, cumulative doses could reach 33 million doses, and hence reach the ‘magic number’ of 80 per cent of the adult population being fully vaccinated – with two doses – by the end of 2021,” Mr Tharenou said.

However, in a ‘‘bearish scenario’’ of vaccines slipping to 100,000 a day, the 80 per cent threshold might not be reached until at least mid-2022, Mr Tharenou said.

“The international experience has shown that vaccine hesitancy is widespread, and the pace of vaccinations slows sharply above 50 per cent of the population.”

AMP Capital chief economist Shane Oliver foresees less risk of lasting damage, but expects the Greater Sydney lockdown to last seven weeks.

Based on his estimate that it cost $1bn a week and that Victoria’s five-day lockdown will cost about $700m, Dr Oliver said that lockdowns since late May would cost nearly $10bn.

Government income support costing more than $500m a week – payments to businesses contingent on them maintaining their workforce and payments to workers similar to what they would have received from JobKeeper late last year – would “help soften the blow but will mainly serve to help keep the economy resilient so it can bounce back quickly once the lockdown ends”.

He said that, assuming other states kept growing – including Victoria beyond its current lockdown – and NSW rebounded in September, helped by pent-up demand and the lagging impact of support payments, the “extended lockdown will likely flatten GDP growth this quarter”, with a risk of slightly negative growth rather than a 1 per cent rise that he previously expected.

Assuming a “solid rebound” in the December quarter, Dr Oliver expects national growth through the year to the December quarter of about 4 per cent versus 4.75 per cent previously.

While the hit to the NSW economy could push unemployment up temporarily from 4.9 per cent in June, the jobless rate should “quickly resume its downtrend later in the year and through next year, albeit it may not be below 5 per cent at year-end as we were expecting”.

“A further extension of the Sydney lockdown and further Delta outbreaks across Australia are a key risk,” he warned. “Having seen the impact on Sydney, other states are likely to be extra cautious in making sure they don’t see the same – which means the risk of early snap and short lockdowns but averting longer economically debilitating lockdowns.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout